Sell These 3 Dividend Stocks Paying 10% Before They Crash

Recently I received several questions about individual Business Development Companies (BDCs) that have had strong share price gains in 2019. The questions were whether to buy more, hold or sell now. As with any stock market sector or group, there are good BDCs, bad BDCs, and a lot of average BDCs. The share price gains in 2019 have made some of these stocks too expensive. Especially if business conditions turn less favorable.

Business development companies operate under the Small Business Investment Incentive Act of 1980, which was an amendment to the Investment Company Act of 1940. The 1940 Act is the primary law governing investment products such as mutual funds, closed-end funds, and exchange-traded funds (ETFs). The 1980 Act provided some exceptions to Investment Company Act rules. The purpose was to open a new source of financing for small to medium-size business that do not have access to the public debt and equity markets. In structure, a BDC is closely related to a closed-end fund.

A BDC operates under a strict set of rules. First, a BDC can only make loans or equity investments in small to medium-sized corporations that meet the criteria in the law. The next rule is that a BDC can only have debt equal to two times the equity capital of the company.

For example, a new BDC sells stock and has $500 million from the sale. The company can then borrow another $1 billion, bringing the company’s total investment capital to $1.5 billion. By law, a BDC cannot over-leverage itself.

Finally, a BDC must payout at least 90% of net income as dividends to investors. If a BDC pays out 95%, it gets an additional tax break. BDCs are “pass-through” companies, which means if they pay out the 90% of income then they don’t pay corporate income tax.

The actual business of a BDC involves making loans to small to midsized corporations. These are often companies most at risk if there is an economic slowdown or contraction. BDCs are not allowed to set aside loan loss reserves, so client company problems can quickly lead to dividend cuts from a BDC stock.

Another issue is the relation between a BDC’s stock trading price and its net asset value (NAV). I like to see a BDC trading at a premium to the NAV, but if the share price is growing faster than the NAV, there is the potential of a share price decline to get the values back to the historical relationship.

Here are three BDCs where the share price has gotten over the NAV skis, and the share should be sold to lock in profits.

Apollo Investment Corp. (AINV) this year has produced a total return of 57%. Nice. The problem is that the BDC’s NAV has generated a NAV total return of just 5.6%.

AINV carries a higher amount of leverage than its peers. The company cut its dividend by 25% when business conditions slowed in late 2015, early 2016.

The current dividend yield is over 10%. If you made a killing on AINV this year, consider selling to lock in your profits.

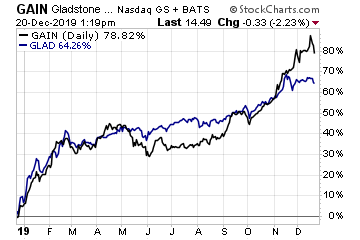

Gladstone Investment Corp (GAIN) and Gladstone Capital Corp (GLAD) have produced total returns in 2019 of 71% and 40%, respectively. NAV total returns for the two BDCs were almost identical at 9.6% and 9.6%.

Both are now trading at much higher than historical premiums to NAV. Premiums are 20% and 26%, respectively. These are both small BDCs, with market caps below $500 million.

A stock market disruption could quickly drive the share prices back to discounts to the NAV, which would also be declining. Double ouch! — If that happens.

A merger of the two would be a benefit to investors, but that seems unlikely. If you have big gains in either GAIN or GLAD, think about selling and taking your profits to more undervalued investment ideas.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

I agree that $GAIN is far too close to all-time highs. It is a stock WORTH owning, however. So I'd sell now, and re-buy as it dips over the next few weeks/months.

unless you have to worry about taxes and will lose your long term tax rate at 15% and plan to hold this for a long time.

You really think a crash is inevitable?

$GAIN has done well for me. I've been wondering how much room there is left to grow.