Real Total Return Of OMXI All-Share Index Still Negative

I always revisit and update my analysis and commentary. In a prior post, I pointed out the 2.270 level as an important support for the OMX Iceland 15 Index (OMXI15). As can be seen in the chart below, recently the index tested that level again - this time almost to the penny. However, it is now facing relatively strong overhead resistance.

OMXI15 - Daily Chart

(Click on image to enlarge)

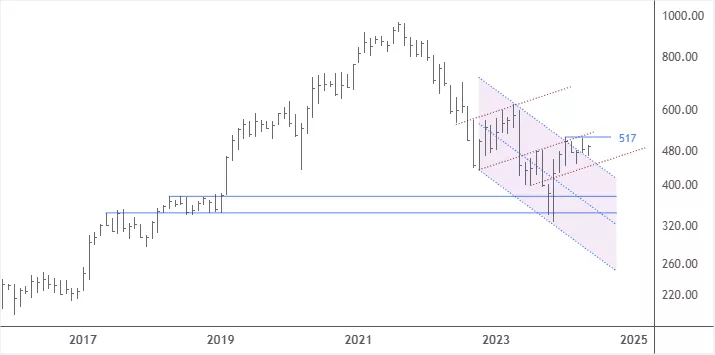

To reiterate what I have said earlier, it would be a very positive sign if the stock price of Marel manages to rise convincingly through 517 ISK per share and stay above that level for the following few days.

Marel´s Share Price - Monthly Chart

(Click on image to enlarge)

I still consider the longer-term trend of the stock price of Alvotech to be up. For the last three days, the price has been riding potential support (see solid brown line). I will re-evaluate my view if the price closes convincingly below 1.784 ISK per share. On the chart, I have drawn in the next possible resistance zone above the current price and the potential areas of support under the current price.

Alvotech´s Share Price - Daily Chart

(Click on image to enlarge)

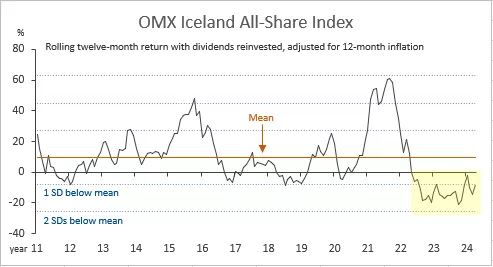

OMXI All-Share Index Real Total Return

My last chart shows the rolling one-year, real total return of the OMX Iceland All-Share Index. Since June 2022, the real rate of return has been negative and has for the most part oscillated between one and two standard deviations below its +12-year average or mean. Its current standing, using April numbers, is -8.2% and up from the -14.5% reading in March.

(Click on image to enlarge)

More By This Author:

Promising Long-Term Gold Price Formations

Share Price Of Alvotech Up 28%

Nasdaq Financial 100 Index Has Surpassed An Important Swing High

Disclosure:

The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more