Room To Run: Why This Bull Market May Be Just Getting Started

Image: Bigstock

When asked what has made the greatest investors so successful in the long run, they all share a key ingredient: patience. The best investors exhibit discipline over decades, navigating their way through heightened-volatility phases including pullbacks and deeper corrections.

It is these more difficult periods that are a natural and necessary component of any bull market. We’ve just encountered (and may still be in the midst of) a pullback that saw stocks move broadly lower over the past few months. Pullbacks and corrections are a common feature of young bull markets, but they pave the way for stocks to continue trending in a positive direction.

High Levels of Pessimism Remain

Despite the notable advances off last year’s bear market lows, plenty of skepticism remains. Bulls took control of the narrative late last year and have retained their dominance throughout this year. Thursday marked the official one-year anniversary of this new bull market.

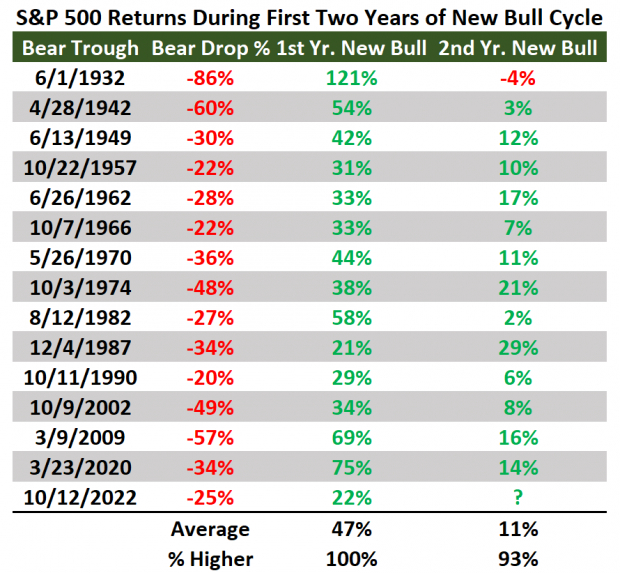

Yet there are plenty of pessimists out there that feel that even though we have entered a new bull market, high interest rates and other concerns will kill it off in short order. But those same people are asking for something that hasn’t happened since the depths of the Great Depression in 1932:

Image Source: Zacks Investment Research

Let’s take note of a few things here. First, notice there’s only one instance spanning all new bull markets (since 1932) in which the second year showed a negative return. Also of importance is the fact that the first year of new bull markets typically sees outsized gains; the first year of this new bull was on the lower side of the spectrum, which leaves plenty of upside potential ahead.

In fact, this was the weakest start to a new bull market since the year following the 1987 crash. The good news? Stocks gained 29% in the second year of that bull cycle.

Earnings Season Brings Renewed Optimism

The third-quarter earnings season is underway with mega-financials reporting this past week, including heavyweight JPMorgan Chase (JPM - Free Report). A Zacks Rank #2 (Buy), JPMorgan Chase came out with quarterly earnings of $4.33/share, an 11.31% surprise over the $3.89/share consensus estimate. The bottom line soared 38.8% versus the year-ago period.

JPM posted Q3 revenues of $39.87 billion, a 1.89% surprise over the Zacks Consensus Estimate and a 21.9% improvement relative to the same quarter last year. JPM shares shot up more than 4% in the early going yesterday morning and have advanced more than 15% year-to-date.

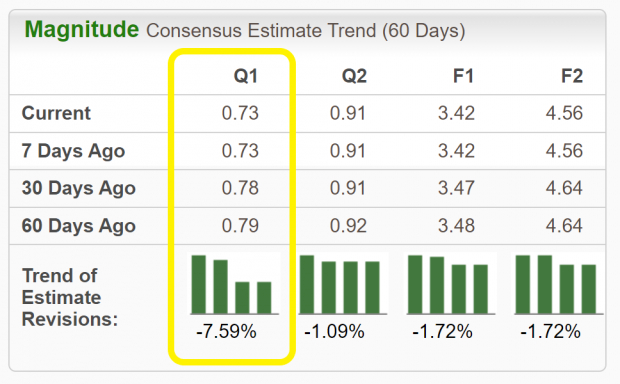

Image Source: Zacks Investment Research

Outside of financials, the Q3 earnings season will heat up next week with a number of companies reporting, including EV giant Tesla (TSLA - Free Report). Analysts have been slashing third-quarter earnings estimates for Tesla after the company reported disappointing delivery data earlier this month of 435,059 vehicles, down 6% from the second quarter.

TSLA EPS estimates have dropped 7.59% in the past 60 days. The Q3 Zacks Consensus Estimate now stands at $0.73/share, reflecting negative growth of -30.5% relative to last year. Third-quarter revenues for TSLA are projected to increase 13.6% to $24.38 billion.

Image Source: Zacks Investment Research

Final Thoughts

Historical data points to a high likelihood that the recent volatility will turn out to be a buying opportunity, as odds are solid that the second year of this bull market will be positive and may even surprise to the upside.

Despite the facts, high levels of pessimism remain as doubters are prevalent – something that I think can help this bull market reach new heights. Remember, stocks climb a wall of worry.

The Q3 earnings season is underway, and with it we may see renewed optimism. Make sure to take advantage of all that Zacks has to offer as we head further into the historically bullish fourth quarter.

More By This Author:

4 Top-Ranked Sector ETFs To Buy For Q4Time To Buy These Top-Rated Finance Stocks Before Earnings?

3 Quarterly Reports To Watch Next Week

Disclosure: JPM is a current long-term holding in the Zacks Income Investor portfolio.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed ...

more