Sempra: A "Pick And Shovel" Income Stock Set To Capitalize On AI Boom

Image source: Pixabay

AI stocks are booming, but they’re an absolute “dividend desert” for us contrarian income-seekers. Or are they? What if we could find a way to grab more of our AI profits as dividends – particularly growing dividends – so we don’t have to “buy and hope” for price gains alone? We can if we employ a “pick and shovel” approach, and one stock I like is Sempra (SRE), advises Brett Owens, editor of Contrarian Income Report.

Most tech stocks – and I’d put AI darling Nvidia (NVDA), with its pathetic 0.02% yield, at the top of the list here – don’t pay dividends when they’re growing quickly. Only later, when growth slows, do they “find religion” and return cash to shareholders as dividends and buybacks. That’s too bad for those of us who like to have more than one way – price gains – to book returns on our stocks.

That said, during the gold rush of the 1840's, hordes flocked to California to get rich mining for gold. But the guys who made the real money didn’t actually mine anything. They were the entrepreneurs who sold the picks and shovels (as well as booze and lodging) to the hapless speculators.

Sempra is an ideal pick and shovel play on the AI boom. It’s a California- (and Texas-) based utility set to profit as AI drives power demand through the roof—to 85 terawatts a year by 2027, according to Scientific American. That’s more power than many small countries use.

Let’s start with California, where Sempra has 25 million customers in the southern and central parts of the state. Despite recent tech layoffs, California created 260,000 jobs in 2023, according to the Public Policy Institute of California, a rate that matched pre-pandemic levels.

But Texas, where Sempra has 13 million customers and operates 143,000 miles of transmission lines, is the real growth driver here.

The state’s tech sector is on fire. According to the Texas Economic Development Corporation, 17,600 tech firms now call Texas home, and they employ some 203,700 workers there. In Austin alone, the number of tech jobs jumped 9.8% in 2022, according to the city’s chamber of commerce.

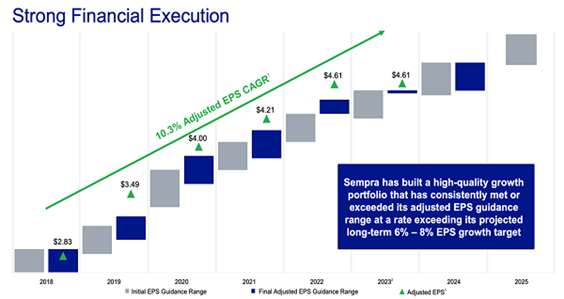

All of this builds a strong case for Sempra, and its stellar earnings history drives the point home. Management continuously sets a 6% to 8% EPS growth target -- and continuously crushes it.

Source: Sempra fourth-quarter investor presentation

No wonder the payout (recent yield: 3.5%) is on a growth tear, and it has pulled up the share price with it, too. That connection is a phenomenon I call the “Dividend Magnet” – and we’ve seen it in dividend stock after dividend stock.

My recommended action would be to consider buying shares of SRE.

About the Author

Brett Owens graduated from Cornell University and soon thereafter left Corporate America permanently at age 26 to co-found two successful SaaS (Software as a Service) companies. Today, they serve more than 26,000 business users combined.

He took his software profits and started investing in dividend-paying stocks. Mr. Owens employs a contrarian approach to locate high payouts that are available thanks to some sort of broader misjudgment. Renowned billionaire investor Howard Marks called this "second-level thinking."

More By This Author:

IBIT: A Spot Bitcoin ETF Whose AUM, Price Is SurgingBullish 2024 Outlook On Track After Four-Month Market Win Streak

Silver: Breaking An Important "Curse" – And Looking Strong

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.