Roku Stock Crushes: Buying Opportunity

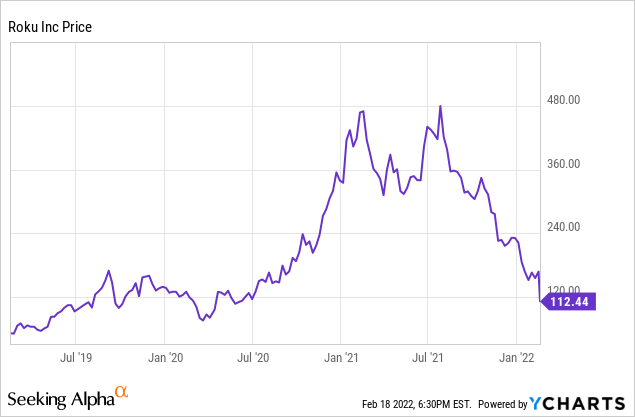

Roku (Nasdaq: ROKU) stock is getting destroyed: Shares of the leading streaming platform are down by a breathtaking 77% from their highs of the year. Quite a staggering decline in a relatively short period of time.

This is partly due to market conditions, as the stock was already declining in a bear market environment for growth stocks. However, the most recent earnings report exacerbated the negativity around Roku, and the stock lost an additional 23% on Friday alone.

The earnings report was bad, as the company missed estimates, and guidance was substantially below expectations. However, the report was bad for good reasons. Roku is being affected by the supply chain dislocations, and management is aggressively investing for growth with a long-term perspective.

There is a big chance that Roku stock will remain under pressure in the short term. However, the stock is priced at bargain low levels, and the fundamental thesis has not changed. For investors with a multi-year time horizon, this could be an excellent opportunity to buy Roku stock.

A Bad Report From Roku For Good Reasons

Roku is being seriously affected by the supply chain issues, smart TVs are getting increasingly expensive, with a year-over-year price increase of 33% last quarter. Some of the company's partners had problems getting access to the components to build the TVs.

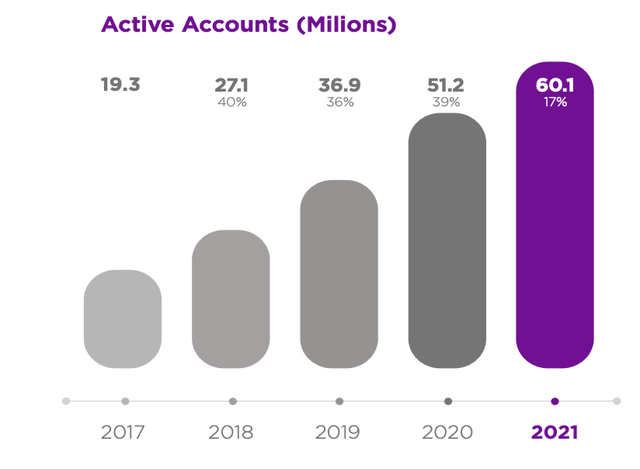

In spite of this, Roku delivered higher-than-expected active accounts at 60.1 million. Quite an important achievement, considering the circumstances.

Roku Investors Relations

Another key point is that, even if guidance was weak for Q1, management reiterated its revenue guidance for the full year 2022, indicating that the company believes that its problems are temporary by nature.

It is always possible that management is simply mistaken, and they can certainly be biased in their assessment of the business. However, I don't think that management is intentionally lying to investors and trying to hide fundamental weakness under the excuse of supply chain problems.

If management believes that the business is permanently damaged, the smart thing to do is re-setting expectations for the full year once and for all, always using macroeconomic conditions as an excuse.

But this is not what Roku did. On the contrary, guidance is for a weak quarter in Q1 and solid performance for the full year 2022, which implies an acceleration over the remaining 3 quarters of the year.

Revenue for Q4 2021 was $865.3 million versus $893.3 million expected by the market. Adding insult to injury, guidance for next quarter is for $720 million versus $746.8 million expected by Wall Street.

The guidance number represents a 25.4% year-over-year increase in revenue for Q1 2022, so it is not like the business is decaying by any means. But still, a company that delivers both revenue and guidance below expectations is going to get crushed in this market.

