Re-Examining Facebook

Credit: WSJ

The big question mark in the Internet sector is sustainability. Currently, we have seen amazing margins for companies that can sustain growth and offer desirable features to users. On the downside, we have seen the case of Twitter (NYSE:TWTR), where MAU (Monthly Average Users) has stalled, sending the stock spiraling down prior to the recent run-up and yielding negative free cash flow.

(click to enlarge)

Image from Google Finance

In our previous BOW article, we visited the potential that a company like Twitter may still have, especially considering the possible buyout from a larger firm either within the current sector, or from a company like Apple (NASDAQ:AAPL) that might wish to participate more heavily in social media and internet. This is a testament to the value that firms in this space have, even when growth has slowed. TWTR's run-up in the past weeks, shortly before its most recent price resetting, proves the point.

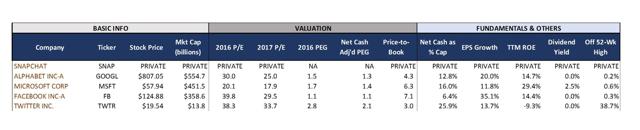

The table below compares the major players within the Internet space with key valuation and fundamentals (note: companies like Apple and Amazon (NASDAQ:AMZN) could easily make the list; but because their core business is not Internet, we have excluded them from the table). In addition, we have also included Snapchat as a main competitor, but because of their private ownership, we will not be able to properly compare the company's metrics.

(click to enlarge)

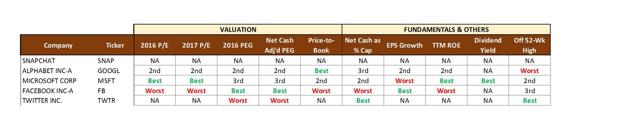

To better contract the difference across the peer group, I also created the rankings below:

(click to enlarge)

Facebook (NASDAQ:FB) stands out from the group with the worst P/E for 2016 and 2017. But even though the stock trades at a premium, investors are certainly receiving perceived value in exchange through growth expectations: FB has a 1.1x PEG (P/E over EPS growth) in 2016, and lead the sector in that metric.

Let's take a further look into Facebook and assess if the stock still has upside left in it.

- Facebook is a powerhouse in the industry that is still seeing nice MAU and DAU growth in all regions, especially Asia and other regions of the world. ARPU (Average Revenue Per User) is still seeing significant double-digit growth across all regions.

- Struggles with traditional media to adapt to the evolving technology world can offer additional sources of ARPU for existing online platforms

- As market saturation becomes more of a threat to MAU/DAU, Facebook will need to stay ahead of new entrants to the market

MAU Growth

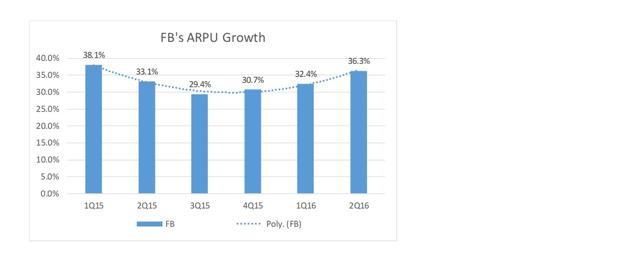

Facebook dominated another earning season with a sizable 15% MAU YOY growth. In addition, the company also delivered material ARPU growth of 36.3%, as ad revenues rose an astounding 63% YOY. These results boosted investor confidence in reassuring the position of the firm within the industry, and also solidified the company's recovery from a deceleration in ARPU growth experienced through most of 2015.

(click to enlarge)

Source: DM Martins Research, using data from SEC filings and company's press release

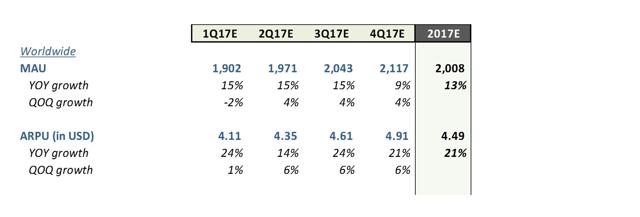

This came a day after Twitter announced a disappointing quarter due to slowing growth and questions of the platforms usability and future ability to generate revenue. The table below is my estimate of the growth Facebook will need in MAU and quarterly ARPU in order to meet analyst estimates of approximately $36 billion in revenue for 2017:

(click to enlarge)

Facebook Live and the opportunity from traditional media

Although listed as a potential risk on the 2016 10-K, we see traditional media as a potential opportunity for ARPU generation.

Prior to the age of the Internet, print media enjoyed an immense run of high margins and predictable cash flows. After the shift to digital media, many print media companies have struggled with print as a way to offer premium content to users. Although not highly publicized, in 2015, Facebook started experimenting with partnering with select news companies to distribute premium content on the Facebook platform.

In addition, as reported by the Wall Street Journal recently, Facebook Live continues to attract relevant and highly desirable content. I believe the feature is well-positioned to support content creation - a potential cash cow for the company. Even as competitors like Twitter and Snapchat continue to make similar pushes to lock up premium content, I believe Facebook will exercise higher buying power over premium content providers. This will allow for a more sustainable model going forward.

New Entrants

New entrants are not a new problem for Facebook but should continue to be a growing concern. Just as Facebook shook the world from a Harvard dorm room, new creative ideas for Internet use are always on the loom. As referenced above, Snapchat is a private company that has been a disrupter in the industry, just as Instagram and Whatsapp (now owned by Facebook) were in the past. Snapchat declined Facebook's offer for a buyout for roughly 3 billion dollars, and has continued to steal users from the social media leader ever since - online media guru Gary Vaynerchuk, in his book "Ask Gary Vee", makes a reference to the "Snapchat generation" that seems to be replacing the 30-to-35-year old Facebook one. Facebook recently launched the Instagram story to combat Snapchat's Story feature in an effort to replicate the high DAU from this feature. We will have to see how successful Facebook's play will be, although I tend to choose innovation over imitation.

"Old" entrants

Facebook has done well in the acquisition space so far, even if some of its major bolt-on platforms have yet to be properly integrated and monetized (e.g. WhatsApp). But the company might not be able to continue to buy their way to new heights, as the industry consolidates further - now that Microsoft (NASDAQ:MSFT) has acquired LinkedIn (NYSE:LNKD) and Twitter, by many accounts, seem to be next. In addition, as we have seen with Microsoft, it would not be out of question for companies like Apple and Amazon to fully enter the space now dominated by Facebook. If this were to happen, Facebook and other companies within the industry could face fierce competition from cash-rich gorillas. Even though I see Facebook still having an advantage in this scenario, Amazon's entry into the audio/video space must have been quite a shock for Netflix (NASDAQ:NFLX).

Takeaway

Overall, I believe Facebook continues to be a great investment in the near term. Not only does the stock seem to have momentum, but the company also appears to have enough business development upside in store. However, due to the rapidly changing environment of the Internet sector, an investment in this space, including in FB, should be researched diligently and monitored closely.

This report was authored by a third-party contributor and edited by Daniel Martins. It may provide a contrarian view to what D.M. Martins Research had previously published on FB.