Recent Earnings Reports Suggest Economic Growth Has Peaked

A close analysis of earnings reports from five companies over the last two weeks suggests to me that economic growth has peaked.

(Click on image to enlarge)

The clearest example of a coming slowdown comes from $10 billion home furnishings retailer Restoration Hardware (RH). On Tuesday afternoon, RH forecast only 5%-7% revenue growth for 2022 compared to 32% in 2021. As you can see in the chart above, its stock has been punished in the wake of the report. Though RH blamed the war in Ukraine, its troubles are likely due to a slowdown in the housing market.

(Click on image to enlarge)

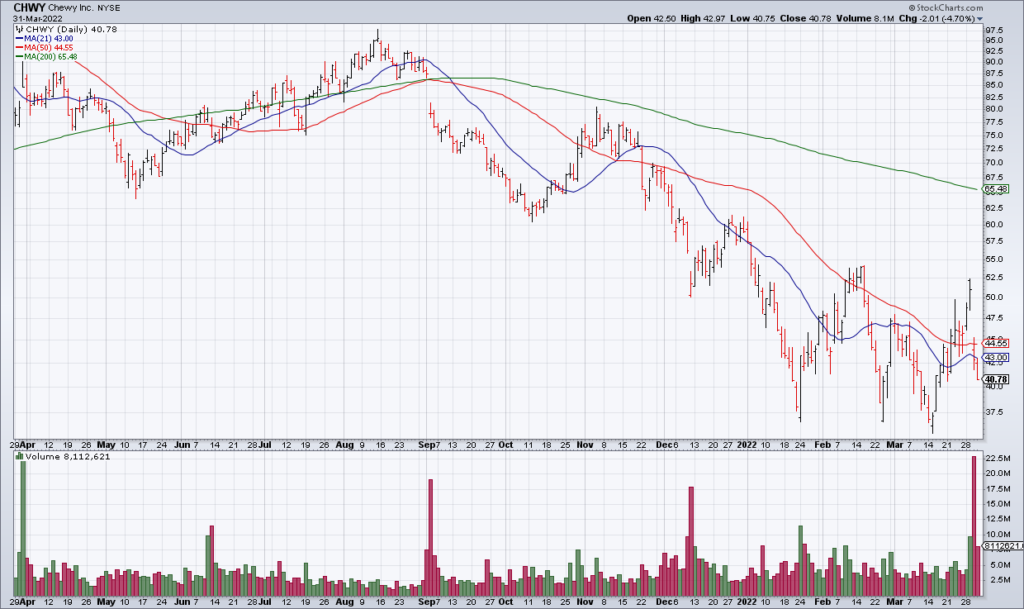

The next clearest example of a coming slowdown comes from $17 billion online pet retailer Chewy (CHWY). As I wrote on Wednesday, CHWY’s revenue growth is decelerating from 47% in 2020 to 24% in 2021 to guidance for 15%-17% in 2022. Now, in CHWY’s case a good deal of this is due to economic reopening, not an economic slowdown. Pet adoption surged during the pandemic and is waning as the economy reopens. So I’m not sure to what extent CHWY’s reports suggests being careful about consumer discretionary stocks versus pandemic beneficiary stocks.

(Click on image to enlarge)

Next, let’s take a look at $17 billion restaurant chain Darden (DRI) – owner of Olive Tree. Here are DRI’s quarterly comps for 3QFY22 (ended February 27, 2022), 2QFY22 and 1QFY22: +38.1%, +34.4% and +47.5%. What am I getting at? While DRI’s quarterly comp though the first three quarters of its FY22 appear to be in the high 30s, last Thursday it guided full year comps to only 29%-30%. Clearly their 4QFY22 is going to show a big slowdown in comps. Now – to be fair – 4QFY22 has a very tough compare with the quarter ended May 30, 2021 when the economy was reopening in the wake of the vaccines and huge pent up demand resulted in +90.4% comps. So – as with CHWY – this is not a clear read but it is nevertheless noteworthy in my opinion.

(Click on image to enlarge)

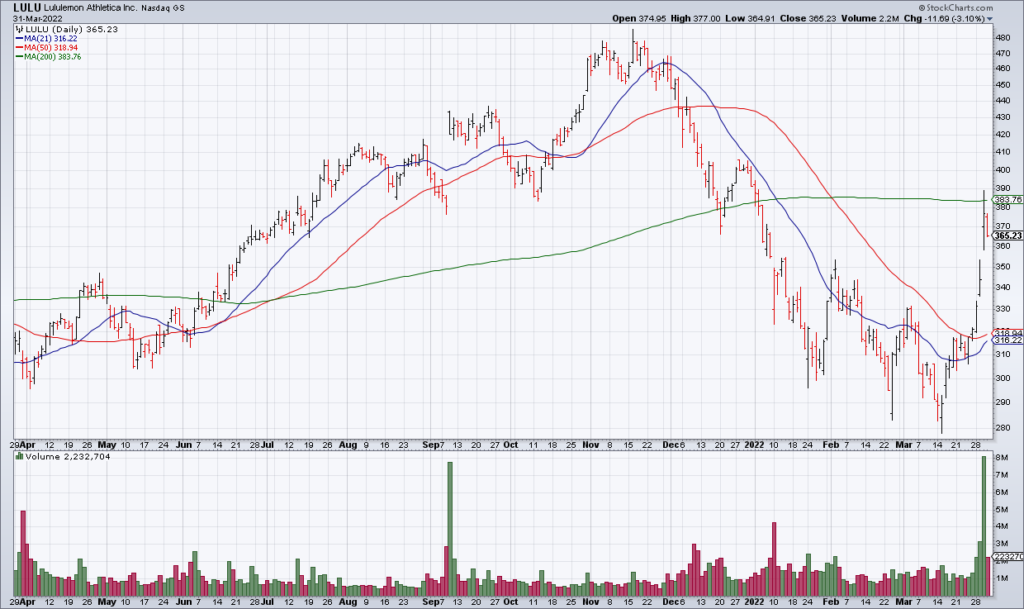

Now let’s consider $47 billion athleisure retailer Lululemon (LULU). In 2021, LULU reported 42% revenue growth but is guiding 2022 to only 20%-22%. As you can see in the chart above, LULU got a nice relief rally in the wake of its earnings report Tuesday afternoon, but I’m not convinced it’s anything more than that.

(Click on image to enlarge)

Last let’s review $216 billion software company Adobe’s (ADBE) most recent report. ADBE’s revenue growth appears to be decelerating as well from 23% in 2Q21 to 17% in its just completed 1Q22 with guidance for only 13% in 2Q22. The slowdown here is gradual but apparent nonetheless.

What does it all add up to? Objectively – in all five cases – we’re seeing a deceleration in the rate of growth – though revenues are still growing and not rolling over negative. I think we can definitely draw the conclusion that the economy is decelerating from its scorching post-COVID, stimulus driven, trajectory. Whether we’re going to have a soft landing or a hard one is yet to be determined – but peak growth is in the rearview mirror.