In addition to the problems related to TV inventory and production, there was also a softness in advertising in industries such as autos and consumer packaged goods during the quarter. Advertisers don't have the product availability to meet current sales, so it makes no sense to spend money on advertising when you have more demand than availability.

In spite of the weak numbers for the TV market during the quarter, Roku managed to exceed expectations for new accounts because the company delivered strong sales in players.

This segment suffered from rising costs, but Roku decided to swallow the costs via lower margins as opposed to charging higher prices to consumers. This obviously has a negative impact on margins, player gross profit margin was a negative -28.4% in Q4 2021 versus a slightly positive 2.6% in Q4 2020.

Roku also guided to Q1 adjusted EBITDA of $55 million versus $80 million forecasted by Wall Street. This is due to higher expenses in areas such as the operating system and the Roku Channel, with a big focus on international expansion.

In simple terms, the company is swallowing the cost pressures in players, and management is investing strongly for growth in a tough environment, so margins are getting hurt.

This approach from management provides the perfect excuse for Wall Street to cut their price targets on Roku and bring additional downside pressure to the stock price. However, management is doing exactly what it should be doing in order to capitalize on the long-term opportunity.

A growth company is not just a business that is delivering strong top-line expansion during favorable times. It takes courage from management to make the decision to diminish profit margins in order to capitalize on long-term growth opportunities, and this is exactly what Roku is doing.

Roku's Fundamentals Are Still Solid

There is no doubt that the report was below expectations, and even below the company's own guidance. Stock prices move in relation to the data versus expectations, so it is no surprise to see the stock getting killed on these numbers. However, if we take a step back, Roku is still doing quite well in absolute terms.

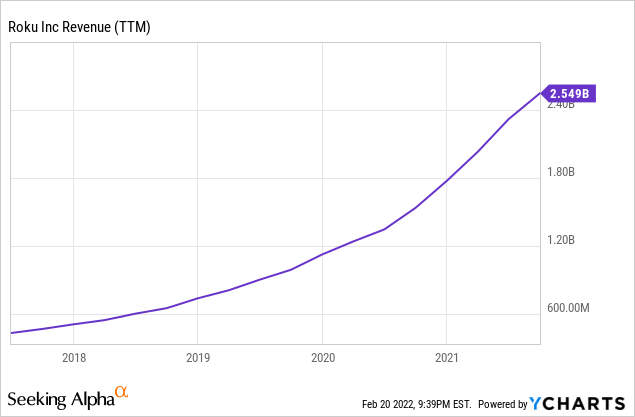

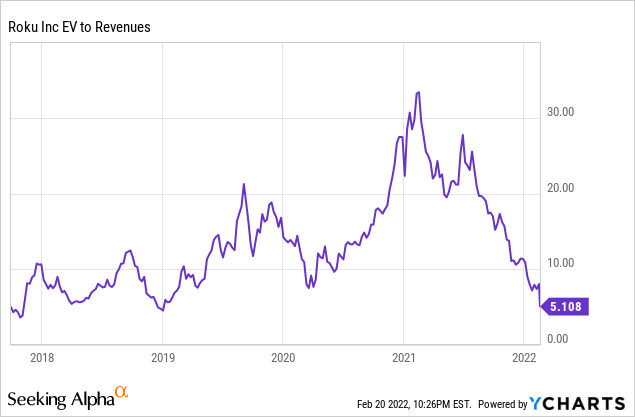

Data by YCharts

This is what a very bad quarter looks like for Roku:

- Total net revenue grew 55% year over year to $2.76 billion.

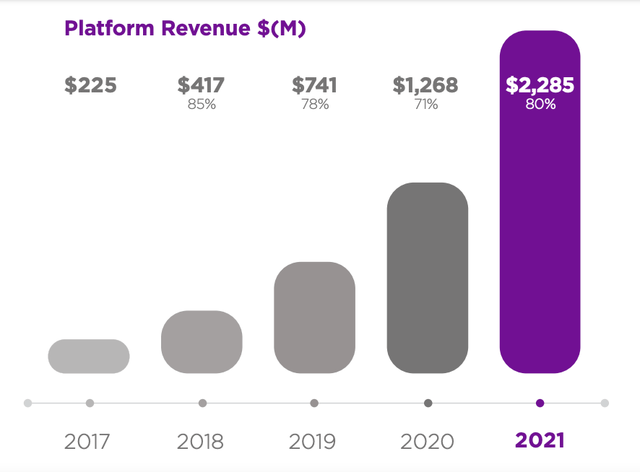

- Platform revenue increased 80% to $2.28 billion.

