Rethinking The Alphabet (Google Investment Thesis)

Contributing Authors: Fred McClimans, John Freeman, Zach Mitchell

Alphabet's Google (NASDAQ:GOOG; GOOGL) has attracted a good bit of press lately as a result of its continued expansion into new markets, compelling us to ponder an increasingly relevant question about our own investment thesis: In which Google are we invested, the market dominant search & advertising behemoth or the emerging provider of enterprise/cloud IaaS (infrastructure as a service)?

While we've always been enamored with GOOG's dominance of online advertising via its near monopoly in search (at least in those countries that primarily use the Roman alphabet), we see considerable growth potential in what's driving the company's enterprise application development and GCP (Google Cloud Platform). The latter area, in our opinion, is spring-loaded like Amazon's (AMZN) AWS cloud business was several years ago, and both have TAMs (Total Addressable Markets) large enough to justify serving as the foundation of our investment thesis. Note: GOOG is part of the Samadhi 16, our high-conviction category in the Samadhi Capital client portfolios.

Understanding the "financial" Alphabet

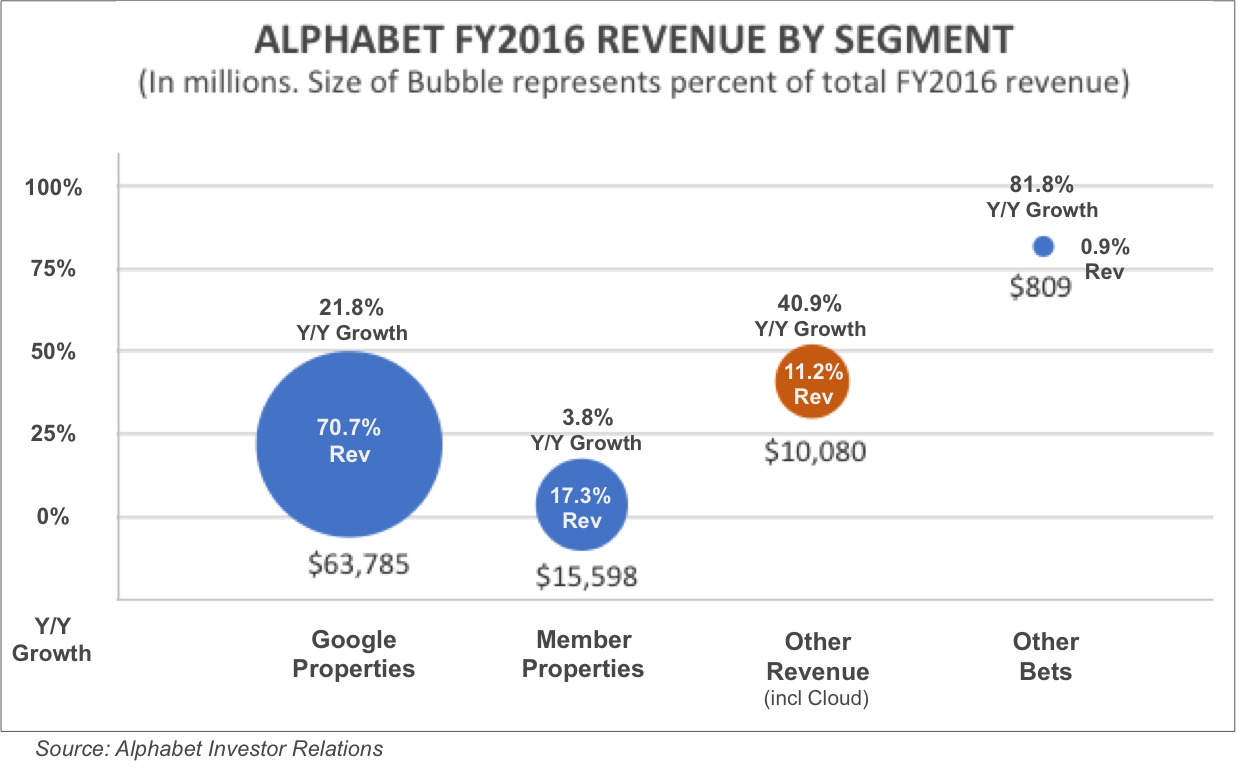

GOOG breaks apart its revenue into four buckets:

- Google Properties, which includes Search, Gmail, Maps, Play, and Youtube;

- Google Network Member Properties, which includes Adsense, Admob, and Doubleclick;

- Other Revenues, which includes Apps, In-app Purchases, Digital Content, Hardware, Licensing Related Revenue, and Cloud; and

- Other Bets, its catch-all category for Moonshots and the like.

