Research Report: Tailored Brands (TLRD)

Company: Tailored Brands, Inc.

Symbol: TLRD

Analysis Date: 6/13/19

Analysis Price: $5.41

Price Target (PT): $9.90

Upside: 83%

Dividend: $0.72 (13.3%)

Recommendation: Buy

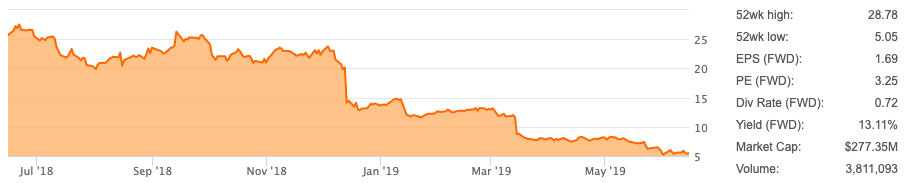

TLRD: 1-Year Chart

INVESTMENT THESIS:

The flagship brands of TLRD (Men’s Wearhouse and Jos. A Bank) are battling two very disruptive trends in men’s fashion: the growing acceptance of more casual dress in the office setting, and the growing popularity of custom suits. Management is aware that their traditional business model, which consisted of large stockpiles of off-the-rack suits, is losing ground. While it’s too early to tell if the changes they are making can stabilize or reverse the negative trend in comps, the severe punishment the stock has received this year seems to already price in a dividend cut (or elimination). Further downside seems unlikely given the already low forward P/E of under 6x, and any improvement in the top-line in the coming quarters could offer a nice boost to the stock price.

LIQUIDITY POSITION: Good

As of 1Q fiscal year (FY) 2019, TLRD had $30M of cash and $425M of available credit. The long-term debt load of $1.2B is large, but there are no balloon payments due until 2022.

TLRD: Principal Payments Due (By Fiscal Year) ($M)

.png)

Sources: Elle Investments, 2018 10-K, 1QFY19 10-Q

They are still earning healthy profits, so covering the interest payments is not a concern. The liquidity worry at this point is that the $0.72/share dividend (currently yielding 13.3%) will be cut or eliminated in order to reallocate capital towards paying down debt. Management was asked specifically about what gives them confidence to continue paying it in light of the weaker results, and they said that returning cash to shareholders is an important part of their value proposition, and that they remain committed to it at this point.

If comps stay at 2QFY19 guidance levels for the remainder of the year (-4% and -3% for Men’s Wearhouse and Jos. A. Bank, respectively), we have them earning about $50M in adjusted net income. After spending $36M to service the dividend, there is not much left over to make a meaningful impact on debt reduction. Without a stabilization or reversal in the near future of the top line sales decline, a reduction in the dividend would seem likely.

COMMERCIAL PROSPECTS: Fair

TLRD owns and operates the retail brands Men’s Wearhouse (menswear), Jos. A. Bank (menswear), Moores (menswear), and K&G (family retail). They also have a Corporate Apparel segment which provides corporate clothing uniforms and workwear.

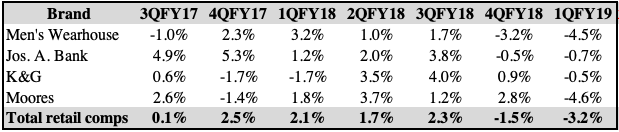

Men’s Wearhouse and Jos. A. Bank together make up the lion’s share of total sales (about 75% as of 1QFY19). The poor recent performance of the stock price can be attributed to the negative comps seen at these two brands over the past few quarters.

TLRD: Comps Across All Brands

Source: Elle Investments, TLRD earnings

The formal menswear industry is currently experiencing two very disruptive trends. First, casual dress is becoming more acceptable in the workplace, leading to changing wardrobe for men that previously used to wear a suit and tie on a regular basis. Second, the options for buying custom suits are improving in terms of convenience of getting measured and the price.

