Select Macro Briefing - Wednesday, June 25

Job worries weigh on the US Consumer Confidence Index in June. “Consumer confidence weakened in June, erasing almost half of May’s sharp gains,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The decline was broad-based across components, with consumers’ assessments of the present situation and their expectations for the future both contributing to the deterioration. Consumers were less positive about current business conditions than May. Their appraisal of current job availability weakened for the sixth consecutive month but remained in positive territory, in line with the still-solid labor market.

(Click on image to enlarge)

Federal Reserve Chairman Powell told Congress that rate cuts are on hold. Testifying in the House on Wednesday, he said: “For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

US Treasury yields are steady after Fed’s Powell testifies in Congress. In early trading on Wednesday, the 10-year Treasury yield was slightly higher 4.30%, while the policy-sensitive 2-year yield was up 1 basis point at 3.797%. The 30-year yield was virtually unchanged at 4.839%.

US home price growth eased to slowest pace in nearly two years. The S&P CoreLogic Case-Shiller National Home Price Index increased 2.7% in April vs. the year-ago level, down from a 3.4% rise in March and dipping to the lowest pace since mid-2023.

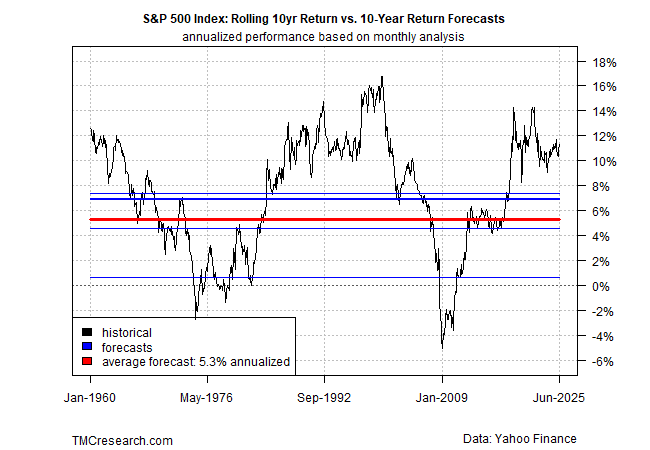

The US stock market remains on track to earn a substantially lower return for the decade ahead vs. recent history, acccoridng to new analysis by TMC Research, a unit of The Milwaukee Company. The average return estimate for the S&P 500 Index via five models anticipates a low-5% total return for the decade ahead, well below the 10%-12% performance that’s prevailed since 2024 for the rolling 10-year return.

More By This Author:

Foreign Stocks Still Lead US Shares By Wide Margin This YearMacro Briefing - Tuesday, June 24

Will The Fed Cut Rates Sooner Than Recently Expected?

Disclosure: None.