Return To Normalcy Harkens Shift In Retail Trading Era

IT WAS BEACH SEASON

In mid-June, Draftkings CEO Jason Robins may have surprised some viewers with his frank commentary about the sports gambling industry during an interview on CNBC. Draftking’s biggest competitor over the coming months isn’t Fanduel or Penn National, it’s “going to the beach this summer.”

That may seem like a pithy comment, but it’s not one to be taken lightly because it was a real risk. And while beach season may now be over, bringing speculators back to gambling venues for the fall and football season, the sentiment underscores a risk for financial markets too.

When the coronavirus pandemic brought the sports industry to its knees in spring 2020 – an industry in America that making $1.5 billion in revenue annually pre-pandemic – it created a wave of liquidity and speculative appetite that needed an outlet. Coupled with the fiscal relief efforts in the form of paycheck programs for businesses and individuals, the American economy was flush with excess capital.

Naturally, shuttered professional American sports leagues demanded a new outlet for speculative appetite, and sure enough surveys show that among individuals who received unemployment benefits during the pandemic, 20% of those funds were recirculated back into American financial markets.

WHERE’S THE MONEY GOING?

The coronavirus pandemic clearly brought in a wave of new retail traders into the financial markets. The surge in account openings in 2020 has continued into 2021: US brokers like Robinhood, TD Ameritrade, Charles Schwab, and Interactive Brokers added more than 2 million users in each of the first and second quarters of 2021.

In fact, Robinhood added more than 1 million users in January 2021 alone thanks to the surge in meme stocks like video game retailer GameStop (Ticker: $GME) and movie theater chain AMC (Ticker: $AMC).

Amid the surge in retail trader interest, something else was happening in recent months: American professional sports leagues were beginning to open to the public once more. And with the return of live professional sports this fall, retail trader interest may be elsewhere than financial markets.

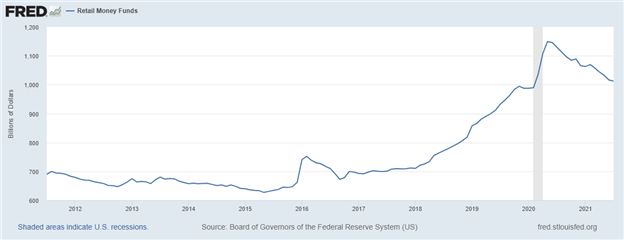

CHART 1: US RETAIL MONEY FUNDS: JUNE 2011 TO JUNE 2021

As the American sports betting industry managed to turn a profit of $3 billion in 2020 – a rather meaningful jump from the $1.5 billion in profit in 2019 – it meant that more individuals were deploying their capital outside of financial markets.

In fact, over the past year, retail money funds have dropped by approximately $100 billion, according to data retrieved from the St. Louis Federal Reserve’s database. Early indications from the third quarter of 2021 suggest that account openings slowed, perhaps as much by 50%, consistent with the data that shows retail money funds are now at their lowest since February 2020 – the month before the US economy began to lockdown.

RETAIL IMPULSE FADING?

With US equity markets near all-time highs at the time this commentary was written, the drop of retail money funds suggests that speculative fervor has faded; Americans are deploying their capital elsewhere. If asked, ‘where has all the retail gone?,’ at first consideration, you might say, ‘sports betting.’

But recall what DraftKings CEO Robins said about his company’s biggest competition: “the beach this summer.” There’s an argument to be made that this mindset – shifting away from pandemic-era leisure activities and returning to pre-pandemic life – has been felt in American financial markets as well, one which may continue now that speculators’ attention has shifted from beach season to football season.

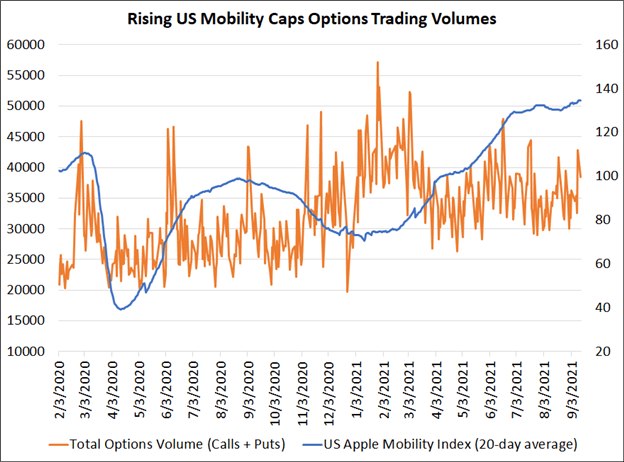

CHART 2: US MOBILITY INDEX (APPLE MAPS) VERSUS TOTAL SINGLE STOCK CALL OPTIONS VOLUME (2021 YTD)

Using an equal-weighted model of Apple’s driving and transit data from their mobility data file allows us to construct a simple US Mobility Index. Indexed to 100 on January 13, 2020 (the beginning of the time series made available by Apple), our US Mobility Index suggests that Americans are nearly +35% ‘more mobile’ (depending upon method of mobility) as of September 13, 2021, than they were prior to the start of the pandemic.

What’s noteworthy is the fact that even though June saw a significant Federal Reserve policy meeting followed by the largest quad witching day in history (in terms of options contracts traded and total volumes), total trading call volumes actually peaked back in February. The fact of the matter is that with more mobility within the US economy, there are fewer people participating in financial markets.

AN OMEN, GOOD OR BAD?

At the end of the day, participation in financial markets, particularly for newer investors and traders, is contingent on one thing and one thing only: opportunity. When does opportunity arise in financial markets? Well, to put it simply…when things are moving. In non-layman’s terms: volatility.

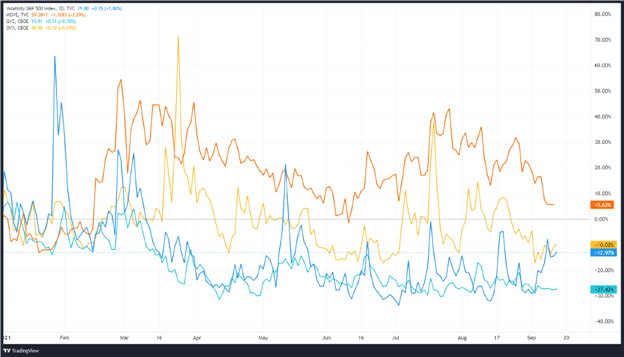

CHART 3: GVZ, MOVE, OVX, & VIX DAILY TIMEFRAME (2021 YTD)

But for a brief spike in March around the Fed meeting and then again this June (also around the Fed meeting), measures of volatility have been on a steady downward trajectory for the better part of three months (and really, since the beginning of the year if you ignore MOVE, Treasuries volatility).

This adds another layer of intrigue to the retail trader mania saga. It’s quite the feedback loop, if you think about it: as the US economy improves, measures of mobility should continue to increase; evidence of increasing mobility gives greater hope that improvements in the US economy will be sustained; which in turn reduces investors’ concerns about the future, finally dragging down expectations around volatility.

It stands to reason that as we persist in a lower volatility environment, which incidentally may be good for a steady float higher in US equity prices, could also see the level of interest among retail traders start to fade. After all, people want to go to where the action is. And now that summer’s over, it’s no longer at the beach – but back on the football field.