Saratoga Investment Corp - Stock Of The Day

Summary

- 100% technical buy signals.

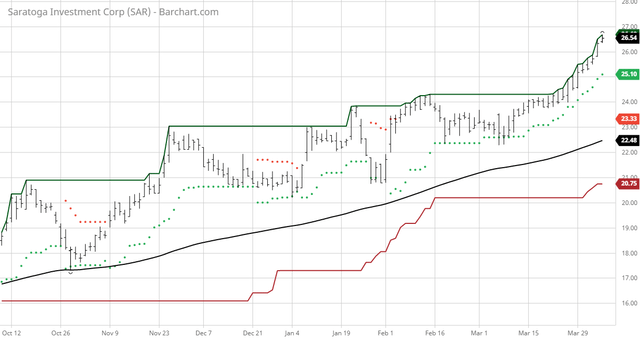

- 20 new highs and up 16.29% in the last month.

- 137.06% gain in the last year.

The Barchart Chart of the Day belongs to the business development company Saratoga Investment Corp (OTCPK: SAR). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 2/4 the stock gained 16.29%.

Saratoga Investment Corp. is a business development company specializing in leveraged and management buyouts, acquisition financings, growth financings, recapitalization, debt refinancing, and transitional financing transactions at the lower end of middle-market companies. It structures its investments as debt and equity by investing through first and second lien loans, mezzanine debt, co-investments, select high yield bonds, senior secured bonds, unsecured bonds, and preferred and common equity. It seeks to invest in the United States. The firm primarily invests $5 million to $20 million in companies having EBITDA of $2 million or greater and revenues of $8 million to $150 million. It invests through direct lending as well as participation in loan syndicates. The firm was formerly known as GSC Investment Corp. Saratoga Investment Corp. is based in New York, New York with an additional office in Florham Park, New Jersey.

Barchart technical indicators:

- 100% technical buy signals

- 93.63+ Weighted Alpha

- 137.06% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 an d100 day moving averages

- 20 new highs and up 16.29% in the last month

- Relative Strength Index 76.89%

- Technical support level at 25.93

- Recently traded at 26.54 with a 50 day moving average of 23.57

Fundamental factors:

- Market Cap $295 million

- P/E 12.19

- Dividend yield 6.53%

- Revenue expected to be down 4.60% this year but up again by 9.00% next year

- Earnings estimated to decrease by 83.40% this year but increase again by 103.00% next year

- Wall Street analysts issued 2 strong buy, 1 buy and 2 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 21 to 2 that the stock will beat the market

- 7,252 investors are monitoring the stock on Seeking Alpha

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more