Return Of The SPAC: They’re Back And Bigger Than Ever

The Briefing:

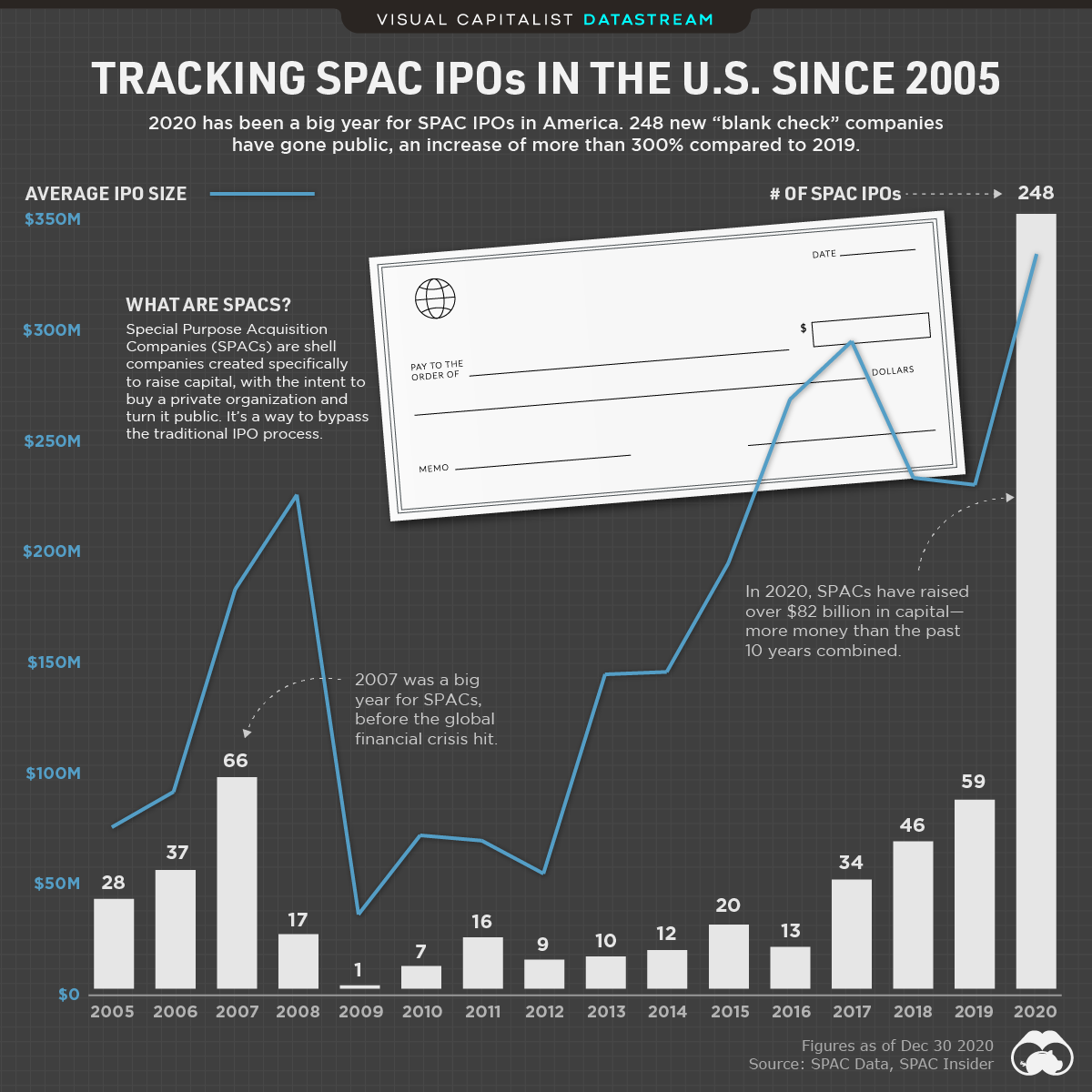

- Special Purpose Acquisition Companies (SPACs) are shell companies created with the sole intent to raise capital and buy a private organization or a stake in a company.

- In 2020, 248 new SPACs went public, an increase of more than 300% from 2019.

- 2020 was a record-breaking year for SPACs on many fronts. For instance, Bill Ackman’s Pershing Square Tontine Holdings (PSTH) raised $4 billion—the largest raised in SPAC history.

SPACs are Back and Bigger than Ever

In 2020, SPACs raised over $82 billion in capital. That’s more funds in one year than in the last 10 years combined. But what exactly is a SPAC, and how have they changed over the years?

SPAC IPOs versus Traditional IPOs

SPAC IPOs are essentially the opposite of traditional IPOs. In a traditional IPO, an established company goes public to raise funds. In contrast, SPAC IPOs involve a shell company that’s already raised capital and is looking to purchase an organization (or a stake in a company). While traditional IPOs are seeking funds, SPAC IPOs already have the funds — what they’re seeking is an organization to attach themselves to.

SPACs, also known as “Blank Check” companies, provide a faster way to raise funds compared to traditional IPOs. That’s because the audit process for a SPAC is shorter, since they don’t have any financial statements to review.

A Brief History of SPACs

248 SPACs went public in 2020 — 189 more than in 2019.

2020 has by far been the biggest year for SPACs in the last few decades. Here’s a look at the number of SPAC IPOs over the last 15 years, along with their average size:

| Year | # of SPAC IPOs | Average IPO Size (M) |

|---|---|---|

| 2005 | 28 | $75.5 |

| 2006 | 37 | $91.5 |

| 2007 | 66 | $183.2 |

| 2008 | 17 | $226.0 |

| 2009 | 1 | $36.0 |

| 2010 | 7 | $71.8 |

| 2011 | 16 | $69.4 |

| 2012 | 9 | $54.5 |

| 2013 | 10 | $144.7 |

| 2014 | 12 | $145.8 |

| 2015 | 20 | $195.1 |

| 2016 | 13 | $269.2 |

| 2017 | 34 | $295.5 |

| 2018 | 46 | $233.7 |

| 2019 | 59 | $230.5 |

| 2020 | 248 | $334.4 |

SPACs had a brief moment in 2007 prior to the financial crisis, but by 2009 they had lost traction — that year, only one SPAC IPO went public. However, in the last few years, SPACs have picked up momentum again. And in 2020, the use of this curious go-public vehicle had skyrocketed.

The New and Improved SPACs of 2020

Historically, SPACs haven’t had the highest returns for investors. In fact, they were once considered a last resort when it came to raising capital. But in the last few years, SPACs have ramped up their game. According to a recent report by McKinsey & Company, there have been three significant changes:

- Improved track record: In 2020, more than 90% of SPAC deals closed. That’s a notable improvement compared to previous years — before 2015, at least 20% of SPACs liquidated.

- Bigger in size: The average SPAC trust size is 5x larger than it was a decade ago.

- Well-known participants: Some high-profile investors have jumped on the SPAC-train this year, which has helped generate hype.

While some experts are expecting the popularity of the SPAC to continue in 2021, it’s still too early to tell. So it’s hard to know for certain if SPACs are back for the long-haul.