Russell 2000 Kicks On Again With A Bright Start To Week

I didn't expect the Russell 2000 (IWM) to have it in itself after a strong finish to last week, but today is a positive start to this week as the index looks to shape a right-hand-side base. Technicals are net positive with what could turn out to be a relative outperformance against the S&P.

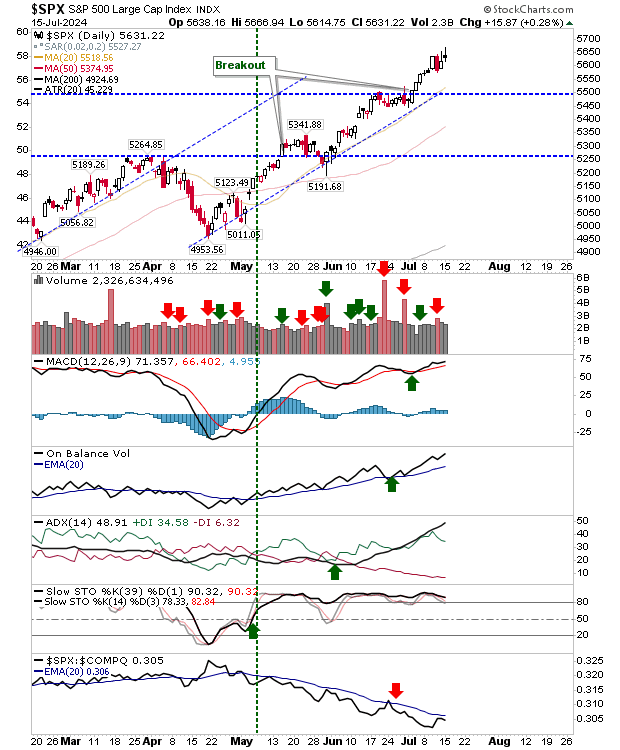

The S&P and Nasdaq both opened with gaps higher, but neither could build on their success. Technicals are net positive, although the S&P is underpeforming the Nasdaq. Today's doji has the potential to mark a reversal, a weak pre-market tomorrow would likely confirm.

The Nasdaq doji was contained by last Thursday's high, making it a little more vulnerable to a reversal tomorrow. As with the S&P, if there is a weak pre-market then it could turn into a tough day. A move above 18,670 will break the bearish implications of last Thursday's selling, and today's potential reveral doji.

Watch premarket for leads. The Russell 2000 is now the bullish one to watch with lots of room for upside, so buying down days will be good for investors. A weak pre-market has the potential to hurt S&P and Nasdaq traders, particularly with money cycling into Small Cap stocks. However, if the latter indices are able to (EOD) close above today's highs then the reversal potential of these doji are negated.

More By This Author:

Russell 2000 Falters Despite Strong Opening GapRussell 2000 Surges As S&P And Nasdaq Head South

Slow Day At Highs For S&P And Nasdaq

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more