Rallies Move Into Fresh Air As Friday's Bearishness Is Negated

A bright start to the week has given bulls an important advantage, although trading volume remained light overall. Since the breakouts in early July I would be looking for a more substantial retest of breakout support than what we saw last week. However, there is no guarantee we will see such a move.

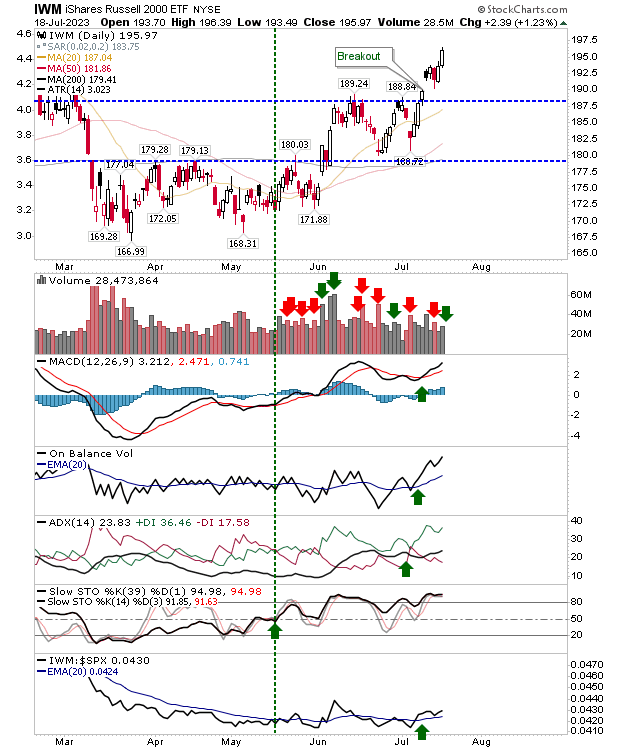

In the case of the Russell 2000 (IWM), today's gain pushed beyond the tight trading of the last four days. Volume rised to register as accumulation, but in overall terms, today's volume was light. Technicals are net bullish. I would like to see tight trading near the highs of today to consolidated the jump.

Today's gain in the Nasdaq has pinged channel resistance. Given the pace of advance, the angle of the current channel is one earmarked for sustainability, so if there was a break in the channel I would look for a rapid acceleration into a late summer blowout top, or at least, a rally that will lead to an extend sideways trading range. This index has been steady-as-she-gos for a good time now, and this is likely to change.

jul18.png)

The S&P is also up at channel resistance similar to the Nasdaq. Trading volume was more in line with traditional accumulation, something that the Nasdaq did not enjoy. If one was to pick which index was going to break channel resistance, the S&P would get the nod.

What might drive gains in the S&P more is the breakout in the Dow Jones Industrial Average. Recent buying has skewed in favor of accumulation, with a solid trend shift in On-Balance-Volume after a couple of months of selling. What's needed now to confirm the change is a new 'buy' trigger in relative performance against the Nasdaq 100.

The Semiconductor Index has accelerated beyond its triangle consolidation, backed by a new MACD trigger 'buy' above its bullish zero line. Other technicals are net bullish.

As a final note, the other asset looking ready to breakout is Bitcoin. It has been caught in an extended range for a while but is now ready to begin the process of building a right-hand-side base.

(Click on image to enlarge)

More By This Author:

Friday's Selling Ranks As Distribution, But Positives Remain

S&P And Nasdaq Follow Russell 2000 Breakout

Russell 2000 Breaks From Base In (Low) Key Move

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more