Scientific Games - Chart Of The Day

Summary

- 100% technical buy signals.

- 17 new highs and up 36.47% in the last month.

- 286.89% gain in the last year.

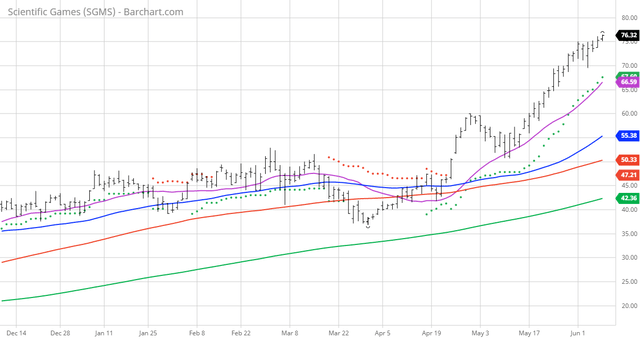

The Barchart Chart of the Day belongs to the computer services company Scientific Games (Nasdaq: SGMS). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. That resulted in a watch list of 54 stocks. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 4/23 the stock gained 51.25%.

Scientific Games Corporation develops technology-based products and services, and related content for the gaming, lottery, social and digital gaming industries in the United States and internationally. The company's Gaming segment sells new and used gaming machines, electronic table systems, video lottery terminals, conversion game kits, and spare parts; slot, casino, and table-management systems; table products, including shufflers; and perpetual licenses to proprietary table games. It also leases gaming machines; provides gaming operations and licensing arrangements; and installs and supports casino management systems, such as ongoing hardware and software maintenance and upgrade services of customer casino management systems. The company's Lottery segment designs, prints, and sells instant lottery products; designs and manufactures instant games tickets; offers instant products planning, monitoring, management system, warehousing, inventory management, distribution, marketing, and game support functions; supplies player loyalty programs, merchandising services, and interactive marketing campaigns; and sublicenses brands for lottery products and lottery-related promotional products. It also provides software, hardware, and related services for lottery operations; and lottery systems software maintenance and support services. The company's SciPlay segment sells virtual coins, chips, or bingo cards; and third-party branded games and original content through mobile and web platforms. Its Digital segment provides digital gaming, iLottery, and sports betting solutions and services, including digital RMG and sports wagering solutions, distribution platforms, content, products, and services; software design, development, licensing, maintenance, and support services; Open Platform Systems; and content aggregation platforms. The company was incorporated in 1984 and is headquartered in Las Vegas, Nevada.

Barchart technical indicators:

- 100% technical buy signals

- 264.77+ Weighted Alpha

- 286.89% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- Trend Spotter buy signal

- 17 new highs and up 36.47% in the last month

- Relative strength Index 77.34%

- Technical support level at 74.01

- Recently traded at 75.59 with a 50 day moving average of 55.38

Fundamental factors:

- Market Cap $7.23 billion

- Revenue expected to grow 15.90% this year and another 11.90% next year

- Earnings estimated to increase 100.70% this year and an additional 5,300.00% next year

- Wall Street analysts issued 5 strong buy, 3 hold and 1 sell recommendation on the stock

- The individual investors following the stock on Motley Fool voted 149 to 42 that the stock will beat the market

- Louis Navellier's Portfolio Grader give the stock a Quant Grade of A

- 6,550 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SGMS over the next 72 hours.

Disclaimer: The Barchart Chart of the Day highlights stocks ...

more