Revenue breaks down roughly as follows:

We highlight the 'Other Revenue' category, which includes G Suite and Google Cloud Platform (where GOOG's 'enterprise' initiatives are concentrated) and is most alluring to our investment thesis at present.

In FY2016, this category grew 40.9% Y/Y, significantly higher than GOOG's traditional search, advertising, and ad-supported apps (note: the 81.8% growth of the 'Other Bets' category is misleading as it only represents less than 0.9% of total GOOG revenue, and we anticipate successful initiatives may ultimately be shifted into the 'Other Revenue' category).

What is fueling the growth of GOOG's enterprise business? At the end of FY2015, GOOG had approximately 2m paying businesses as G Suite (then Google Apps) customers. At the end of FY2016, that number had increased 50% to 3m paying customers. Not too shabby.

How Alphabet got our attention

During the past few weeks, GOOG has launched a flurry of initiatives designed to rapidly expand the value offered for the enterprise market, allowing it to better compete with the likes of Microsoft (NASDAQ:MSFT) and Amazon. If it were anybody else, we wouldn't think much. But GOOG? We're all ears. Right now, it's all about the enterprise, and if one new player has the infrastructure to make a dent, it's GOOG.

What is G Suite? Morphed out of Google Apps, G Suite initially focused on paid versions of Gmail, Docs, Sheets, etc. with a focus on being a low-cost alternative to MSFT's Office offering (primarily for SMBs, business professionals, and small collaborative teams). But the overall cloud and enterprise offering has expanded a bit and received a good level of market/customer interest of late.

Here's a quick recap of 5 notable, and recent, moves by GOOG that we feel highlight its increased focus and initiatives in the enterprise and cloud spaces and given what we feel is an already lucrative investment opportunity even greater upside potential:

1. GOOG pushing to grow "enterprise" cloud through partnerships. GOOG's SVP of Cloud, Diane Greene, spoke on CNBC about the company's intention to use publicly endorsed partnerships as a primary means to expand its reach. The list of G Suite partners currently includes 13 companies across 9 categories, all of whom are young and growing, including SaaS helpdesk provider Freshdesk, who we feel is giving Zendesk (NYSE:ZEN) a run for its money.

Of the listed partners, only RingCentral (NYSE:RNG) and Xero (XROLF) are publicly traded, each with market caps of less than $3b. GOOG's approach is indicative of a long-term view, as it looks to steadily take share from cloud behemoths Amazon and Microsoft by employing a ground-up strategy targeted towards SMBs.

We believe GOOG has the ability to leverage its massive existing data center infrastructure to create value for enterprises of all sizes IF it can appropriately rebrand itself. Presently, it is an elephant in plain sight, so to speak, that is somewhat ignored in the enterprise market due, at least partially, to its poor track record of targeting and winning enterprise IT customers. Obviously, its track record of winning CMOs and other decision makers with ad dollars to spend on AdWords is well established.

Of note, GOOG recently was listed in SNAP's S1 as the beneficiary of a five-year contract worth $2b for cloud hosting-services, along with AMZN ($1b over 5 years).

Bottom line: We believe that this partnership-based strategy for growth is solid, and in line with what we'd expect from Ms. Greene, who, we should note, is also a GOOG Board Member and was the CEO of VMware (VMW) from 1998 - 2008 (Ms Greene joined the firm in 2015, assuming responsibility for G Suite and GCP). More than anything else, we expect Ms. Greene's strategic vision and tactical leadership to play key roles in GOOG's success selling into the enterprise market where Ms. Greene possesses a strong track record of success.

