Robinhood Planning Confidential IPO As Early As March: Report

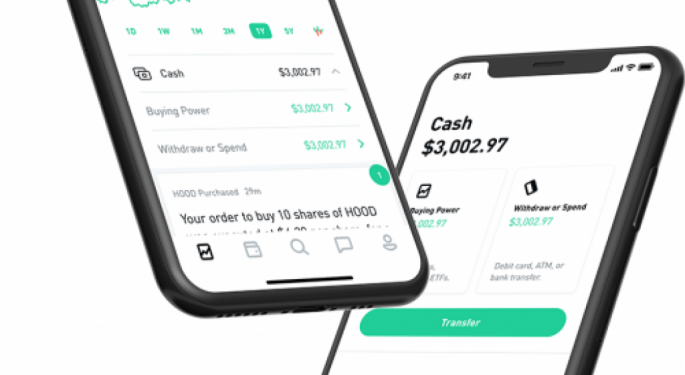

Robinhood Markets Inc is moving forward with its IPO plans.

What Happened

The fintech startup is planning to file confidentially for an initial public offering, possibly as early as March, Bloomberg has reported, citing sources close to the brokerage. The decision is not yet final, the sources said.

Reuters reported earlier in December on Robinhood's IPO plans, saying it would come with a valuation of $20 billion and assistance from Goldman Sachs Group Inc (GS).

Why It Matters

Robinhood would enter a hot market that it has helped fuel. Robinhood's decision to suspend the purchase of Reddit-fueled stocks such as GameStop Corp. (GME) and AMC Entertainment Holdings Inc (AMC) during the so-called meme-stock frenzy triggered lawsuits over the last month.

The trading platform drew a lot of heat, fueling conspiracy theories of being in cahoots with hedge funds that had shorted the stocks. The company since has had to repeatedly defend itself — including in front of a congressional hearing — saying a spike in clearinghouse collateral requirements was behind the curbs.

According to Reuters, the company has said that it's in settlement talks with the Financial Industry Regulatory Authority over temporary curbs to the trading of certain stocks, as well as its policies on options trading. Earlier this month, Robinhood began allowing its customers to withdraw and deposit cryptocurrencies such as Bitcoin (BITCOMP) and the meme-themed Dogecoin (DOGE-X).

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

We should all short them!

Let’s short it like how Citadel and Melvin Capital do!

Lol When citadel n Melvin start shorting Robinhood. Cause all they know is money.

May learn to short just for them.. Don't use them, but my brothers and sisters in trading got screwed..