Should You Buy The Dip On Netflix Stock After Earnings Miss?

Image Source: Unsplash

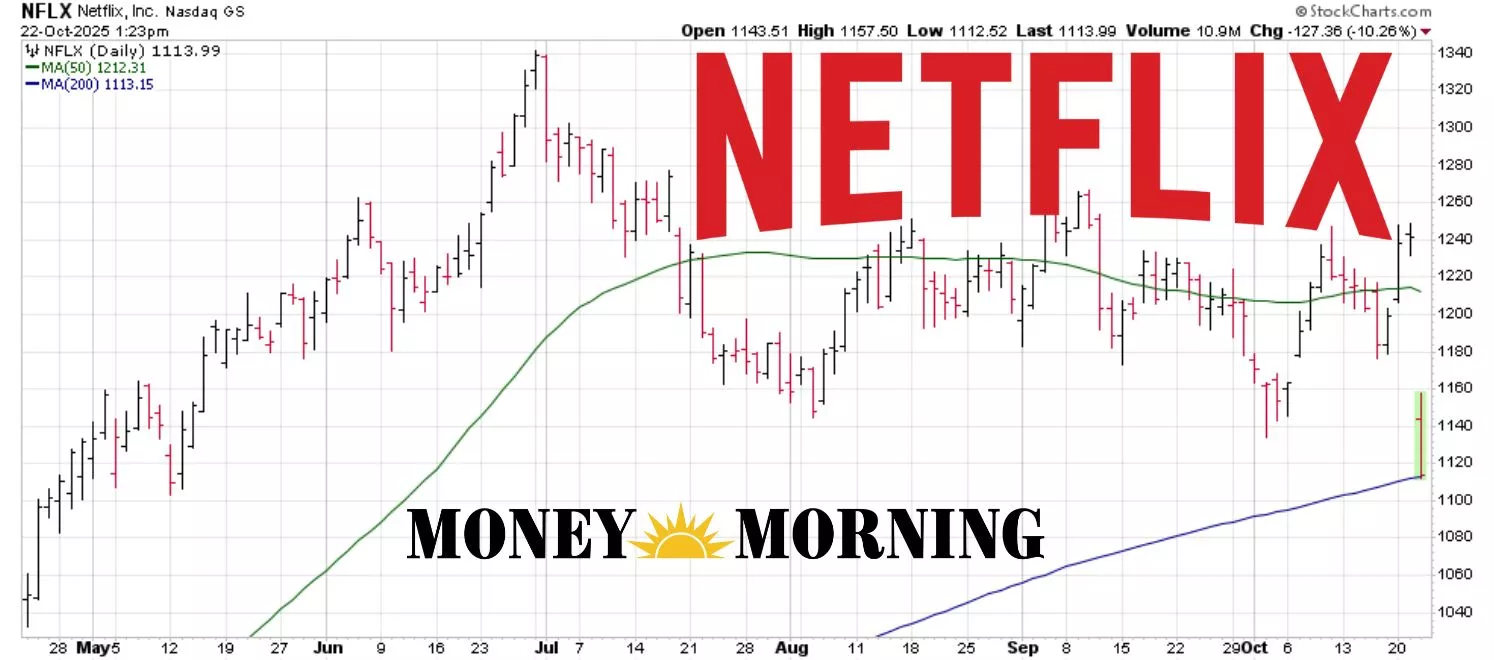

Netflix (NFLX) stock fell by 10% today after the company missed earnings expectations. It reported EPS of $5.87 for Q3 2025 against estimates of $6.94 to $6.97. Revenue met expectations and grew 17% year-over-year.

The large earnings miss was due to a Brazilian tax expense not originally included in the company’s forecasts. This tax expense caused earnings to plunge.

And while Wall Street would normally ignore one-time expenses, this one came in abruptly and was quite a large sum at $619 million. Per Netflix, “Absent this expense, we would have exceeded our Q3’25 operating margin forecast. We don’t expect this matter to have a material impact on future results.”

Why I’d buy the dip on NFLX stock

Now that the stock has taken a breather, it is a good time to increase your holdings before Netflix picks up speed again. The company has been getting leaner ever since management started cracking down on password sharing, with the recent ad revenue growth making the outlook even better.

