Research Report: XIN

Elle Investments Research Report: XIN

Company: Xinyuan Real Estate Co., Ltd.

Symbol: XIN

Date of analysis: 5/5/19

Recommendation: Buy

Price at analysis date: $4.47

PT: $9.87

Upside: 121%

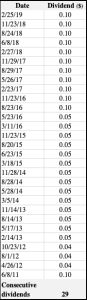

Dividend: 0.40 (9%)

XIN: 1-Year Chart

Source: Seeking Alpha

INVESTMENT THESIS:

XIN is a Chinese real estate developer and property manager that is trading at a very depressed valuation, which is common for Chinese companies of this nature. But we feel that the real estate projects outside of China (i.e. NYC, UK), the substantial investment by global private investment firm TPG, and the 29 consecutive quarters of paying a dividend significantly de-risk a position in XIN. It may take awhile (if ever) for the market to give XIN’s stock a fairer valuation, but in the meantime, patience can be rewarded via the 9% dividend.

LIQUIDITY POSITION: Fair

As of 4Q18 (which ended 12/31/18), XIN had cash on hand of $1.2B (includes cash, cash equivalents, restricted cash, and short-term investments). They were profitable in 2018, and for 2019 they gave guidance of 15-20% net income growth, which would imply net income to common shareholders of about $87M for 2019.

However, XIN does have a very large debt load, which stood at $3.5B as of 4Q18. Thus far XIN seems able to easily access more funding and extend their debt maturities into the future. The risk here is the questionable terms of the financing decisions that management is making, which continue to push their weighted average interest rate up. Just a few days ago on April 29, they announced the issuance (offered outside of the US) of $300M worth of 14.2% senior notes due 2021. The proceeds were used to partially retire two other batches of senior notes paying interest rates of 8.1% and 9.9%.

Frankly, the jury is still out about management’s rationale behind this expensive-looking maneuver.

COMMERCIAL PROSPECTS: Very Good

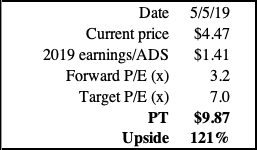

As previously mentioned, XIN earned very healthy profits in 2018 and expects to grow net income by 15-20% for 2019, implying net income to common shareholders of about $87M. For 2019, we calculate earnings of $1.41/ADS (this excludes the very small number of dilutive securities that are not included in the diluted ADS count of 61.9M as of 4Q18).

The absurdly low valuation (indicated by the forward P/E of 3.2x) is not uncommon for Chinese real estate companies, given the heightened risk US investors have towards real estate valuations in China.

It’s true that the majority of their revenue comes from their real estate development projects in tier-one and tier-two cities in China such as Beijing, Shanghai, Zhengzhou, Jinan, Xi'an, and Suzhou. This makes it difficult for US investors to verify the stated book value of their assets. However, they do have a growing list of projects outside of China, most notably in New York City (the Oosten Project in Brooklyn and the Hudson Garden Project in Manhattan) and the UK.

These projects validate their business operations. The fact that they have paid a quarterly dividend for 29 consecutive quarters (and counting) speaks towards management’s willingness to return capital to shareholders—something that many other Chinese companies are reluctant to do.

Because of these important differences, we think XIN is deserving of a more favorable valuation and have assumed a target forward P/E of 7x to calculate our PT.

XIN: Price Target

Source: Elle Investments

XIN: Dividend History

Source: Elle Investments, Yahoo Finance

CONCLUSION:

XIN is not without risks. The questionable financing decisions by management, the slowing Chinese economy, and the effect of Brexit on the UK’s real estate market need to be considered. But we feel that this has been punished too severely. The very low valuation is not indicative of a company that is growing the top and bottom line, has a growing list of real estate projects in major cities of both the US and Europe, has the backing of well-known global investor TPG, and has paid a dividend (currently 9%) consistently for the past several years. We think XIN is a buy.

Disclosure: We are long XIN.

Additional commentary from Elle Investments can also be found at elle-investments.com.

Disclaimer: The Elle ...

more

$XIN sounds promising.