Serious Market Events Ahead For S&P 500, FTSE 100, DAX And Nikkei

S&P 500, FTSE100, DAX 40, and Nikkei 225 Fundamental Forecast Talking Points:

- Liquidity will reverse course from this week to next as the US Thanksgiving holiday’s seasonal curb on both US and global markets passes

- The economic calendar next week is dense including key inflation statistics, economic activity readings, and the ever-popular NFPs

- General ‘risk appetite’ trends have drifted higher, but this seems more supported by unreliable seasonal norms than an actual fundamental backdrop

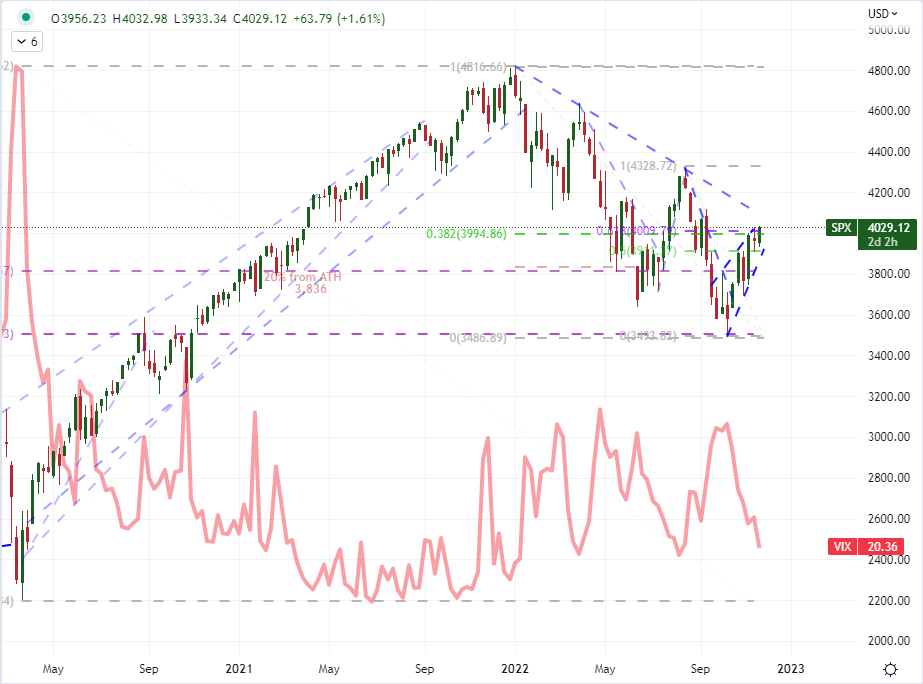

Fundamental Forecast for the S&P 500: Bearish

Liquidity will return next week to a market that has seen both a seasonal and structural suppression of volatility. While we are heading into the year-end holiday-strewn period which typically amplifies expectations for a tapering off of activity and participation, there is no guarantee that quiet will prevail. In fact, given the unresolved and converging threats of rampant inflation, recession risks, and the lagging effect of rapid financial market tightening; maintaining enthusiasm can prove increasingly costly. For the benchmark, S&P 500 – the most heavily traded index from the world’s largest market – the drop in implied volatility (‘expected’) volatility mirrors the choppy rebound over the past six weeks. Corrections in prevailing trends happen and there have been glimmers of support from the headlines such as the remarkable enthusiasm that followed the modestly softer pace of CPI at the beginning of the month or this week’s FOMC minutes restating that a slower pace of hikes is likely ahead. That may be enough for a little more stretch, but it doesn’t represent the foundation for an earnest rally moving forward. From the US docket over the coming week, there are data points like the PCE deflator (Fed’s favorite inflation indicator), Conference Board consumer confidence survey, and November NFPs that could draw attention. Yet, the probability that the data can significantly lower the Fed’s terminal rate or ensure we avoid a recession is low. That skews the potential impact of the data restoring the prevailing bearish trend versus the headlines projecting relief.

