Should Investors Consider High Yield Dividend Stocks?

Image Source: Pixabay

When selecting dividend-paying stocks, one of the first things that investors look at is, of course, the annual yield.

But are high-yield stocks always the best route for income-focused investors? Let’s break it down.

Are High-Yield Stocks Best?

At a quick glance, a dividend-paying stock with an annual yield above 10% indeed seems like a solid investment from an income-focused standpoint. This is particularly true from a shorter-term perspective, but it’s not always that simple and clear-cut.

Dividend yields fluctuate, as they are a function of share price movement. If the stock goes up, the yield goes down, and vice versa. Investors should be fully aware of ‘dividend traps,’ a situation in which an enticing annual yield has been caused by poor share performance.

The risk to the initial investment is often much greater in these situations, given the already negative sentiment causing poor price action. Remember, stocks can always go lower than previously thought, and you don’t want to get trapped in bearish price action.

In addition, companies sometimes increase their payouts significantly in a one-time event when business is fruitful, known as ‘Special Dividends.’

But for those who seek reliability, targeting companies that are considered Dividend Aristocrats provides precisely that.

Companies in the Dividend Aristocrats club have upped their dividend payouts for a minimum of 25 consecutive years and are included in the S&P 500, owing to well-established and successful business operations.

A few companies in the elite club include Johnson & Johnson (JNJ - Free Report), Coca-Cola (KO - Free Report), and Procter & Gamble (PG - Free Report).

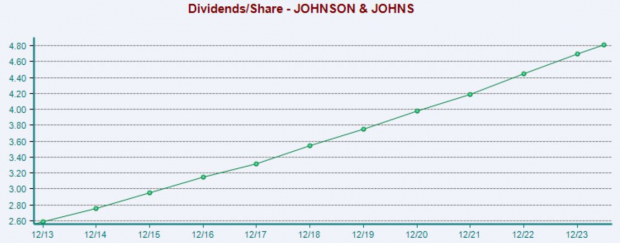

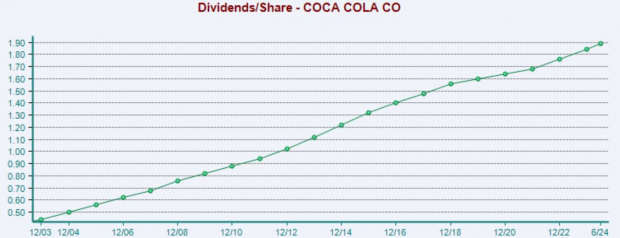

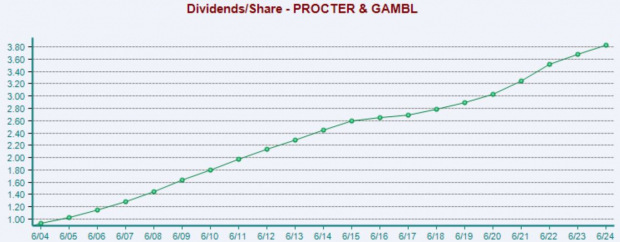

Below are charts illustrating these companies’ dividends paid on an annual basis.

Johnson & Johnson

JNJ shares currently yield 3.2% annually.

Image Source: Zacks Investment Research

Coca-Cola

KO shares currently yield 2.8% annually.

Image Source: Zacks Investment Research

Procter & Gamble

PG shares currently yield 2.4% annually.

Image Source: Zacks Investment Research

More By This Author:

3 Key Releases To Watch This Earnings Season: NVDA, MCD, TSLAWhat's Going On With China Stocks? Alibaba, JD.com, PDD Holdings

Should Investors Buy PepsiCo Shares Before Earnings?