Safe-T Group - An Emerging Cybersecurity And Privacy Solutions Provider

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Company Profile

Safe-T Group Ltd. (Nasdaq: SFET) is a global provider of innovative cyber-security and privacy solutions to consumers and enterprises. The Company operates in three distinct segments: enterprise cyber-security solutions, enterprise privacy solutions, and consumer cyber-security and privacy solutions. Safe-T’s aggressive growth model is backed in-part by strategic M&A activity with businesses and technologies that are complementary to its existing products.

The Company’s impressive products, such as its U.S. General Services Administration- & NASA-approved zero trust network access product, have boosted Safe-T's growth an average of 80% on a year-over-year basis the past two years. Safe-T’s total annual revenues have grown from $1.4 million in 2018 to a projected $9 million in 2021. Aside from the Company’s impressive growth and product line, Safe-T holds no debt and maintains cash holdings of around $19 million, as of the end of the second quarter 2021.

Safe-T’s cybersecurity and privacy products are not your typical anti-virus scanning software. The ZoneZero platform is the only available zero trust network access (ZTNA) product that can integrate with existing virtual private networks (VPNs) or replace the pre-existing infrastructure. This enables employees or contractors to work from home with or without a VPN and an in-house worker to safely and securely access the network with full protection against cyber vulnerabilities. The ZoneZero platform accomplishes this by controlling a user's access based on their identity and/or role within the organization.

On the consumer side, Safe-T’s cybersecurity and privacy products are focused on stopping threats at the “gateway” level. Typical cybersecurity software tends to address and eliminate threats once they have already infected your computer. Safe-T’s solutions focus on eliminating the threat before hackers have infected your computer with malware, phishing attempts, ransomware, etc. This allows users to be protected before they are compromised.

Safe-T Group’s partners and distributors feature several prominent companies, such as Accenture, Fujitsu, Edvance, DataGroupIT, and more. The Company’s customer basis is equally as impressive, featuring companies like eBay, Philips, CheckPoint Software, and more. Furthermore, Safe-T’s products and services have been recognized by key market research firms, Garnter, Forrester and Frost & Sullivan.

(Click on image to enlarge)

Enterprise Cyber Security Solutions

Safe-T provides a range of secure access solutions using its patented reverse access and proprietary routing technology. The company’s technology allows the reverse movement of communication and information while reducing the need to store data in the DMZ (the space between the internet and the LAN). Safe-T’s secure access network services are based on the ZoneZero®MSSP (Managed Service Security Provider), cloud and on-premise offerings.

ZoneZero Solutions -

ZoneZero® is a ZTNA solution designed to help organizationsadopt more effective security, based on the "never trust, always verify" principle. ZoneZero® allows one to access internal applications, services, and data, securely and transparently. It seamlessly integrates multi-factor authentication and identity awareness into all access scenarios.

Safe-T has a deep understanding of the need for efficient ZTNA solutions that address all remote access scenarios and requirements, they therefore created the first ever Zero Trust Access Orchestration Platform, supporting the following access scenarios: remote access users (non-VPN), VPN users, internal network users.

ZoneZero, is a client-less solution providing secure access to all types of users, corporate applications, data, and services like HTTP/S, SMTP, SFTP, SSH, APIs, RDP, and legacy applications. Their technology eliminates the need to open incoming ports in the organizations’ firewalls providing the broadest data access solution available within the SDP market.

(Click on image to enlarge)

Enterprise Cyber Privacy Solutions

Safe-T’s Enterprise Privacy Solutions act as an Internet Protocol Proxy Network (IPPN) for business customers. They have partnerships and agreements with strategic ISP around the world which allow its customers to scour the internet through dozens of internet service providers, networks, and major internet exchange points (IXPs) globally. Safe-T grew its product portfolio after acquiring NetNut in 2019 - expanding enterprise privacy and SIA solutions.

With these added capabilities, clients can gather data using residential IP to service customers through global routers. This allows companies to anonymously collect limitless data from any public source online. According to Frost & Sullivan, the total IPPN Serviceable Obtainable Market (SOM) is valued at $76.3 million in 2018 and expected to grow at a CAGR of 16.8% through 2025, hitting $259.7 million.

