Short Gamma Suppressing The VIX

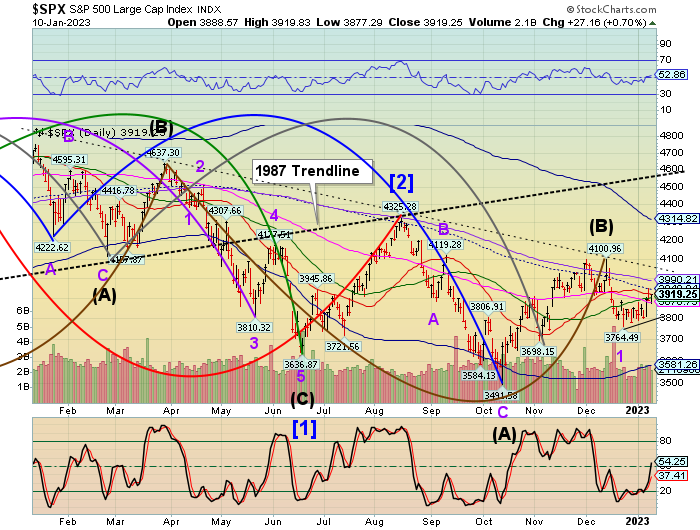

SPX futures are hovering in a narrow range near the close. The high at 3950.57 remains intact, but there seems to be a hesitancy to decline. There are three weeks left in the current Master Cycle. Whichever way the market goes may set the tone for the rest of the year.

ZeroHedge reports, “US equity futures were set to rise for a second day as upbeat sentiment ahead of tomorrow’s key CPI print – which JPM gives 85% odds of pushing stocks at least 1.5% higher – lifted global markets despite a freak outage of key FAA advisory system this morning led to a nationwide ground halt for all domestic flights (until at least 9 am) pre. Contracts on the S&P 500 and Nasdaq 100 ticked up 0.1% as of 7:15 am ET while Europe’s Stoxx 600 Index rose 0.8%. The FTSE 100 climbed within striking distance of a record high; Asian equities were supported by China lifting Covid restrictions. Among the top corporate news, Credit Suisse weighs cutting by half the bonus pool for 2022 after a turbulent year and Apple plans to start using its own custom displays in mobile devices as early as next year. Treasury yields dropped and the dollar gained for the second day in a row.”

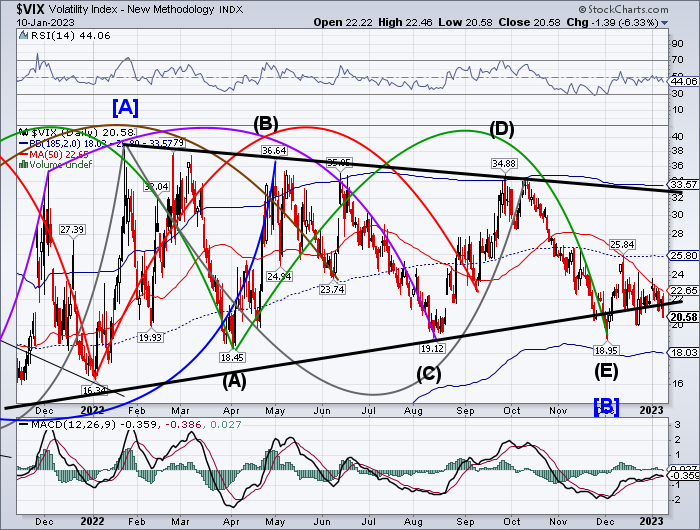

VIX futures appear stuck at the lower end of yesterday’s trading range. This may be due to the weekly op-ex this morning. At the last count, there were 40,229 put contracts with a strike at 21.00 expiring this morning. This may be a good example of short gamma suppressing the VIX. At the same time, VIX may spring out of its box as the expiry is settled.

More By This Author:

A Review Of Indices In The New YearHeadlines To Take You Through Xmas

Consolidation Day

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more