Chart of S&P 500 Overlaid with VIX Volatility Index (Weekly)

(Click on image to enlarge)

Chart Created on Tradingview Platform

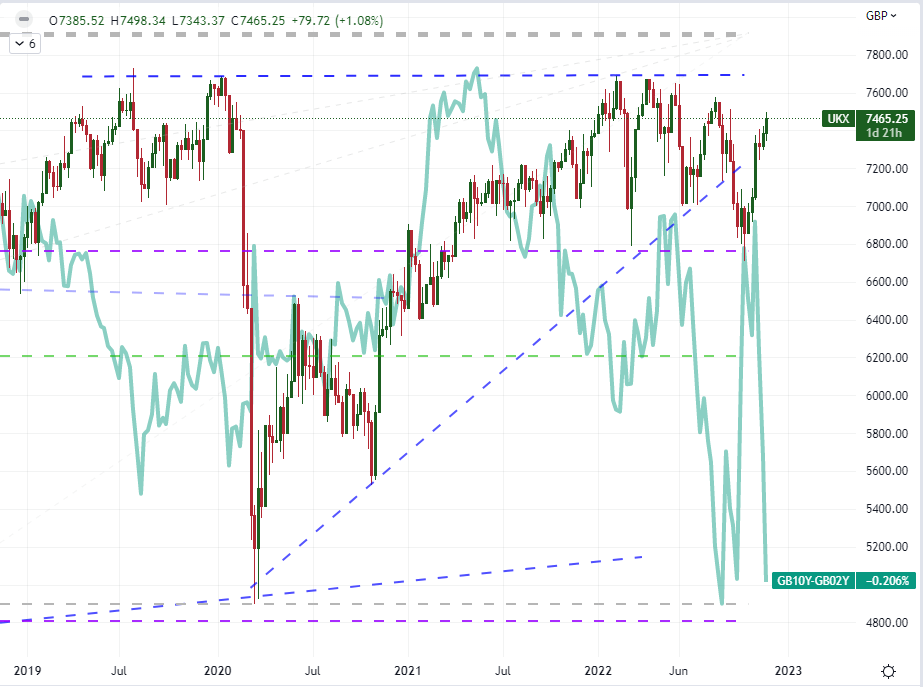

Fundamental Forecast for the FTSE 100: Neutral

In a few short weeks, we have seen the Bank of England warned of a painful UK recession, the Chancellor of the Exchequer delivered his own economic warning alongside a tighter budget and the OECD warned that the world’s fifth-largest economy was facing pain from internal and external (energy costs) pressures. Yet, wouldn’t get that impression if you were just looking at the FTSE 100. Utilizing a more popular gauge from the US, I’ve overlaid the UK index with the 10-year / 2-year Gilt yield spread as an investor-monitored measure of the economic forecast. This is not as frequented a measure for UK markets, but the concept is similar. Barring the ‘mini budget’ fiasco of September, the general recognition of economic constraint going forward is increasingly showing through in the pressure behind the higher duration paper. Can the market continue to defy this generally expected trend toward economic hardship? The economic docket will not offer up a lot of schedule provocations besides housing inflation, consumer credit levels, and a private retail sales report. That may leave the market open to global sentiment drift or to unpredictable headline fodder.

Chart of FTSE 100 Overlaid with the UK 2-10 Gilt Yield Spread (Weekly)

(Click on image to enlarge)