2. GOOG beefs up Hangouts. GOOG has worked on improving the robustness of its Hangouts offerings and is now releasing it to enterprise clients as part of its larger enterprise strategy. Hangouts, GOOG's long-time on-the-fly social video chat tool, will now consist of two products: Hangouts Meet and Hangouts Chat. The former will allow for video conferences consisting of up to 30 team members, and the latter is a Slack/Hipchat alternative populated with software bots that help with simple tasks including the scheduling of meetings.

Bottom line: It's about time. Hangouts, despite its popularity in the social sphere, has lacked a compelling value for the enterprise. We believe this value is finally materializing, at exactly the time GOOG needs it the most. Expect it to compete directly against Slack, Skype, and AMZN's recently released Chime offering.

3. GOOG releases Data Studio worldwide. GOOG launched its worldwide beta of Data Studio, a simple data visualization tool for enterprise business intelligence and marketing analytics.

Bottom line: Expect this to help drive adoption of G-Suite, and help position GOOG to move up-market with its enterprise offerings. As an aside, it is precisely the growth of very attractively priced or even free data visualization offerings that has kept us out of Tableau (NYSE:DATA) despite the substantial pull back over the last 18 months.

4. GOOG releases free cloud-hosting tiers. In an effort to improve monetization, GOOG released free cloud hosting tiers on Thursday, consisting of two offerings: The first is an "always free" offering, which allows users free use below certain thresholds. The other allows usage for until 12 months have passed or until $300 worth of data have been consumed.

Bottom line: GOOG is number four in a three-horse race, behind AMZN, IBM (NYSE:IBM), and MSFT. It needs enterprise users (and their higher margins). The approach of creating a large funnel of active freemium users that can be up-sold to paid status has proven to be an incredibly effective tool for cloud-based apps and services and should prove so for GOOG as well.

5. GOOG nails SNAP. GOOG landed an impressive $2b cloud deal to provide primary infrastructure for SNAP over the next five years (we've previously covered SNAP here). Yes, AMZN also has a $1b deal as backup capacity, and SNAP has left open the door to building its own cloud infrastructure.

Bottom line: This was a clear win for GOOG (who only had $10b in total FY2016 in its 'Other' category, which includes its Hardware and Digital Content offerings in addition to Cloud), beating out its nearest competitors in a high-stakes cloud (and marketing) battle.

So, what's missing?

While GOOG is selling enterprise apps, it is focused on the small business set, not necessarily the larger enterprise, where Business Intelligence tools are required, or the technical shop, where developer tools and collaboration tools dominate. It is advancing its Data Studio initiative (as noted above), but it still lacks some of the more collaborative team-oriented tools we believe are necessary to successfully penetrate this market (we're still waiting to see if Hangouts Chat can compete in this space). GOOG is also missing some of the core project management tools (like Trello) that are disrupting the collaborative segment.

We're not suggesting that GOOG is going directly against MSFT, but it is positioned to take away business at the lower end of the market, and potentially keep MSFT from stealing GOOG business users. It appears that, for now at least, GOOG is not competing too directly with offerings from CRM that tend to be more exclusively "up the stack". However, as a pure Infrastructure-as-a-Service provider, GOOG is as formidable a competitor as there is despite its late entrance. Remember, GOOG's data center capacity is well above one million servers. That is likely greater than both AMZN and MSFT and dwarfs the capacity of new entrants such as ORCL and even those that have been in the "hosting business" for decades and have just recently moved that one rung up the "stack ladder" to offer true IaaS - i.e., IBM and virtually all of the major telcos.

Comparing Alphabet to Amazon

Our original investment thesis (like many others) considered GOOG's enterprise initiatives but weighted them relatively low compared to GOOG's much-larger search and ad-based offerings, including YouTube and other content-driven products. However, with these recent moves, and the progress that GOOG is making, we believe GOOG may be undervalued IF it can continue to grow this core segment.

