Restaurant Earnings Roundup: MCD, CAKE, TXRH

Image Source: Unsplash

The 2024 Q4 earnings cycle is beginning to lose a bit of steam, with a wide majority of S&P 500 companies already delivering their quarterly results. The period has remained positive, underpinned by strong earnings growth and favorable commentary.

Among the bunch this week are several well-known restaurant operators, a list that includes Cheesecake Factory (CAKE - Free Report) and Texas Roadhouse (TXRH - Free Report). But what should investors expect from the pair? Let’s take a closer look at expectations and results from a restaurant peer, McDonald’s (MCD - Free Report), to get a better feel.

McDonald’s

Concerning headline figures in its release, MCD posted EPS that met our consensus estimate and reported sales modestly below expectations. EPS fell 4% year-over-year, whereas sales of $6.4 billion fell -0.3% year-over-year.

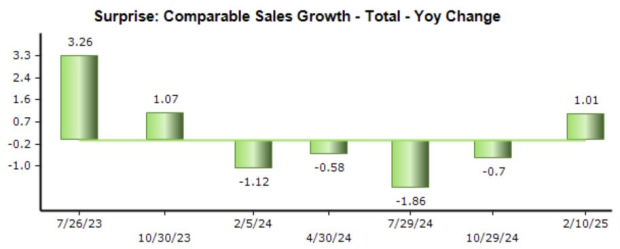

While the top and bottom line results weren’t great, the real thorn in the side of MCD remains its same-store sales. U.S. comparable sales fell 2% year-over-year, likely reflective of consumers becoming wary about their spending habits given the menu’s continued price increases over recent years.

Still, other regions have helped ease the U.S. drag, with global comparable sales overall increasing 0.4% year-over-year. As shown below, the results helped snap a streak of negative surprises on the metric, finally exceeding our consensus estimate.

Image Source: Zacks Investment Research

Cheesecake Factory

Analysts have shown a sliver of positivity for CAKE’s upcoming print, with the $0.92 Zacks Consensus EPS estimate up marginally over the last several months and suggesting 15% growth year-over-year. The consensus sales estimate has remained unchanged over recent months, with the company expected to see 4% sales growth year-over-year.

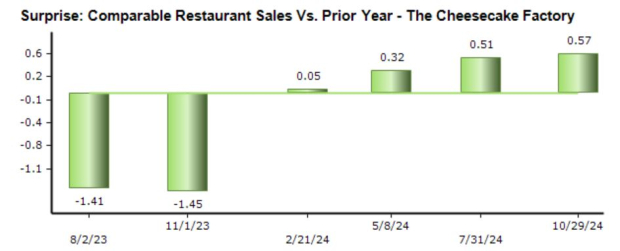

Similar to MCD, comparable restaurant sales will be a key metric to watch in the release, which have regularly exceeded our consensus expectations as of late. Comparable restaurant sales increased 1.4% year-over-year throughout its latest period, undoubtedly a positive development.

Image Source: Zacks Investment Research

David Everton, CEO, delivered positivity following the latest print, stating, “We are capturing market share as evidenced by the continued strong outperformance in comparable sales and traffic at The Cheesecake Factory restaurants versus the broader casual dining industry. Execution within our restaurants was exceptional with our operators delivering significant improvements in labor productivity, hourly staff and manager retention, and guest satisfaction scores.”

Texas Roadhouse

Analysts have remained silent for TXRH’s upcoming release, with top and bottom line revisions remaining stagnant over recent months. Big growth is expected, with current estimates alluding to 53% EPS growth on 21% higher sales.

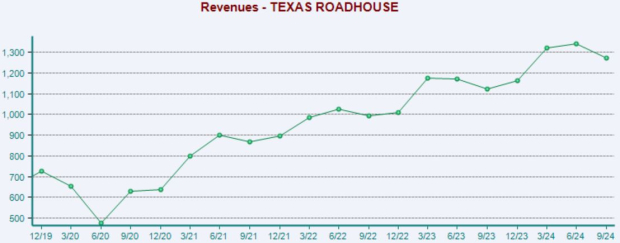

The company’s top line has shown consistently strong growth over the past five years, as shown below.

Image Source: Zacks Investment Research

In addition, TXRH’s latest set of quarterly results were filled with positivity, with the company seeing 8.5% comparable sales growth year-over-year. Expansion has also aided the company nicely, with Texas Roadhouse expecting to grow its footprint even further throughout 2025.

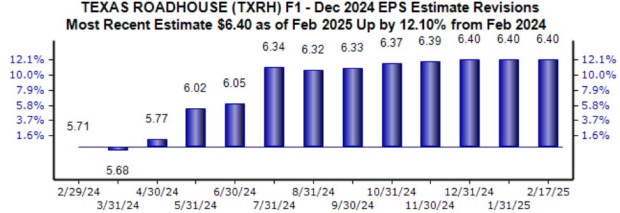

Analysts have taken note of its momentum, raising its current year outlook bullishly and helping land the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Wrapping Up

We’ve got several well-known restaurant operators on the reporting docket this week, a list that includes Cheesecake Factory and Texas Roadhouse.

A peer, McDonald’s, has already revealed its quarterly results, with U.S. comparable sales remaining weak. Global comparable sales did take a small step higher relative to the prior period, but U.S. consumers have seemingly shifted preferences following menu price increases.

Comparable store sales will be key for both CAKE and TXRH, essentially telling us whether their established locations are still seeing growth. Both CAKE and TXRH posted favorable results concerning the metric in their latest releases, with TXRH’s momentum much clearer.

More By This Author:

Ride The AI Infrastructure Buildout With These 2 Stocks: Super Micro Computer, VertivThese 3 Companies Crushed Quarterly Expectations: PLTR, NFLX, RCL

Why Earnings Season Matters

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more