Consumer Cyber Security and Privacy Solutions

Safe-T acquired two consumer privacy and cyber security companies in the past year, thereby expanding and diversifying its revenue streams. With the acquisition of Chi Cooked LLC and Cyberkick, the company strives to build a more robust platform and safer experience for its consumers.

Cyber Security Solutions -

Safe-T’s acquisition of CyberKick provides Software as a Service (SaaS) security and privacy tools which counter and reduce users’ vulnerability to multiple threats.iShield identifies, eliminates, and helps avoid security threats and data breaches, protectingthe user from phishing, ransomware, identity theft, data scams, viruses, and malware. A commercial-grade version of iShield is expected to launch in the next several months.

Privacy Solutions -

CyberKick’s and Chi Cooked privacy solutions let consumers protect their privacy through a powerful encrypted network. Consumers can encrypt sensitive user data on banking sites or private emails thereby protectingusers from hacks while connected to unsecured wi-fi networks.

How Does the Company Generate Revenue?

The company has built multiple revenue streams from the sale of enterprise cybersecurity and privacy solutions, and consumer cybersecurity and privacy solutions. Through these product lines, revenue is generated in two forms: Perpetual Licenses and Subscribed Licenses.

The perpetual license revenue includes yearly rebills from customers purchasing Safe-T’s solutions with one to three years of maintenance and support services. Thereafter, customers pay for updates and upgrades providing a consistent revenue stream. On average, the renewal rate for maintenance and support contracts was approximately 77% through 2018 and 2019.

Additionally, they generate revenue from annual support subscriptions - which last one to three years on average.

Distributor Profile

Safe-T has active data partnerships with numerous well-heeled distributors across North America and Europe, allowing them to market their solutions to those regions. Partnerships and distributors include Fujitsu, Accenture, Edvance, Data Group IT and, most recently, Philemon Security USA and ELCA Informatique SA.

Philemon Security is ramping up its marketing of ZoneZero Solutions with the intention of targeting the $92 billion government IT Sector. Philemon Security will be Safe-T's lead distributor in North America.

In June 2021, Safe-T inked another partnership with ELCA Informatique SA to bring its Zero Trust Network Solutions to the Swiss market. ELCA is a Swiss-based business and tech provider andtheyalso function as the largest cybersecurity consultancy in Switzerland.

Customer Profile

Safe-T services more than 6,000 customers through 600 partners worldwide, with their solutions being used by blue chip companies like Phillips (NYSE: PHG), eBay (NASDAQ: EBAY), Checkpoint (NASDAQ: CHKP).

Understanding the Need for Cyber Security and Privacy Solutions

A staggering 66% of small and medium-size businesses in the US had at least one cyber attack and 60% of them went out of business within six months of falling victim to these data breaches or hacks.

(Click on image to enlarge)

Exhibit 3: Cyber Security Threats and Losses (source: company presentation)

With the widespread adoption of BYOD and WFH trends, there’s a growing demand for cloud-based software, driving the need for cybersecurity solutions. The trends have also led to an increasing demand for ZTNA technology and zero-trust solutions. ZTNA resolves all the drawbacks of VPNs while providing secure multi-cloud access, which reduces the vulnerability to attacks,third-party risks, and offers accelerated M&A integration.

The global ZTNA market is estimated to increase from $19.6 billion to $51.6 billion, a growth rate of 17.4%. North American markets are likely to account for the largest share with key players such as Akamai Technologies, Cisco Systems, and Okta Inc.. According to Gartner, a global research and advisory firm, 60% of businesses will phase out remote access virtual private networks in favor of ZTNA.

