Should Investors Buy The Dip In Alibaba Or Walmart's Stock After Earnings?

Image Source: Pixabay

The dip in Alibaba (BABA) and Walmart‘s (WMT) stock may be catching investors' attention after both companies reported their quarterly results on Thursday.

Alibaba and Walmart’s stock ended today’s trading session down 8% and 9% respectively but let’s review their quarterly reports and current valuations to see if the drops are a buying opportunity.

Image Source: Zacks Investment Research

Alibaba’s Q2 Review

There is a case that today’s selloff in Alibaba shares was overdone as it was mostly attributed to the news that the e-commerce behemoth would not spin off its Cloud Intelligence Group into a separate IPO as many investors have anticipated.

Still, Alibaba topped its fiscal second quarter earnings expectations with EPS at $2.14 per share and 1% above the Zacks Consensus despite sales of $30.81 billion slightly missing estimates of $31 billion. Year over year, Q2 earnings rose 17% with sales rising 6% from the comparative quarter. Notably, Alibaba has now surpassed earnings expectations for eight consecutive quarters after today’s EPS surprise.

Image Source: Zacks Investment Research

Walmart’s Q3 Review

Following Target's (TGT) much better-than-expected third-quarter earnings report on Wednesday, investors were underwhelmed with Walmart’s Q3 results. Walmart was able to reach its Q3 earnings expectations of $1.53.per share but this was not as eye-popping as Target’s 42% EPS surprise on earnings of $2.10 a share.

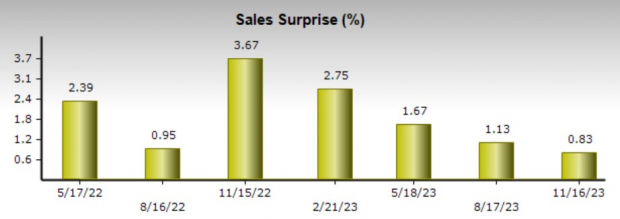

However, Walmart was able to beat top-line estimates in contrast to its omnichannel competitor Target. Walmart’s Q3 sales of $160.8 billion slightly surpassed estimates of $159.48 billion. Compared to the prior year quarter, Walmart’s Q3 earnings rose 3% with sales up 5% but underwhelming guidance for Q4 sales growth of 5%-5.5% fueled the selloff in WMT shares.

Image Source: Zacks Investment Research

Current Valuations

Alibaba’s stock has lost some of the mojo and excitement in years past but makes a strong case for being undervalued after Thursday’s selloff. Currently at a 9.8X forward earnings multiple Alibaba’s stock trades at a significant discount to the Zacks Internet-Commerce Markets' 32.8X and the S&P 500’s 19.7X. More intriguing is that Alibaba’s stock trades well below its historical high of 66.6X and at a 73% discount to the median of 36.2X.

Image Source: Zacks Investment Research

As for Walmart, its stock trades at 26.3X forward earnings which is near the Zacks Retail-Supermarkets' 23.8X and not at a stretched premium to the benchmark. Walmart’s stock also trades below its own decade-long high of 28.1X but above the median of 20.2X.

Image Source: Zacks Investment Research

Takeaway

Experiencing their largest percentage declines in over a year, buying the dip in Alibaba and Walmart’s stock is certainly tempting with reasonable valuations as the busy holiday season approaches. For now, both stocks land a Zacks Rank #3 (Hold) as the upside in Alibaba and Walmart shares may largely depend on the trend of earnings estimate revisions in the following weeks.

More By This Author:

Dividend Watch: Three Companies Boosting PayoutsCisco Systems Q1 Earnings And Revenues Top Estimates

3 Fidelity Mutual Funds To Buy For Long-Term Gains

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more