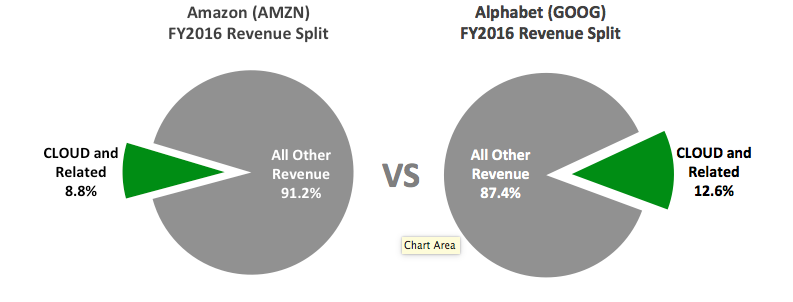

Let's compare AMZN and GOOG on this point. At present, both firms derive approximately the same percentage of revenue from "cloud-related" activities (to be fair, GOOG's cloud activities are a subset of its 'Other' revenue category, which only brings it closer in line to AMZN).

GOOG's Other Revenue (which includes cloud and enterprise software) only provides 12.6% of its overall revenue (note that we believe cloud represents less than half of that total value). Similarly, AMZN derives only 8.8% of its revenue from its AWS cloud offering. The point here is that cloud-based revenue can offer great leverage and operating margins.

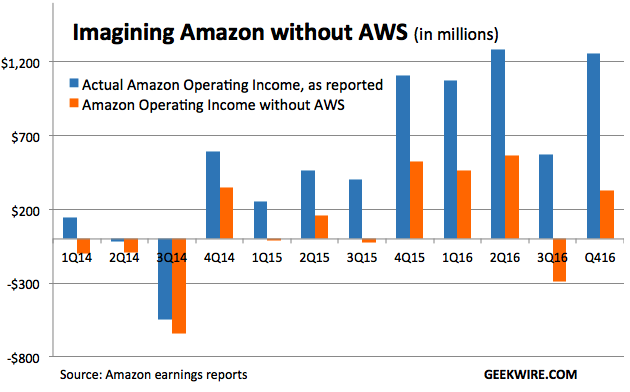

Comparing operating margins, AMZN's AWS (by itself) is presently delivering 25.4% (FY2016), not far below GOOG, at 26.3% (FY2016). But we're projecting AWS operating margins to surpass GOOG, growing to over 33% by 2021. In fact, our investment thesis on AMZN is almost entirely based on AWS. When stripped of AWS, and its cloud-based operating income, AMZN barely garners a second of interest.

If you consider GOOG's non-cloud/search/ad business as somewhat analogous to AMZN's online retail business (and pushing aside each company's moonshots), we would expect GOOG to benefit from expansion of its cloud business just as AMZN has.

We believe GOOG has one of the world's largest background infrastructures, and believe there is tremendous opportunity for GOOG to leverage what it is doing in the cloud and into the enterprise app space even more so than people would expect.

To be clear, we are not saying that GOOG is about to challenge AMZN in this market, in which it is a distant third or fourth (depending on which industry research firm you read). However, GOOG, which likely possesses the world's largest background infrastructure, has a unique and tremendous opportunity to leverage this strength into the cloud and into the enterprise app space-even more than people would expect.

Bottom Line

Google is growing up a bit, and its approach towards monetizing the enterprise and the cloud is finally gaining solid traction. We like both the direction and the execution we see, particularly under Ms. Greene's leadership, and we believe that GOOG may be undervalued relative to its potential in the enterprise/cloud markets even when considering any other issues with GOOG's recent financial performance.

We are in the process of updating our investment thesis, and our weighted scenarios, and will provide additional guidance shortly. In the interim, we reiterate our current long position in GOOG as a member of the Samadhi 16, our high-conviction category, in our Samadhi Capital client portfolios.

more

Thank you for this very well written and informative piece Fred. I strongly agree with your analysis on GOOG and its entry into the cloud business. GOOG has continually showed they know what they are doing as they successfully carve out market shares for themselves in every segment they choose. I'm inclined to believe in their ability to capture significant market share in the cloud business despite how entrenched AMZN's position is. GOOG's reputation alone has brought in partnerships for the enterprise cloud business and I see even more coming in the future. If there was one challenger to AMZN's cloud business, it would have to be GOOG.