Retail Earnings Looming - What To Expect

Image Source: Unsplash

Walmart (WMT - Free Report) shares have tracked the broader market year-to-date, with Target (TGT - Free Report) shares modestly on the weaker side. But since the onset of the regional banking uncertainty following the Silicon Valley Bank failure in early March, Walmart shares have been notable outperformers, up +4.9% in that period vs. an +0.8% gain for the S&P 500 index and an -8.3% decline for Target shares.

The chart below shows the year-to-date performance of Walmart and Target shares vs. the S&P 500 index.

Image Source: Zacks Investment Research

The stability in Walmart shares makes intuitive sense, as its core business offers a high degree of defense during periods of economic instability and uncertainty. Walmart’s ‘value orientation’ allows it to gain market share as relatively better-off consumers ‘trade down’ during times of ‘economic stress.’

Walmart and Target are on deck to report quarterly results this week. Walmart will report on Thursday, May 18th, and Target will report on Wednesday, May 17th, with both quarterly reports coming before the market’s open. Walmart’s quarterly EPS expectations coming into this report have been very stable, with the current Zacks Consensus Estimate of $1.30 per share up by a penny over the past two months and unchanged over the past month. Unlike Walmart, there has been some pressure on Target estimates, with several analysts pointing to near-term challenges for the company.

One key point of differentiation between these two retail giants is Walmart’s bigger grocery business, which gives its results greater stability given the ‘staply’ nature of that otherwise low-margin business. That said, groceries drive foot traffic and are also responsible for the aforementioned ‘trade down’ phenomenon that is helping Walmart gain share.

Analysts see relatively greater momentum in Walmart’s business on the back of higher average selling prices, foot traffic, gains on the e-commerce side, and better margin results relative to what they reported last time on February 21st. Target is seen as suffering from weak traffic during the period, with the price trend only marginally positive.

Both companies struggled with evolving consumer behavior as the pandemic went into the rearview mirror. We saw this in their April 2022 quarterly results, for which they were punished by the market. While both took drastic steps to steady their floundering ships, Walmart clearly did a better job of adjusting to the new environment compared to Target.

With respect to the Retail sector 2023 Q1 earnings season scorecard, we now have results from 20 of the 33 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.

The Zacks Retail sector includes not only Walmart, Target, and other traditional retailers but also online vendors like Amazon (AMZN Quick QuoteAMZN - Free Report) and restaurant players. The 20 Zacks Retail companies in the S&P 500 index that have reported Q1 results already belong to the e-commerce and restaurant industries.

Total Q1 earnings for these 20 retailers that have reported are up +11% from the same period last year on +8.1% higher revenues, with 80% beating EPS estimates and 70% beating revenue estimates.

The comparison charts below put the Q1 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

As you can see above, the online players and restaurant operators easily beat earnings and revenue expectations.

With respect to the earnings and revenue growth rates, we like to show the group’s performance with and without Amazon, whose results are among the 20 companies that have reported already. As we know, Amazon’s Q1 earnings were up +46.8% on +9.4% higher revenues, as it beat top and bottom-line expectations.

As we all know, the digital and brick-and-mortar operators have been converging for some time now. Amazon is now a decent-sized brick-and-mortar operator after Whole Foods, and Walmart is a growing online vendor. This long-standing trend got a huge boost from the Covid lockdowns.

The two comparison charts below show the Q1 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart).

Image Source: Zacks Investment Research

One recurring theme in the Q1 earnings season has been the continued resilience and stability of the U.S. consumer. We heard this from the banks, the leisure and hospitality players, and consumer-facing digital operators.

There is undoubtedly stress at the lower end of income distribution. Given this development, one can intuitively project moderation in consumer spending as the economy further slows down under the weight of tighter monetary conditions. We will hear more about that on the Walmart and Target earnings calls, likely in the context of their outlooks for the coming periods. But on the whole, consumer spending trends remained intact in 2023 Q1, and that’s what these results will reconfirm.

Q1 Earnings Season Scorecard

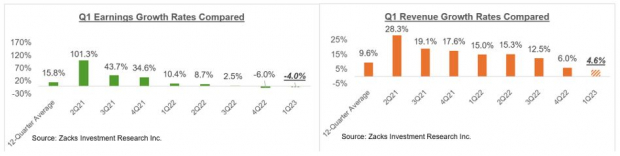

Including all the quarterly reports that came out through Friday, May 10th, we now have Q1 earnings from 459 S&P 500 members or 91.8% of the index’s total membership. Total earnings for these companies are down -4% from the same period last year on +4.6% higher revenues, with 77.6% beating EPS estimates and 74.9% beating revenue estimates.

