Santa Rally Coming To Town?

The Santa Rally, a period of strong stock market performance in the last part of December. It exists due to a combination of psychological, market, and technical factors. Investor optimism during the holiday season, combined with the conclusion of tax-loss harvesting and fund managers’ year-end “window dressing,” often boosts buying activity. Low trading volumes during this period can amplify price movements, while year-end bonuses and positioning for the new year further contribute to upward momentum. Additionally, the self-fulfilling nature of the phenomenon, where investors buy in anticipation of the rally, reinforces its existence. Together, these elements create a favorable seasonal trend in the S&P 500, though its strength can vary depending on broader market conditions.

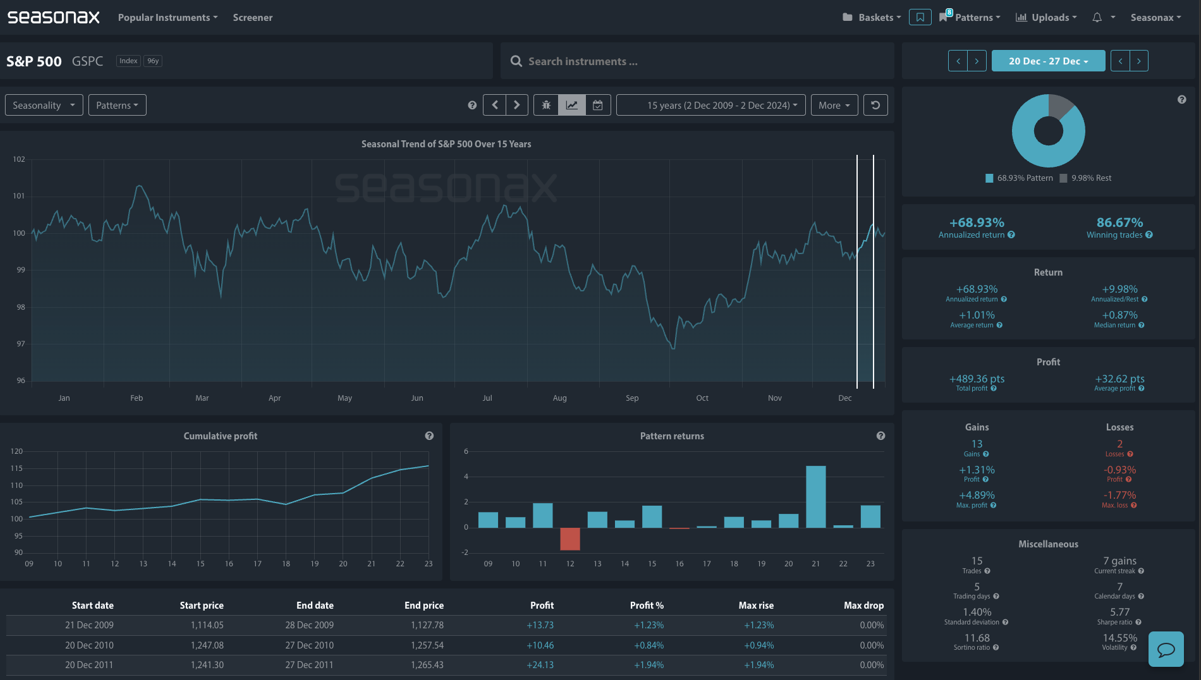

The S&P 500 shows a historically strong seasonal pattern from December 20 to December 27, delivering an annualized return of +68.93% over the past 15 years with a high win rate of 86.67%. The average return during this period is +1.01%, supported by low volatility (1.40% standard deviation) and a consistent seven-year streak of gains. This performance aligns with the broader Santa Rally phenomenon, driven by year-end portfolio adjustments, reduced tax-loss selling, and holiday optimism. With a maximum single-period gain of +4.89% and a relatively mild drawdown of -1.77%, the trend suggests a favourable short-term risk-reward dynamic for traders. However, while historical data points to consistent profitability, external market factors could still influence outcomes.

(Click on image to enlarge)

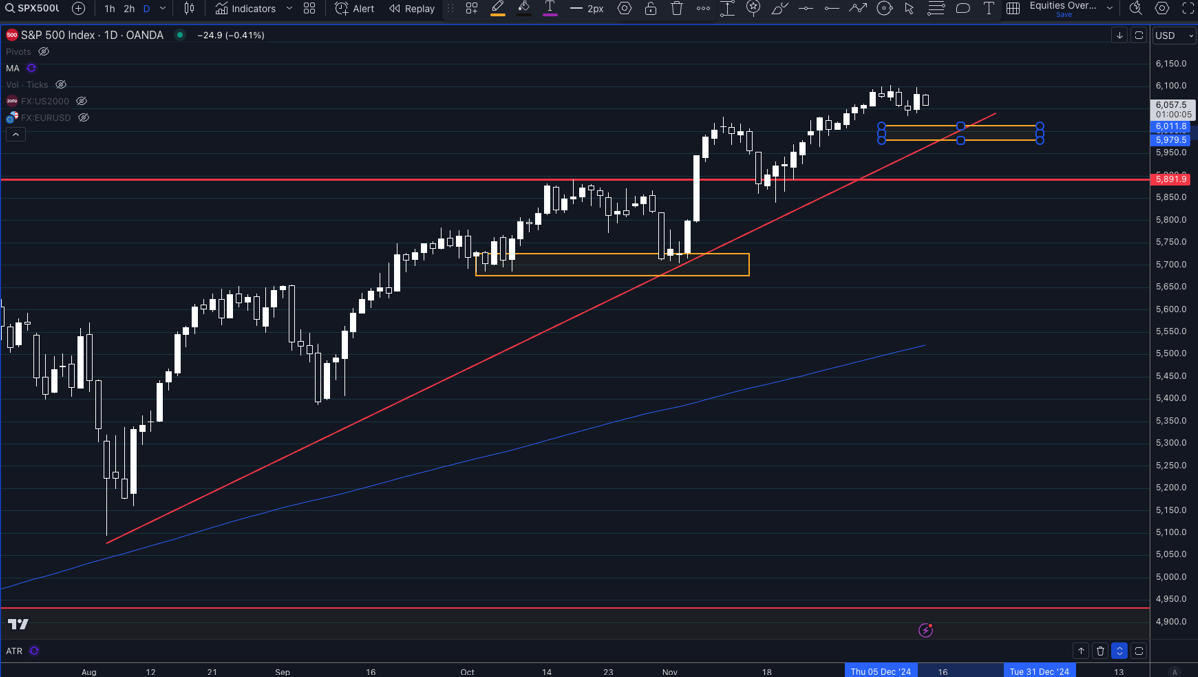

Technically, there is a very strong support level at 6,000 marked on the chart below as a decent area for potential entries/stop placements.

(Click on image to enlarge)

Trade risks

While historical data points to consistent profitability, external market factors could still influence outcomes.

Video Length: 00:01:45

More By This Author:

Nasdaq And The Fed: Key Insights For December 18WTI Crude Oil’s Seasonal Strength Meets OPEC+ Challenges

Seasonal Strength: Dax’s Strong Year-End Rally

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more