Seeking Income? 3 High Yield Stocks Worth A Look

Image Source: Pixabay

Everybody loves dividends as they provide a passive income stream and more than one way to reap a return from an investment. Dividend-paying stocks are generally less volatile by nature, another positive benefit in the current landscape.

And for those seeking payouts, three high-yield stocks – Verizon Communications (VZ - Free Report), Philip Morris (PM - Free Report), and Walgreens Boots Alliance (WBA - Free Report) – could all be considerations. Let’s take a closer look at the advantages and disadvantages of high-yield stocks before we examine each.

Are High-Yield Stocks Best?

A dividend-paying stock yielding more than 5% annually seems like a solid investment from an income-focused standpoint. But dividend yields fluctuate, as they are a function of share price movement.

If the stock goes up, the yield goes down, and vice versa. Investors should be aware of ‘dividend traps,’ a situation in which an overly-enticing annual yield has become a result of negative share performance stemming from poor business fundamentals.

PM Shares Soar

Philip Morris shares have benefited nicely from its latest set of better-than-expected results, with EPS growing 14% alongside a strong 7% move higher in sales. Demand has remained strong for the tobacco titan, with product innovations, namely its smoke-free business (SFB), remaining key for its future.

Notably, smoke-free products exceeded 40 billion units for the first time ever throughout its FY24, with full-year net revenues for its SFB increasing by 14.2% alongside an 18.7% move higher in gross profit.

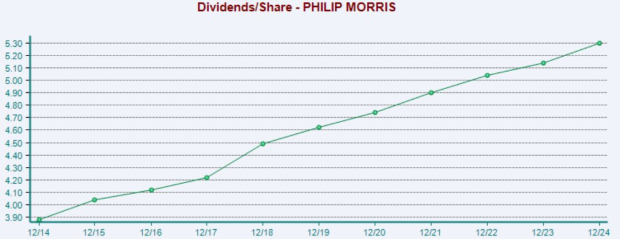

Shares currently yield a market-beating 3.5% annually. Dividend growth has been rock-solid, with PM holding a membership to the elite Dividend Kings group. Below is a chart illustrating the company’s dividends paid on an annual basis.

Image Source: Zacks Investment Research

VZ Generates Serious Cash

Verizon Communications is one of the largest telecommunications companies in the United States, providing wireless, broadband, and fiber-optic services to millions of consumers and businesses.

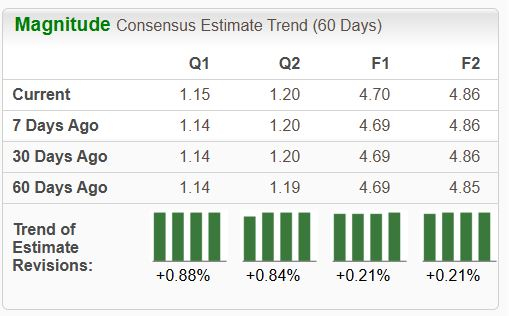

The earnings picture for VZ has become bullish over recent months, with analysts revising their EPS expectations modestly higher. Strong cash generation has placed the company as a favorite among many income-focused investors’ lists, with its low-volatility nature also highly-appealing.

Image Source: Zacks Investment Research

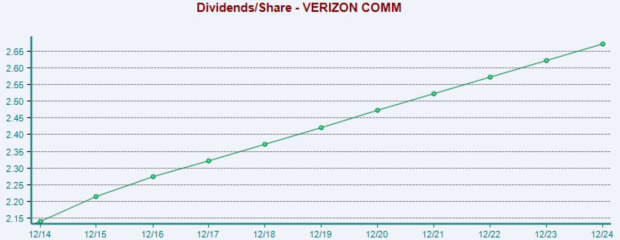

Below is a chart illustrating the company’s dividends paid per share on an annual basis. FY24 free cash flow of $19.8 billion grew 6% year-over-year. Shares currently yield a steep 6.3% annually, crushing that of the S&P 500.

Image Source: Zacks Investment Research

WBA Shares Bounce Back

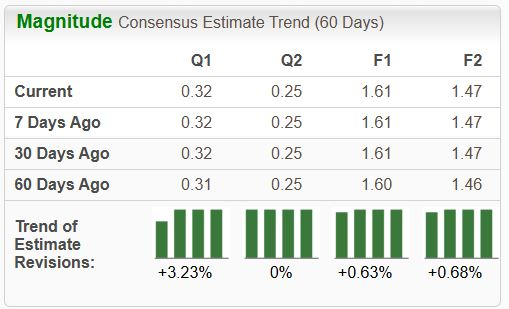

Walgreens Boots Alliance is a retail drugstore chain that sells prescription and non-prescription drugs. Analysts have taken a bullish stance on its EPS outlook, raising expectations across several timeframes over recent months and pushing the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Weak price action over the years has pushed WBA’s annual yield up to roughly 9.3% at present, crushing that of the general market. Though the stock has taken a beating over recent years, shares have finally bounced back in 2025, gaining nearly 15% and showing relative strength compared to the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

Dividend-paying stocks can allow investors to build a cash pile quickly. After all, isn’t payday the best?

And for those seeking high yields, all three stocks above – Verizon Communications, Philip Morris, and Walgreens Boots Alliance – precisely fit the criteria currently.

More By This Author:

Seeking A Volatility Shield? 2 Stocks Worth A LookVolatility Presents Opportunities: A Positive Stance

These 3 Stocks Are Ignoring The Market's Woes

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more