Royal Dutch Shell, A High Dividend Player In A New Trump Era

Royal Dutch Shell, a dividend stock ready for take-off.

What the business landscape will look like under Trump's presidency will be the little unknown. His intention to "renegotiate" the North American Free Trade agreement with Canada and Mexico and the imposing of economic protectionist policies are fears that could have an impact on the stock exchanges worldwide in the coming years.

But one thing is for sure, Trump will not accept the climate deal signed in Paris. Trump's pro-infrastructure policy will be good for pipeline infrastructure. From the Keystone XL pipeline to the North Dakota Access Pipeline, two of several projects that will perk up the U.S. oil and gas drilling boom again.

The Keystone XL 1,179-mile pipeline, which could carry 800,000 barrels a day of carbon-heavy petroleum from the Canadian oil sands to the Gulf Coast, will create jobs and stimulate economic growth.

With uncertainty back on the agenda, one popular investing theme could evolve once again.

Dividend investing

Dividend investing is a great way to mitigate worries investors have about the investment climate.

"Once a dividend is established, companies tend to maintain payments in order to avoid sending a negative signal to investors".

Everyone should read the report Challenging some of the myths surrounding equity income investing to get a better understanding of some common thoughts (read: mistakes) about dividend investing.

In my last article regarding Royal Dutch Shell (RDS-A, RDS-B) I already mentioned that divestments and existing cash flow will be sufficient to support the company's dividend policy. That's why I opted that Shell's dividend is sacred. My opinion has not changed and I think Shell could sustain their dividend going forward.

Attractive Dividend Yield

The dividend yield of good old Royal Dutch Shell is approximately 7.3%.

Shell has promised its shareholders that the generous dividend from previous years will be continued this year.

Two weeks ago, Royal Dutch Shell announced Q3 results that were better than expected. It reported an 18% increase in profit before non-recurring items of $2.8 billion. This is substantially higher than expected. Analysts consulted by Bloomberg estimated an average profit of about $1.79 billion. The quarterly dividend will be maintained at $0.47 per share.

Unfortunately, the numbers show once again that the cash flow from Shell at the current low oil price is still not high enough to cover its investments and dividend payments. The gearing ratio, an important measure of the amount of debt that a company can comfortably carry went up to 29.2%, very close to its 30% gearing ceiling.

Something I wouldn't worry about. As already known, this is a transitional year for Shell because of its acquisition of the BG Group and major cost saving programs that are running. The cash now generated by BG Group Plc outstrips its spending, so the acquisition is finally delivering.

In the end, the company will become leaner and meaner.

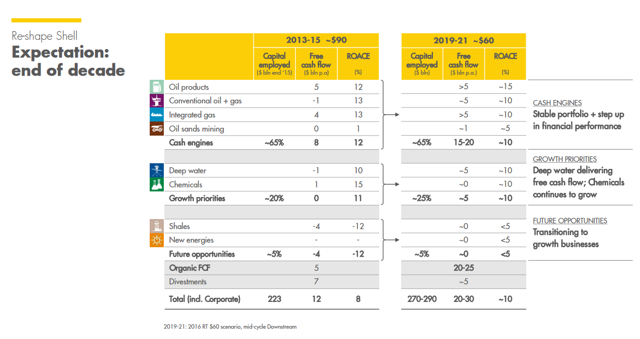

(Click on image to enlarge)

In an oil price recovery scenario, Shell might be able to deliver on its ambitious plans as presented in June: to deliver $20-$ 25 billion of organic FCF in 2019-2021 with an ROACE of around 10%, and that in a $60 oil price environment.

The words of CFO Simon Henry said in the Q3 conference call, says it all.

Shell will be in business for "many decades to come" because it is focusing more on natural gas and expanding its new-energy businesses including biofuels and hydrogen.

I believe Shell has tackled the downturn and the stock is ready for a strong performance again.

Dutch Trader doesn't have any position in Royal Dutch Shell. Please do your own research before ...

more

thanks for sharing