Review Time: How We Scored A +26% Gain In AMD

Members recently netted a +26% gain buying a breakout in Advanced Micro Devices (AMD). Here’s a quick and easy chart review to walk you through the winning entry and exit strategy.

The Setup

Advanced Micro Devices is a leading stock in the semiconductor sector that had a solid rally over the summer. AMD peaked on Aug. 4, then entered into a pullback over the next two months. After we began stalking AMD for a potential pullback entry, the stock caught our attention when it reclaimed support of its 50-day moving average on Oct. 13.

AMD also broke out above its downtrend line from the pullback highs several days prior, which was confirmed by the buy signal on Oct. 13. Volume also ticked higher that day, confirming the rally. Finally, the benchmark S&P 500 Index was still trading below its 50-day MA when AMD reclaimed that level – a clear sign of relative strength.

Entry Strategy

All the above made for an ideal buy entry into AMD on Oct. 13 – but we missed it. If you’re new to trading, realize that missing an occasional buy signal is inevitable.

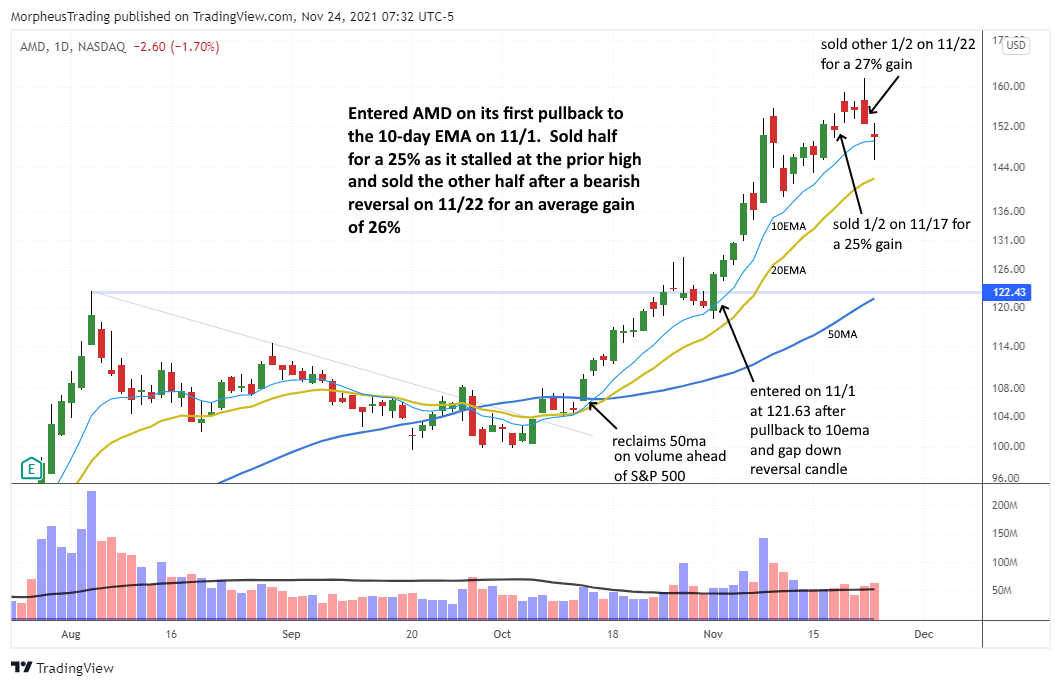

However, the key is to avoid chasing the price action and simply wait for a secondary, low-risk buy point to emerge. That’s what we did. On Nov. 1, we alerted Wagner Daily members that we were buying AMD in the Morpheus Stock Portfolio. We sold AMD for an average gain of +26% just a few weeks later.

The daily chart below shows our entry and exit points in the AMD trade.

Click chart to view the full-sized image.

As shown above, AMD failed its initial breakout attempt to new highs in late October. This led to a short-term pullback to the rising 10-day exponential moving average (on Nov. 1). The price action on Nov. 1 was ideal for buy entry, as the price opened below the prior day’s low and 10-day EMA, but reversed back above the moving average and prior day’s high.

That bullish reversal pattern off 10-day EMA support triggered our buy entry in the portfolio of our nightly stock trading report that day. Daily volume also increased by the Nov. 1 close, which was a positive sign.

Once we are in a trade and market conditions are strong, our typical swing trade targets a gain of 20-40% over several weeks (depending on whether or not the stock is a fast mover).

Exit Strategy

On Nov. 17, we sold half of AMD to lock in a +25% gain due to the stalling action near the prior high of Nov. 9. We closed out the trade with a second sell a few days later, when the price reversed lower after a failed breakout attempt to new highs on Nov. 22.

We sold the second half for a +27% gain, leading to an average gain of +26% on the AMD trade. In addition to the stalling price action, we also sold to reduce our total portfolio exposure to the semiconductor sector.

We were also long both ON and NVDA at the time, with NVDA being a top priority. We locked in gains in AMD and ON, but continued to hold NVDA. As long as AMD remains above its rising 20-day EMA, it may continue to make new all-time highs. This makes Advanced Micro Devices a hold for longer-term position traders who ride clearly established trends.

Disclaimer: Past results are not necessarily indicative of future results. There is a high degree of risk for substantial losses in trading securities. All data and material on this website ...

more