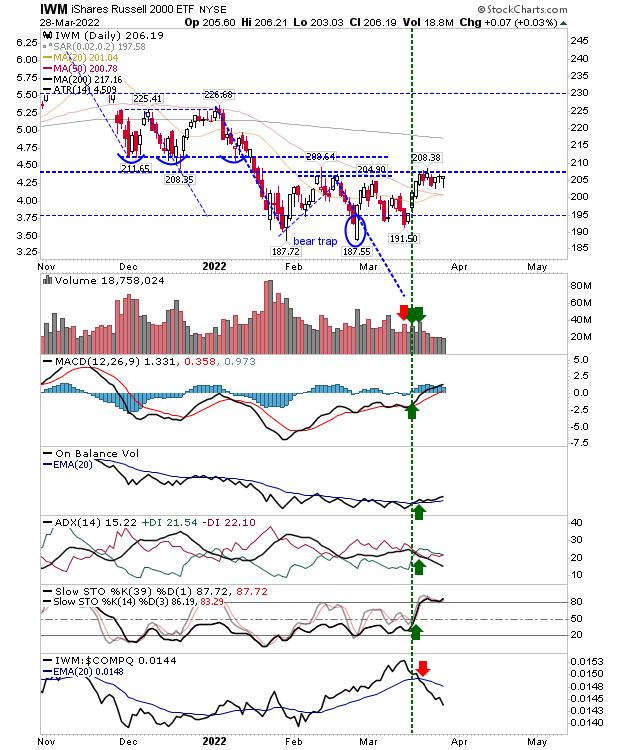

Russell 2000 Is Ready To Breakout

Another day passes with the Russell 2000 primed to breakout. Today saw another small bullish 'hammer' just below resistance even as relative performance against the Nasdaq and S&P continued to plummet. Buying volume was light, so this is an index biding its time until it's again noticed.

The Nasdaq added just over 1% as the rally off March lows makes its way to its 200-day MA. Relative performance against the S&P also gained ground. Traders are sticking with Tech stocks for now, but the Russell 2000 offers the best value.

The S&P had already pushed past lead-moving averages and is on the brink of pushing past the last swing high around 4,600. Technicals are in excellent shape. It's hard to be a buyer here (as a trade, not as an investment), but it's a safe hold.

Today's small 'hammer' in the Russell 2000 does suggest tomorrow could be the day the index breaks from the bottom of its base. Although, the rally we see now in the Nasdaq and S&P were the result of a failed breakdown - when the breakdown was looking the more likely outcome. Watch early morning action for leads.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more