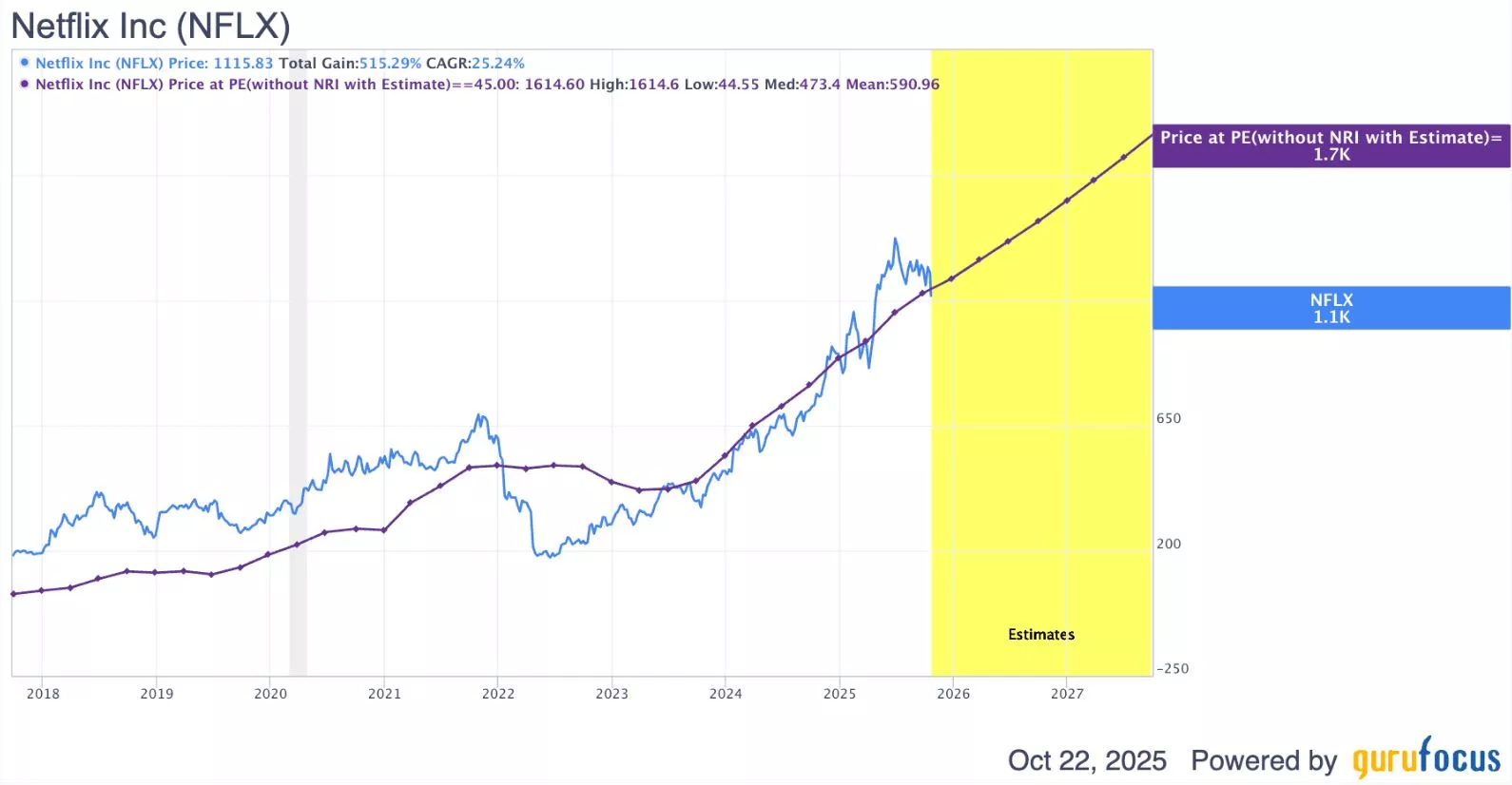

Analysts see 29.3% EPS growth in 2025 and 25.9% EPS growth in 2026. Sales growth is also expected to be 15.56% in 2025 and 12.9% in 2026. The forward earnings multiple is certainly quite rich at over 48 times, but the margins are growing fast enough to take up a position in the stock.

If Wall Street holds the premium, NFLX stock can end up around $1.7k or higher by 2028 if it keeps beating estimates (minus non-recurring items).

More By This Author:

OKLO Stock Is Down Big But Traders Have A Wild Opportunity On Their HandsRigetti’s Buy the Dip Price Revealed

USAR Stock Is Cooling Off. Is This The Right Time To Buy The Dip?

See disclaimers here.