- Gross profit was up 74% to $1.4 billion.

- Active Accounts reached 60.1 million, a net increase of 8.9 million active accounts from Q4 2020.

- Streaming Hours increased by 14.4 billion hours YoY to 73.2 billion.

- Average Revenue Per User (ARPU) grew to $41.03 (trailing 12-month basis), up 43% YoY.

- Roku is now the No. 1 TV streaming platform in the U.S., Canada, and Mexico by hours streamed.

Source: Roku

Again, I completely understand why the stock can get destroyed in this market environment. Even growth companies with blowout earnings numbers are being sold off aggressively, so it is no surprise to see Roku down sharply.

But the weakness is caused by the supply chain issues, and these issues should be temporary by their own nature. We don't know how long it will take for things to go back to normal, and the geopolitical tensions in Europe may not help. However, the supply chain is going to get better over time.

If the demand is there, the supply will sooner or later be there too. High prices and profitability provide the incentives for producers to deliver as soon as they can and as well as they can.

The Main Risk

The big risk is not the supply chain problems, what would really change the investment thesis is Roku losing ground versus the competition, with the tech giants looking like the biggest threat for Roku right now.

Google (GOOG) (GOOGL) and Amazon (AMZN) have increased their focus on smart TVs lately. Also, Apple (AAPL) could enter this market with a full-blown TV product. It would probably be quite expensive, but we can't underestimate the power of the Apple brand.

Roku's operating system is specially designed for TVs, while Google and Amazon are adapting their developments for TVs. This allows Roku to work better and also to use cheaper chips to function well, a major advantage these days.

Roku has the first-mover advantage, and it is building solid competitive strengths based on the first-party data it owns. There is no reason to think that Roku will necessarily lose versus the mega capitalization companies, and there is no evidence indicating that this is happening now.

On the contrary, the market tends to underestimate the smaller and focused players when competing versus the big and more widely spread tech giants. Besides, the industry is big enough for multiple winners.

That being said, if we see evidence of Roku losing ground to the competition in the future, this would materially affect the investment thesis, and it would be a reason to consider selling.

Supply chain problems are transitory, but competitive dynamics can have far more permanent impacts.

ROKU Stock Is Extremely Cheap

Roku's recent problems are already reflected on valuation, and the stock could deliver big gains from current prices if and when things normalize.

The stock price is at a level from June of 2019. This is downright ridiculous when considering the fundamental evolution of the business in the past few years.

Ycharts

For perspective, here are some key statistics for Roku in Q2 2019 versus Q4 2021. Accounts, streaming hours, and revenue per user have roughly doubled. Revenue is up by 246%, and EBITDA is up by 680%.

| Q2 2019 | Q4 2021 | Change | |

| Active Accounts | 30.5 | 60.1 | 97.05% |

| Streaming Hours | 9.4 | 19.5 | 107.45% |

| ARPU | 21.06 | 41.03 | 94.82% |

| Revenue | 250.1 | 865.3 | 245.98% |

| Adjusted EBITDA | 11.1 | 86.7 | 681.08% |

Data Source: SEC Fillings

Even if you want to say that the stock was too expensive in 2019, it would be much of a stretch to justify the current decline based on fundamental metrics and valuation.

The Enterprise Value to Revenue Ratio is now at levels from March of 2020. Back then, the global economy was shutting down, and the world was entering a recession of unprecedented magnitude and unknown duration. Again, the current scenario doesn't seem comparable to the pandemic-driven recession.

Data by YCharts

Over the years ahead, almost all TVs are going to be connected to the internet, and Roku is the leading operating system for connected TVs.

If we look at the history of operating systems in PCs, smartphones, and so forth, there are usually a few big players with widely dominant positions, because the scale of the operation is a crucial advantage.

If Roku can remain one of the top players in connected TV operating systems, the stock should deliver huge gains from currently depressed valuation levels.

Disclosure: I/we have a beneficial long position in the shares of ROKU, AMZN, GOOG either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, ...

more