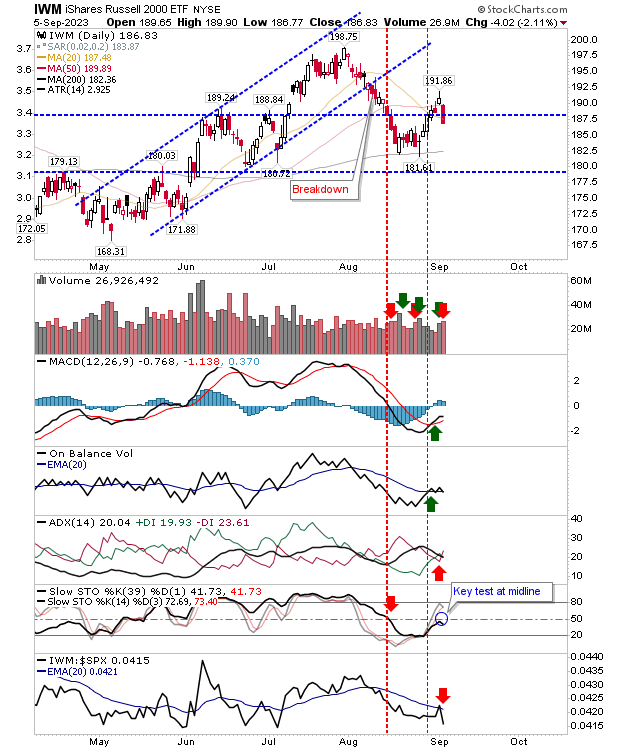

Selling In Russell 2000 Undercuts Breakout Support

The warning signs were there for the Russell 2000 (IWM), and today's action delivered on that foreshadowing. Sellers pushed the Small Caps index below 20-day and 50-day MAs along with the June swing high. Volume rose to register a distribution day, along with a bearish reversal in the ADX and a relative performance loss against S&P. The next target for support is the 200-day MA, but it's going to take a few days of selling before it gets there.

The Nasdaq experienced a small loss as technicals remained net positive. Volume remained light, adding to the general antipathy towards this index today. Whether it can hold out should the Russell 2000 continue to deteriorate remains to be seen.

The S&P also saw light losses as it too held support defined by the June swing high. The significant disparity in the action between the S&P and Russell 2000 meant there was a sizable relative performance gain for the Large Cap index.

For tomorrow, the Russell 2000 will likely continue to be the center of attention. If there is no real recovery in the index we will want to ensure there is no follow up losses in the S&P and Nasdaq that could lead to a break of support in these indices.

More By This Author:

Important Test For Russell 2000 As Nasdaq And S&P Turn Net Bullish

Nasdaq Moves Past Swing High On Improving Technicals

Dow Jones Index Defends Support As Breadth Metrics Stall In No-Mans Land

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more