TLRD management is aware of these trends and is attempting to adapt the business model accordingly. They are stocking more casual wear items to respond to the demand for less formal dress for the workplace, and they are emphasizing the custom suit business. One of the few bright spots from 1QFY19 earnings is that the custom suit business continues to do well, reaching $6M/week in sales through the quarter. This is double from the $3M/week in sales it did at the same time last year. On an annual basis it’s still a small amount of total sales at $200M+, but it’s trending in the right direction. (Another positive from the earnings call was that the current tariffs will not have a negative impact on the financial results given that they do not affect goods that TLRD currently sources. Additionally, any future tariff increases will also not have a material impact, as management has been able to find ways to defray the costs, either through moving production to outside of China, or by getting Chinese suppliers to agree to absorb the costs themselves.)

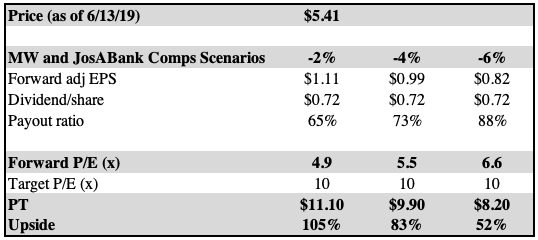

It remains to be seen whether TLRD can stabilize the negative comps as it shifts away from heavily relying on a large stockpile of off-the-rack suits to attract customers. Obviously, if comps continue to come in at -4% indefinitely (or deteriorate further), then sentiment will stay negative, as it will become clear that the “retail apocalypse” will have claimed another victim. But what we think it’s worth doing is looking at what the business might look if the negative sales trends are able to at a minimum stabilize by the end of the year. We have modeled three comps scenarios (-2%, -4%, and -6%) for the third and fourth quarters at Men’s Wearhouse and Jos. A. Bank (the accompanying tables can be found in the Excel file). Our assumptions are as follows:

- 2QFY19 comps of -4%, -3%, -1%, and -3% at Men’s Wearhouse, Jos. A. Bank, K&G, and Moores, respectively (guidance)

- Comps of -1% and -3% at K&G and Moores, respectively, for the second half of the year

- 7 store closures at Jos. A. Bank during 2QFY19 (guidance) (there will likely be additional closures throughout the year)

- Corporate Apparel sales decline of -5% for 2QFY19 (guidance) and continuing at that rate for the remainder of the year

- A year-over-year (YOY) gross margin decline of 150 bps for each of the next 3 quarters

- A YOY reduction of $3M in advertising expense for each of the next 3 quarters

- A YOY reduction of $2M in SGA expense for each of the next 3 quarters

- No further reduction in quarterly interest expense from the current payment of 19M

- Tax rate 23%

- Diluted share count 51M (ignores the immaterial amount of anti-dilutive shares excluded from 1QFY19 EPS calculation)

TLRD: Comps Scenario Analysis

Sources: Elle Investments, Yahoo Finance

For our base case of -4%, we see them earning about $1.00/share. Even if comps were to deteriorate to -6% for the last two quarters of the year, they would still earn enough to cover the dividend. But there is not much left over for debt reduction.

Part of the recent decline in the share price can likely be explained by the expectation that the dividend will be reduced or eliminated. However, even if it is eliminated completely, if TLRD is able to stabilize comps by the end of the year, then the current valuation is simply too low.

CONCLUSION:

Though currently profitable, the low valuation indicates how negative sentiment is towards TLRD right now. The market clearly does not think they can turn things around, and that their sales will continue to decline indefinitely. We think this provides a decent buying opportunity, as a dividend cut seems to already be priced in. Should comps stabilize or improve by the end of the year, there could be a nice boost to the stock price as the market revalues it from a “dying retailer” to a healthy, stable, and cashflow-generating mature business. We think TLRD is a buy.

ACCOMPANYING TABLES:

To view the full model, please click here: TLRD Excel model.

Disclaimer: The Elle Investments portfolio is managed utilizing a “quantamental” approach where each position, while based on Fundamental Analysis, is sized as part of a larger ...

more

What's your view on $TLRD now?