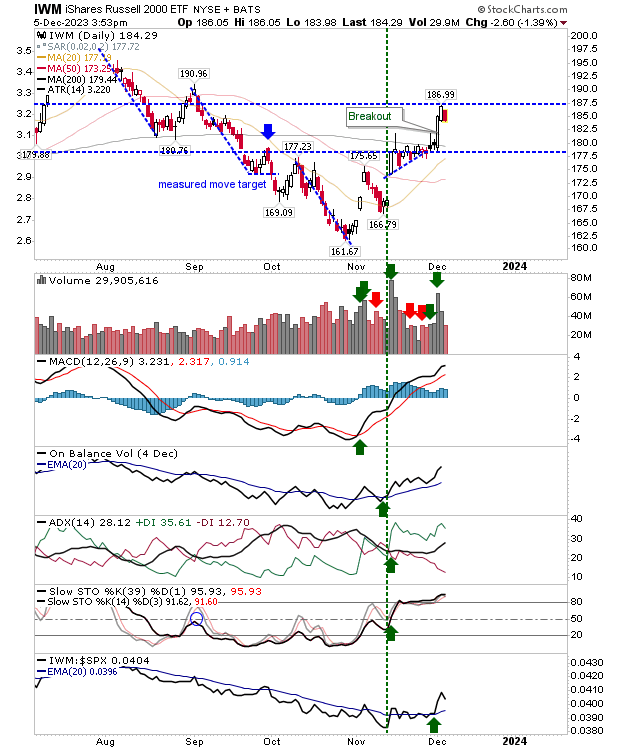

Russell 2000 Pegged By Minor Resistance As Nasdaq And S&P Hold Breakout Support

The Russell 2000 (IWM) posted two days of strong buying that brought the index up towards minor resistance. Not surprisingly, after days of narrow action into the prior ascending bullish triangle consolidation, the resulting price surge has entered a new consolidation period. Technicals for the index are strongly net bullish, but even with the loss, prices are still near highs of the last couple of days.

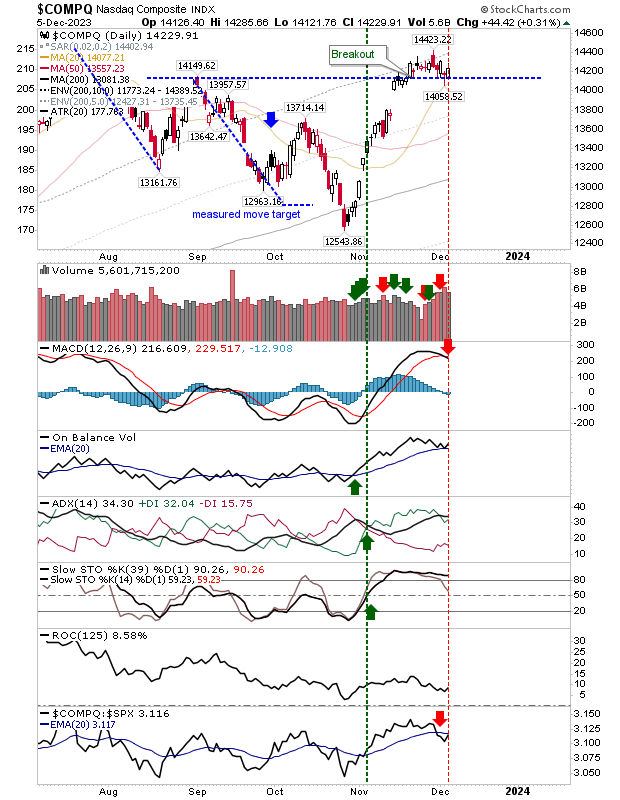

While the Russell 2000 (IWM) is easing off yesterday's highs, the Nasdaq and S&P continue to defend breakout support. The Nasdaq is looking the most comfortable after a successful test of its 20-day MA and it now leaning on support defined by the August swing high.

The S&P is trading just above August swing high support as if it's standing on its tippy toes. It remains debatable as to what comes next after failing to take advantage of Friday's solid white candlestick. A test of the 20-day MA may be required before it can rally again.

There may be some continued downside for the Russell 2000, but if the intraday range can remain narrow it will leave the index well-placed to challenge 52-week highs. It's looking more like a question of 'when' rather than 'if' this will happen. The Nasdaq and S&P might slide around current levels until Small Caps make their break.

More By This Author:

Russell 2000 Smashes A Breakout - Dec. 3, 2023

Markets In "Covered Call" Territory

Another Day Waiting For The Breakout In The Russell 2000

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more