Russell 2000 Futures: Zigzag Correction Likely To Find Support For Extension To New Highs

Image Source: Pexels

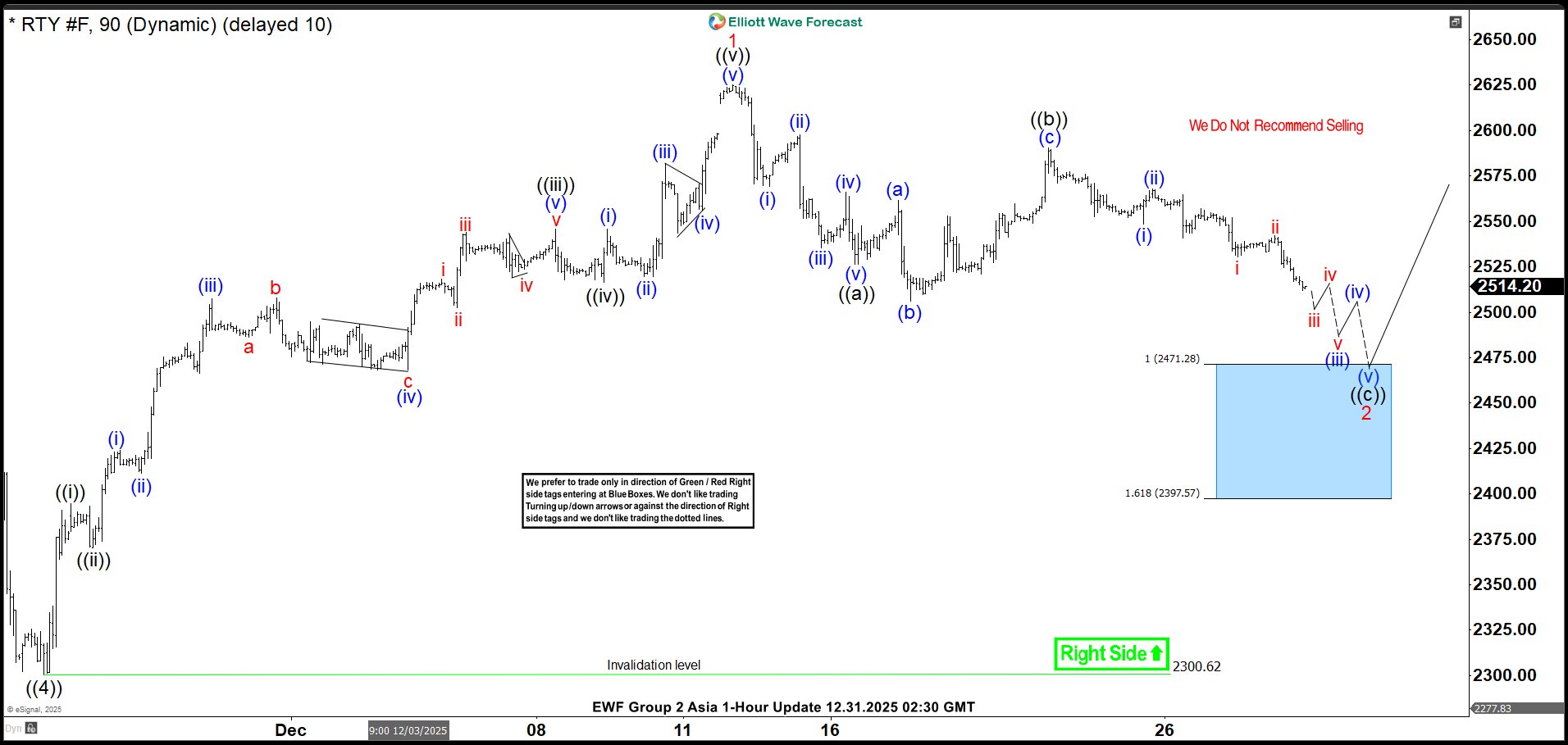

Russell 2000 Futures (RTY) has broken to a new all‑time high, and this confirms that the broader trend remains bullish. The cycle from the April 2025 low continues to advance as an impulse. Wave ((4)) finished at 2300.6, as shown on the 90‑minute chart. From that level, wave ((5)) began to unfold with a clear impulsive structure at a lower degree.

After wave ((4)), the index pushed higher in wave ((i)) to 2396.4. A brief pullback in wave ((ii)) followed and ended at 2370.3. RTY then accelerated in wave ((iii)), reaching 2545.8. A shallow consolidation in wave ((iv)) held at 2516.6. The final leg, wave ((v)), carried the index to 2625, which completed wave 1 at a higher degree. A correction in wave 2 is now in progress. It is retracing the cycle from the November 21 low and is forming a zigzag pattern. From the wave 1 peak, wave ((a)) declined to 2526.2, and wave ((b)) recovered to 2590.30. Wave ((c)) should extend lower toward 2397–2471, which aligns with the 100%–161.8% Fibonacci extension of wave ((a)).

This area should act as support and allow wave 2 to finish. As long as the pivot at 2300.6 holds, buyers are expected to appear in the next 3, 7, or 11 swings, and the broader uptrend should resume.

Russell 2000 Futures (RTY) 90 minute chart from 12.31.2025 update

RTY Elliott Wave video:

More By This Author:

S&P 500 E‑Mini Maintains Bullish Structure, Eyeing Further UpsideRobinhood (HOOD): Can It Dip Below $100 Before New Highs?

A 25% Drop Shook Traders, But Shopify Still Points Higher

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more