Sangamo BioSciences Provides Well Defined Opportunity

On Tuesday, February 10th, Sangamo BioSciences (SGMO) announced its earnings results. The clinical stage biopharmaceutical company reported ($0.06) EPS for the quarter, beating consensus estimates of ($0.09) by $0.03. Revenue was $15 million for the quarter, which is up 117% on a year-over-year basis. Sangamo focuses on the research, development, and commercialization of zinc finger DNA-binding proteins for gene regulation and gene modification as regulated in the United States. Its main driver of revenue is collaboration, the most prominent being co-development deals with Biogen Idec (treatment of beta-thalassemia) and Shire Plc (treatment of hemophilia). The most advanced drugs in SGMO’s pipeline are two significant treatment drugs, both in mid-stage Phase 2 clinical trials: SB-728 for the treatment of HIV/AIDS and CERE-110 for the treatment of Alzheimer’s.

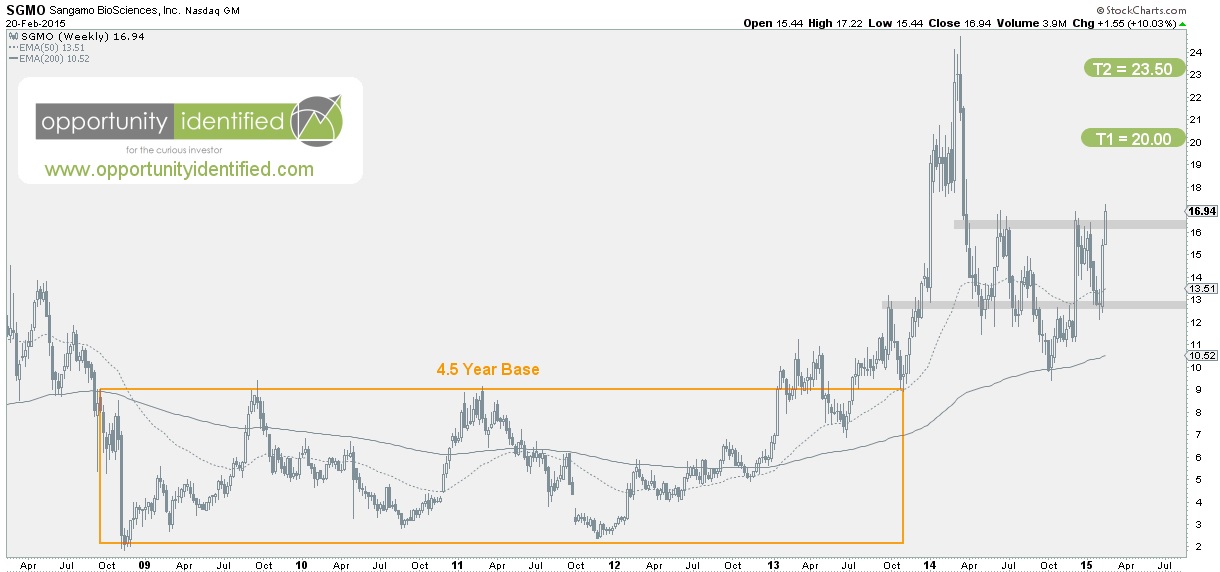

Since releasing earnings, the stock has moved 32%, from $12.74 to $16.94. This move has brought SGMO to a well-defined inflection point. Looking at the weekly chart below, it’s easy to see how important this current price level is, marking historical points of supply over the past year. It should also be noted that the price action over the past year is the result of breaking out of a 4.5 year long base. We heart long bases!

When zooming into the daily chart, the important price levels are easily identifiable. If the $17 level is broken, it will likely play the role of future demand (resistance). The price pattern over the past year has created a classic Inverse Head and Shoulders pattern. This pattern provides upward reward targets of $20.00 (18%) and $23.50 (38%). Frequent readers know that we like trade positioning that provides well defined risk, as well as significant reward in relation to that risk. This set-up fits our criteria for high reward/low risk entry point. With a stop loss at $16.50, our risk is well defined. Our reward targets are identified. Price will tell us which side of the trade to be on. We like this opportunity.

The original article and more like it can be found here: opportunityidentified.com

more

I'm convinced. Thanks.