Shorting The Fatties

Image Source: Unsplash

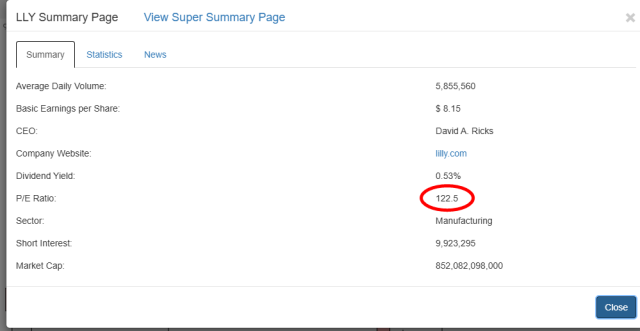

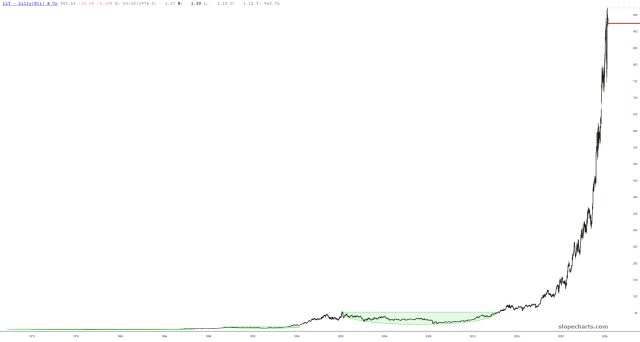

Eli Lilly (LLY) has traditionally scared me. I mean, let’s face it, a totally evil company that sells drugs at 10,000 the times of the cost of materials which has the pathetic U.S. healthcare system over a barrel is a pretty damned good business model. It is sporting a P/E in the triple digits, which is normally what you would associate with a new biotech company at the cusp of curing cancer, not an ancient organization that sells stupidly named pills to the desperate.

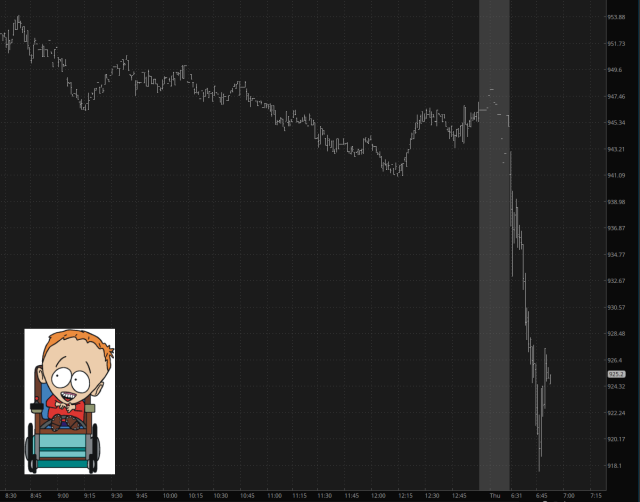

Still, I gave it a shot yesterday and acquired January $960 puts. We’re off to a good start, folks! Making money on a short is a good feeling, but doing so with a clearly malignant company is even better.

And let’s all agree, it has a long, long, long way to go. Fair value for this is probably 1/10th its present price, but the aforementioned broken healthcare system will keep that from happening.

As I said, though, we’re off to a good start, and I’ll cheerfully hold on to this sucker until the mid-750s!

By the way, I see equities have EXPLODED to the upside just now. GOOD! I’ve got cash waiting to get more aggressively bearish. Bid it up, bulls! You’re my new best buds!

More By This Author:

Targeting HuntsmanGTLS: A Thinly Traded Opportunity With Plenty Of Downside Left

Semis Set For A Historic Crash

I tilt to the bearish side. Slope of Hope is not, and has never been, a provider of investment advice. So I take absolutely no responsibility for the losses – – or any credit ...

more

You are demonizing a company that’s saved millions from serious obesity problems. It makes me think you are biased or have a short term short position.