The proportion of these companies beating both EPS and revenue estimates is 62.7%.

Regular readers of our earnings commentary know that we have been referring to the overall picture emerging from the Q1 earnings season as good enough; not great, but not bad either. With this reporting cycle now largely behind us, we can confidently say that corporate earnings aren’t headed towards the ‘cliff’ that market bears warned us of.

The way we see it, the ‘better-than-feared’ view of the Q1 earnings season at this stage may be a bit unfair, given how resilient corporate profitability has turned out to be. But the view isn’t entirely off the mark either.

We have about 300 companies on deck to report results, including 15 S&P 500 members. In addition to the aforementioned Walmart and Target reports, this week’s docket includes Home Depot, TJX Cos, Cisco Systems, Applied Materials, and Deere & Company.

Below, we compare the Q1 results thus far from what we have seen from this same group of 459 index members in other recent periods.

The first set of charts compares the earnings and revenue growth rates for the 459 index members that have reported with what we had seen from the group in other recent quarters.

Image Source: Zacks Investment Research

The comparison charts below put the Q1 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The Earnings Big Picture

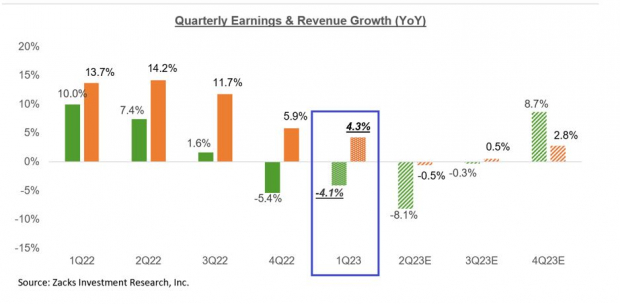

To get a sense of what is currently expected, take a look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2023 Q1 and the following three quarters.

Image Source: Zacks Investment Research

As you can see here, 2023 Q1 earnings are expected to be down -4.1% on +4.3% higher revenues. This would follow the -5.4% earnings decline in the preceding period (2022 Q4) on +5.9% higher revenues.

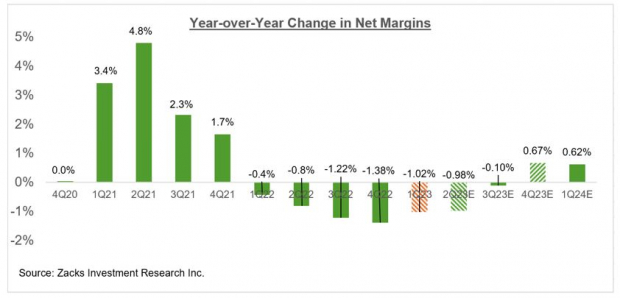

We get to down earnings on positive revenues when margins are squeezed. That’s what we have been witnessing in the ongoing earnings season, which is in line with the trend we have been seeing for some time now. In fact, 2023 Q1 is the 5th quarter in a row of declining margins.

The chart below shows the year-over-year change in net income margins for the S&P 500 index.

Image Source: Zacks Investment Research

Actual results are proving a lot better on the margins front relative to what was expected ahead of the releases.

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

One notable recent development on the earnings front, which I flagged in the weekly Earnings Trends report in greater detail, is the reversal on the revisions front, with full-year 2023 earnings starting to go up since the start of April. This comes after almost a year of steady declines in full-year 2023 earnings, which peaked in April 2022.

Since the start of 2023 Q2, aggregate bottom-up S&P 500 earnings have increased +0.3% as a whole and +0.6%, excluding the Energy sector, whose estimates have been coming down. In fact, estimates for 8 of the 16 Zacks sectors are up since the start of Q2, with notable increases in the Construction, Industrial Products, Autos, Retail, and Tech sectors. On the negative side, estimates are coming down for the Energy, Basic Materials, Aerospace, and Transportation sectors.

More By This Author:

Analyzing Recent Earnings Estimate Revisions

Q1 Earnings: Energy Sector In Focus

Breaking Down Big Tech Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more