A recent development in the cybersecurity space may have significant implications for Safe-T. ExpressVPN, a VPN service provider, was acquired for nearly $1 billion by Kape Technologies, a British-Israeli privacy-first digital security software provider. Kape Technologies stated they want to create a "premium consumer privacy and security player" as the rationale for acquiring ExpressVPN. It is hard to say exactly how this will impact Safe-T. One could speculate, given VPNs' growing popularity amongst security software providers, the shortcomings of VPNs will become increasingly apparent. This will cause providers to seek additional security platforms which Safe-T is uniquely poised to offer. Eitan Bremler, Safe-T's Co-Founder and VP of Corporate Development, stated, "VPNs have become a hackable device, we want to become a second line of defense, so if someone hacks the VPN they cannot jump into the network." This added layer of security could give providers additional assurance that their client's networks are secure in tandem to a VPN.

Company’s Financial Position

Safe-T has acquired three companies since 2017, two of the most recent acquisitions have been in the last year alone. They have multiplied revenues 4.5x in the past 3 years, from ~$1.1 million to ~$4.9 million - this is due to strong organic growth alongside acquisition-led growth.

Exhibit 4: Company’s Financial History

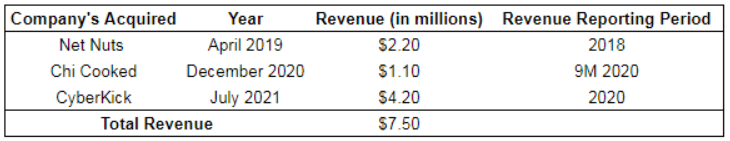

Since the acquisition of NetNut in mid-2019, Safe-T has seen a downtrend in its operating losses, coupled with exponential growth in revenue. This trend is likely to continue in 2021 with its recent acquisition of Chi Cooked in December 2020 andCyberkick in July 2021. The combined revenue of all three entities before acquisition is ~$7.5 million, whereas the company projects revenues of ~$9 million for 2021.

Their revenue estimates seem conservative and it may be possible to hit double digits by the end of 2021. Acquiring both Chi Cooked and Cyberkick has likely narrowed the company's operating losses given the profitable nature of both acquisitions.

Exhibit 5: Revenue Profile of Acquisitions by SFET

Safe-T’s average cash burn rate for the past four years has been in the range of ~$6-$7 million, driven primarily by SG&A expenses. Going forward, this burn rate will likely decrease due to the expected positive cash flow generatedby 2025 . As per the latest filings, their current cash balance is ~$19 million which will fund the business for the next 12-18 months. Given these projections, Safe-T may need to raise cash leading to a further dilution of equity.

Risk Profile

- Risk of dilution: Safe-T is currently a cash-burning company and is expected to remain that way for the next 3-4 years. Current cash balances will support the company for the next 4-6 quarters, after this time period they will have to raise cash, diluting the ownership ofcurrent shareholders.

- Safe-T operates in an evolving industryrequiring continuous upgrades to its offerings in order to stay competitive in the market.

Valuation Outlook

Safe-T has widened its product portfolio by incorporating IP Proxy solutions, thus providing cybersecurity and privacy solutions tothe enterprise and consumer levels.

Recent acquisitions by management will help the company reach a broader market, creating more value for its shareholders. Given the increasing cyber theft andlossesincurred, the need for cybersecurity and privacy solutions willbecomeessential.

With the integration of Cyberkick, revenues are projected to reach ~$10 million in 2021 and ~$14 million in 2022. The company is currently trading at 3.2x 2021E sales and 2.25x 2022E sales.

Exhibit 6: Sensitivity Table

The above sensitivity table provides an expected value of the company at different assumed f revenues and P/S ratios. On a base case, assuming the company’s revenue to be ~$14 million dollars and a price-to-sales ratio of 5x, the company’s expected value is $53.3 million or ~$1.95 per share, indicating an upside of over 65%. The value is calculatedusing a discount rate of 20% while incorporating the time value and inherent risks in the business model. Management expects to achieve $50 million in revenue by 2025, an optimistic scenario. Even if they reach a run rate of $30 million by 2025, there will be immense value creation at current levels. The market has already priced in most of the risks and at the current price level, the risk to reward ratio looks favorable for both current and prospective investors.

Disclosure: None.