Sentiment Is Euphoric

NDX futures have eased down from their new all-time high at 17784.17 to a morning low at 17719.50. Critical support lies at 17374.13, where an aggressive sell signal may be made. A confirmed sell signal lies beneath the Ending Diagonal trendline and Intermediate support at 17025.30. The Cycles Model infers a decline in the making to the end of February or early March. Meanwhile, sentiment is euphoric as stocks may be about to make gains in 14 out of 15 past weeks.

Today’s options chain shows Maximum Investor Pain at 17800.00. Long gamma is sparse, but short gamma begins at 17790.00.

ZeroHedge remarks, “The equity world is wonderful right now, but sometimes even winners need to pause. We do believe equities will be lower over the next few weeks. Miss Market might even teach us a masterclass in humility. Here are the reasons why.”

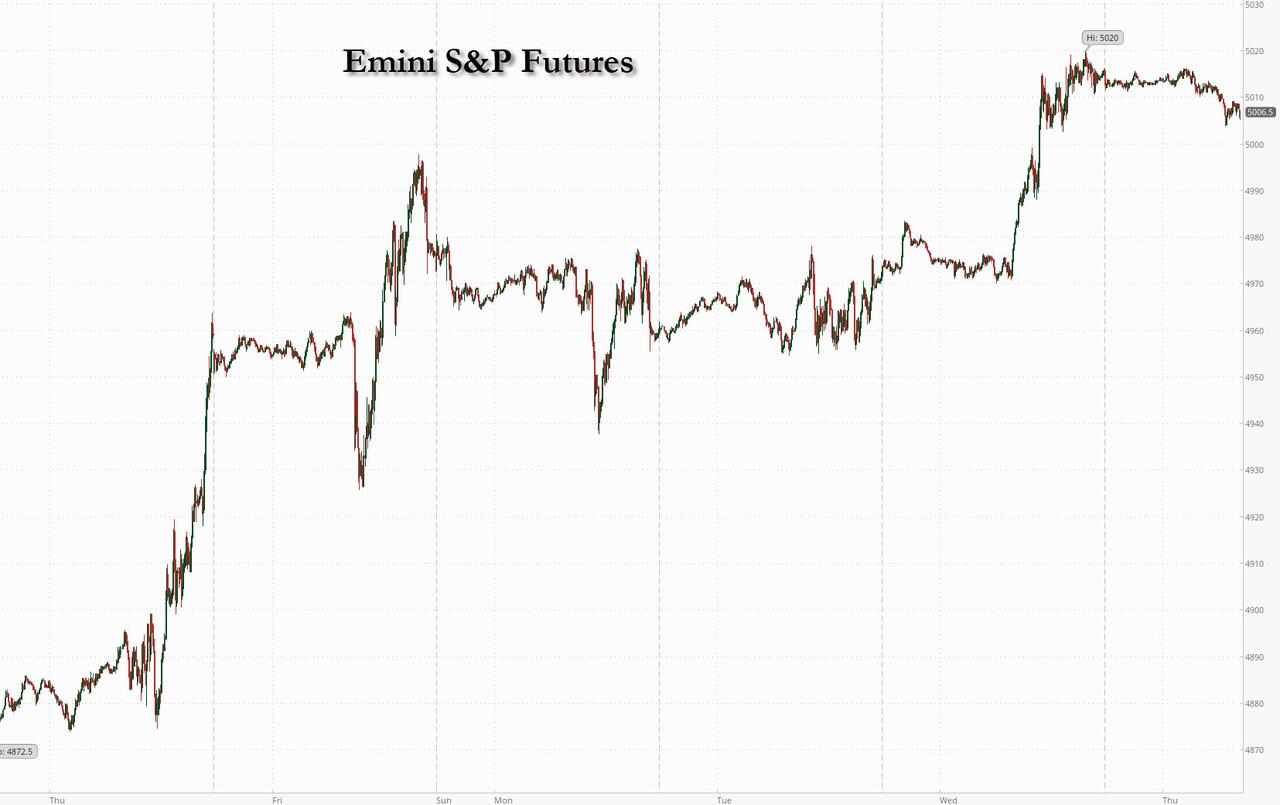

SPX futures are consolidating beneath their new high made yesterday. Today is day 34 (a Fibonacci unit) from the January low. The bullish structure is all but complete. Critical support lies at the Cycle Top at 4891.39. Equities are out on a limb that may snap at any time.

Today’s op-ex shows Max Pain at 4965.00. While long gamma may begin at 4975.00, short gamma resides beneath 4950.00.

ZeroHedge reports, “US equity futures dropped on Thursday after hitting a fresh all time high in the previous session, and bond yields rose as investors analyze a slew of earnings reports and also prepared for the sale of 30Y treassuries. As of 8:00 am ET, S&P futures were down 0.2%, but even with the decline the S&P remains within striking distance of the 5,000 level and a small gain of just 5 points would take it there today. The MSCI World Index of developed-market stocks also rose to a record. The Stoxx 600 traded flat on the busiest day of the European earnings season. The dollar gained after the yen tumbled following dovish comments from BOJ Deputy Governor Uchida who said the BOJ won’t aggressively hike rates even after ending negative rates (unclear who expected the BOJ to unleash a hiking spree). Commodities are the standout pre-mkt as the energy complex leads the group higher and strength across metals. It’s another busy day for earnings: the lineup in the US today includes Expedia, Philip Morris, ConocoPhillips, S&P Global and cereal maker Kellanova. On the macro side, we get jobless claims and wholesale trade and inventories.”

(Click on image to enlarge)

VIX futures have risen from yesterday’s low at 12.81, which may have been a Master Cycle low at day 259. The two-month low readings in the VIX may offer a surprise in the opposite direction once the new Master Cycle has begun.

More By This Author:

VIX Futures: On The RiseSPX Futures: Back To A Flat Position

NDX Futures: Relentless March

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more