Significant Divergences In Play

It has been a while since such short term divergences emerged in the market: big gains for Small Caps, struggles for Tech, with Large Caps stuck in the middle.

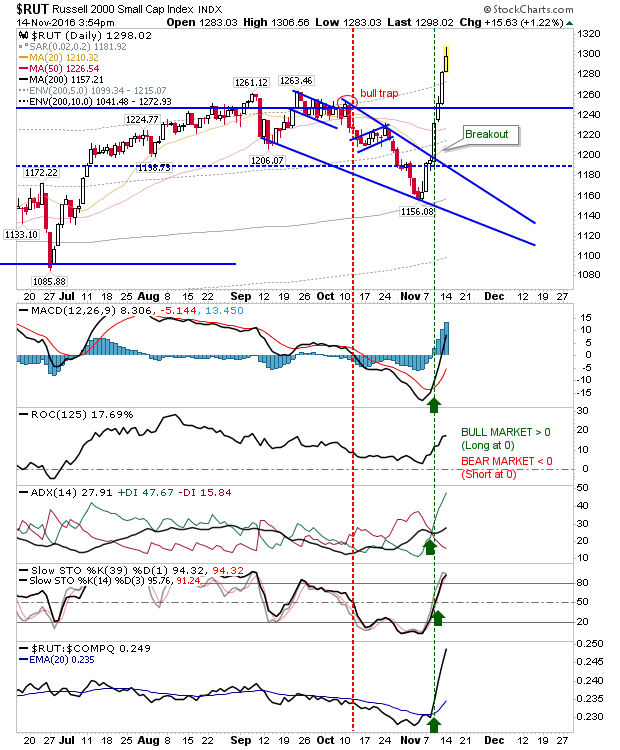

The Russell 2000 chalked up a sixth day of gains as it neatly took out the 'bull trap' and prior highs. The relative performance is off the chart of its historic relationship to other markets. It needs some comeback, but even when that happens it will remain well ahead of other markets. Technicals are net bullish.

(Click on image to enlarge)

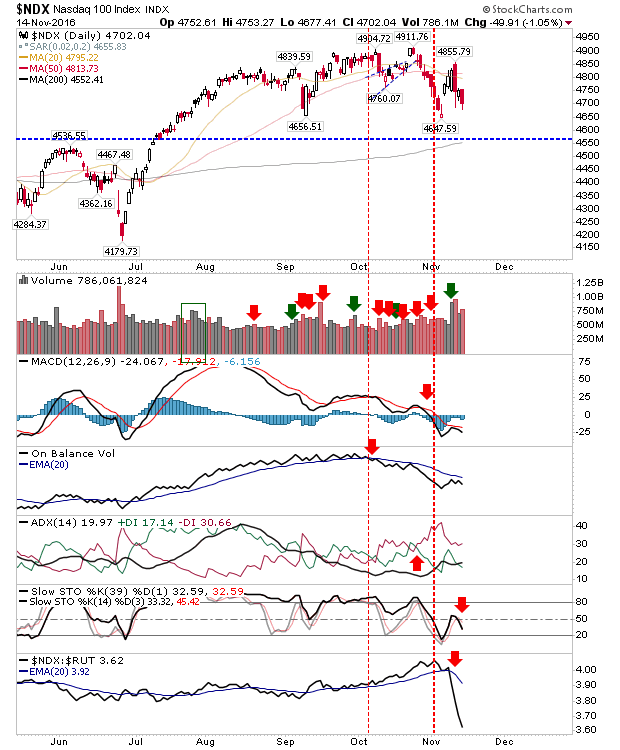

Meanwhile, the Nasdaq 100 is heading in the other direction. Its technicals are net bearish.

(Click on image to enlarge)

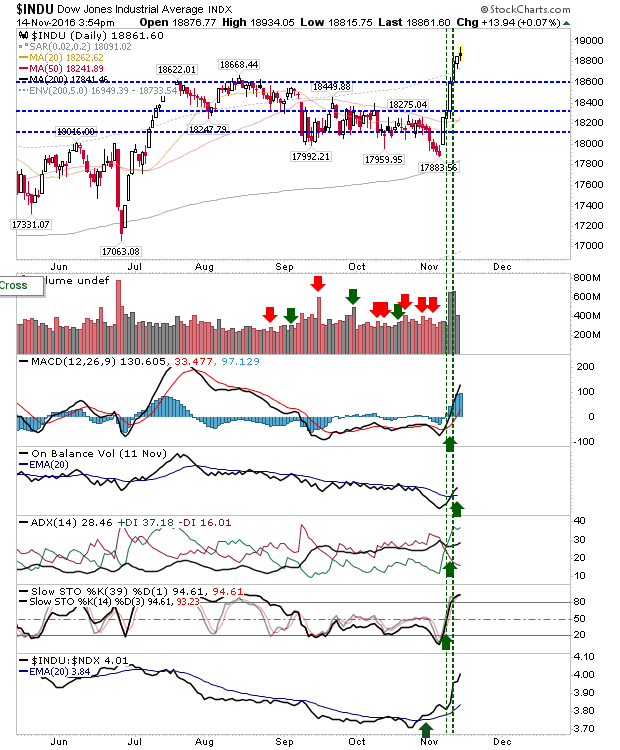

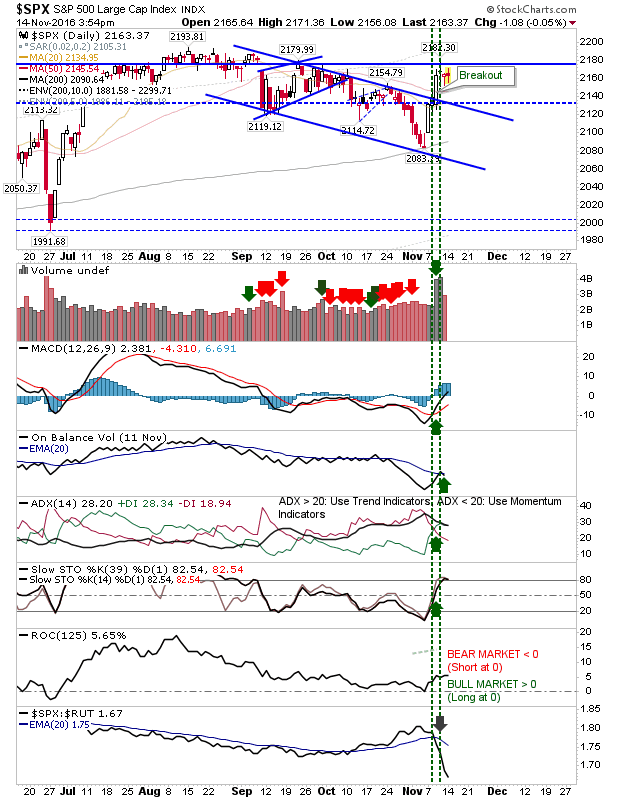

Finally, the Dow and S&P are experiencing their own divergences within the Large Caps sector group: Dow gaining while the S&P stumbles. The relative market performance of these indices confirms their diverging paths.

(Click on image to enlarge)

(Click on image to enlarge)

The time for consolidation should be sooner rather than later as election shock wears off. Holding breakouts will be key for the Russell 2000 and Dow, but if these fail it could spell additional hardships for the struggling Nasdaq and Nasdaq 100. Value buyers could sniff around Tech if Small and Large Caps can hang on to their breakouts.

Disclosure: None.

Thanks for sharing