Retail Inflows Confirm Market Bottom Nowhere Nigh

With a global market cap loss of some $9 trillion this month, stock markets have their worst January on record. Under the surface of market averages, 49% of S&P 500 companies, 76% of Nasdaq, and 82% of the economically sensitive small-cap Russell 2000 stocks are now off more than 20% from recent highs (courtesy of Liz Ann Sonders.).

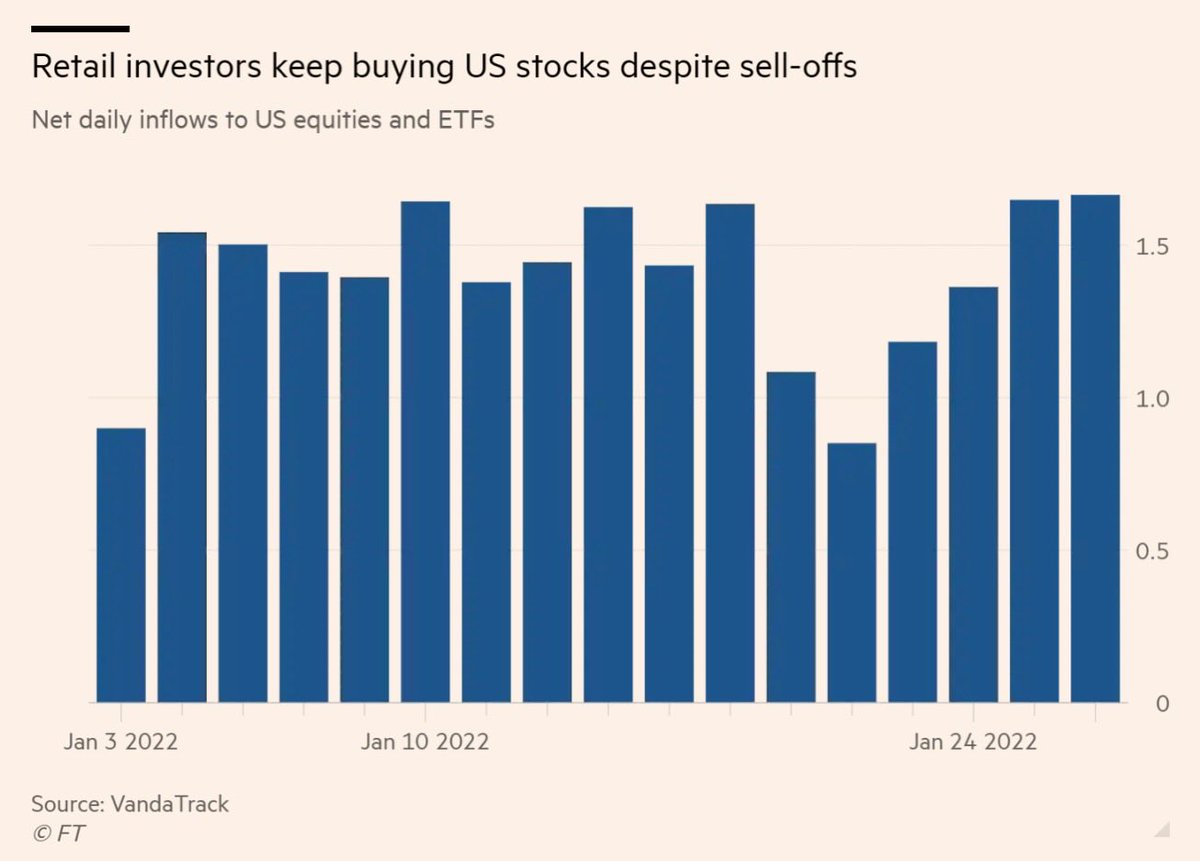

(Click on image to enlarge)

In a sign that retail sentiment is nowhere near the terror of cycle bottoms yet, individuals and their long-always advisors and managers have continued to funnel savings into equities throughout the month (as shown on the left).

Meanwhile, household equity has never been so concentrated in the stock market. Recent Fidelity data showed that 40% of retirement accounts for 60 to 69-year-olds were a reckless 67% in stocks at the highest valuations in history.

High-risk allocations mean that this bear market is going to hurt more than even the 2008 collapse. Sadly, many people at or near retirement today will need to work longer than they presently imagine as their retirement accounts implode again.It doesn’t have to be this way, but effective risk management requires independent analysis, thought, and personal discipline–the opposite of mindless trend following.

David Rosenberg touched on some of these facts in his latest CNBC appearance.

Could the U.S. be looking at a #recession in 2022-23? Has the U.S. consumption story run out of steam? @EconguyRosie lays out what you should be watching out for, and where the #Fed has it wrong, on @CNBCi ... #economy @asiasquawkbox #rates #yields pic.twitter.com/xZSaHjIhNf

— Will Koulouris (@WillKoulouris) January 27, 2022

Disclosure: None.