Chart Created on Tradingview Platform

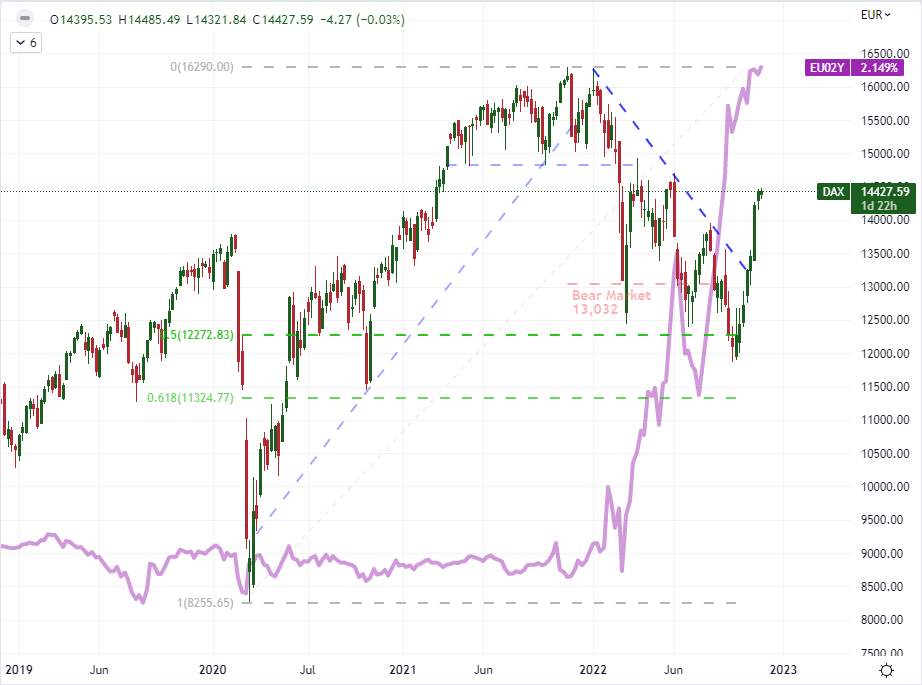

Fundamental Forecast for the DAX 40: Bearish

As remarkable as the disparity in equity performance and economic projecting is for the UK markets, I think the contrast from the major mainland Euro-area benchmarks is in a category all its own. While Germany’s DAX 40 is further from its beginning-of-year highs than the FTSE, the 7-week and more than 20 percent charge for the former suggests an optimism that is far removed from the general fundamental backdrop. The OECD’s stiffest warning around the economic threat in 2023 was reserved for the Eurozone – even though the official forecast is for a US-matching and tepid 0.5 percent growth. The same group had also called on the ECB to close the rate gap with its US counterpart in order to control inflation from getting even further out of hand. From the docket over this coming week, we have Eurozone and German inflation figures, region-wide sentiment surveys, and employment updates. Should we register that impending recession in this data, loosely held confidence may start to seriously waver?

Chart of DAX 40 Overlaid with the 2-Year Eurozone Bond Yield (Weekly)

(Click on image to enlarge)

Chart Created on Tradingview Platform

Fundamental Forecast for the Nikkei 225: Bearish

Japan’s local capital market can be somewhat insular. While it is still open to the ebb and flow of global sentiment, there has been a curb in how severe the ‘risk off’ has been in particular with 2022. That is helped by a local investment appetite that prizes higher capital gain potential versus the relentlessly deflated baseline of yield that can be found in the financial system given the Bank of Japan has kept its commitment to keep interest rates anchored to its virtual zero mark. That said, the rotation of capital within the system cannot keep the markets buoyant forever. Should there be a significant drop in global sentiment that overrides the year-end seasonal expectations or should Japan’s economic glow be snuffed out, we could see the Nikkei 225 not just move back towards the bottom of this year’s range (down to 25,150 - 24,500), it may actually push the index into ‘bearish’ territory which it has thus far been able to avoid. For top event risk, the Japanese docket will offer up retail sales and unemployment on Tuesday, industrial production and housing starts on Wednesday, and 3Q capital spending on Thursday.

Chart of Nikkei 225 Overlaid with the USDJPY Exchange Rate (Weekly)

(Click on image to enlarge)

Chart Created on Tradingview Platform

More By This Author:

Crude Oil Update: Brent Falls On Supposed Russian Oil Price CapNew Zealand Dollar Whipped By Jumbo Rate Hike. Will NZD/USD Rally Continue?

S&P 500 At Risk Of Breakout As PMIs Hit But Follow Through Would be A Problem

Disclosure: See the full disclosure for DailyFX here.