Retail Army Piles Into Tesla At Record-Breaking Pace

↵

Image Source: Pexels

JPMorgan analyst Emma Wu told clients that the current level of retail enthusiasm for Tesla (TSLA) is unlike anything seen in the last ten years. This surge in retail buying comes as the stock remains halved from its December high of around $479. Weighing on shares are concerns over a potential slowdown in electric vehicle deliveries during the first quarter, along with mounting backlash from radical leftist nonprofits seeking to destroy the company and investors.

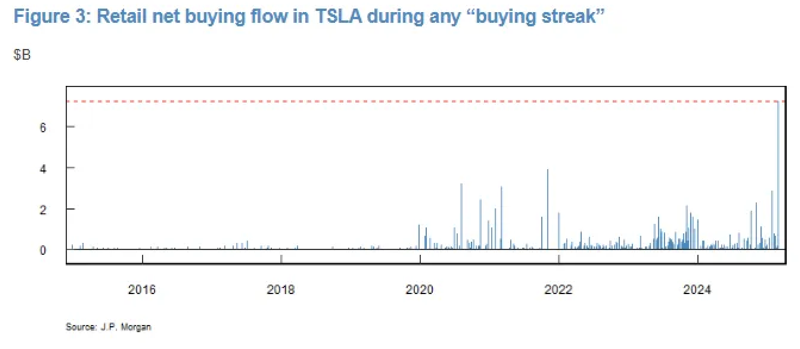

The global equity derivatives strategist told clients that retail net buying flows into Tesla topped $8 billion over the last 13 consecutive sessions through Thursday. This was the longest buying streaks for Tesla via JPM data dating back to 2015.

(Click on image to enlarge)

Data from Bloomberg shows Tesla shares are halved from mid-December's peak of $479.

(Click on image to enlarge)

"Tesla made some rookie to mid-stage public market investors extremely wealthy, a lot of people became millionaires because of this stock," said Nicholas Colas, co-founder at DataTrek Research, quoted by Bloomberg.

Colas said, "People don't forget that. And they will come back to a stock again and again if they feel it has been beaten up," adding, "These kind of investors don't care about valuations at all. They just believe in the future of the company and Elon Musk's abilities."

In recent weeks, Goldman Sachs analysts Mark Delaney, Will Bryant, and others provided clients with a downward revision in their 1Q25 vehicle delivery estimate from 399k to 375k, citing weaker demand.

"Weak Demand": Goldman Lowers Tesla Vehicle Delivery Estimate For Quarter https://t.co/l4K15HjHTC

— zerohedge (@zerohedge) March 5, 2025

On Thursday, Morgan Stanley analyst Adam Jonas lowered his price target for Tesla and slashed sales forecasts, citing the risk of a potential buyers' strike.

Tesla investors are facing not only souring fundamentals but also a network of anti-capitalist NGOs ...

This was my favorite speaker, the independent journalist and hacker who tells us the entire point of these organized protests are to tank Tesla stock.

— Insurrection Barbie (@DefiyantlyFree) March 20, 2025

Not a lawyer but this seems illegal to me. pic.twitter.com/9V2aNrdDR2

... planning color revolution-style campaigns against the most American-made car company—aimed at destroying the brand and driving shareholder value to zero.

More By This Author:

FedEx Plunges After Earnings Miss, Slashes Guidance For 3rd TimeWhat Recession? Initial Jobless Claims Hover Near Multi Decade Lows

Fed Holds Rates, Signals QT Taper; Blames Trump 'uncertainty' For Stagflationary Outlook

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more