Quantum Computing: 12 Stocks For What The Future May Hold

Image Source: Unsplash

Quantum computing companies are still years away from curing cancer, but they can do things in hours that would take classical computers years to do. This article highlights 12 quantum computing stocks that could generate incredible returns for investors over the next few years.

[Ed. note: The first two stocks listed are microcaps and trade under $5. Such stocks are readily manipulated; do your own careful due diligence.]

Quantum Computing vs. Classical Computing

There is a major difference between classical and quantum computing. Below is an edited and abridged explanation from Nicoya Research:

- In classical computing, data is known as a bit, which can be either 0 or a 1 thus giving it binary qualities,

- With quantum computing, qubits are used instead of bits, which

- exist in any proportion of both states at the same time (superposition),

- can be entangled or invisibly connected, that is, if one qubit is altered, the other reacts at the same time allowing such computers to process vast amounts of information simultaneously which leads to an enormous leap in processing power, and

- allow us to simulate the natural world to improve our understanding of science to make improvements in health care, engineering and material science.

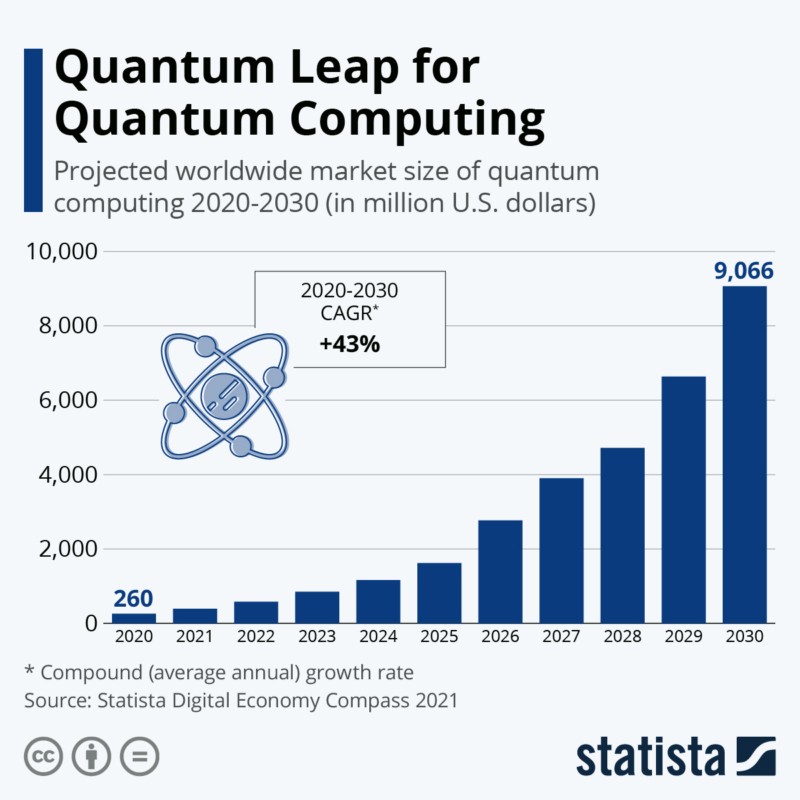

Addressable Size and CAGR of Quantum Computing Market

The size of the quantum computer market is expected to grow dramatically in the next 10 years. Research company McKinsey suggests that companies deploying quantum stand to gain $1.3 trillion in value by 2035 which presents an incredible opportunity for investors.

12 Quantum Computer Company Stock Returns

Over the past 12 months there has been considerable progress in this arena reflected in an average advance of 28.9% in the collective stock prices of the 12 quantum computer companies highlighted below since the last week of April (and 53.6% YTD). In comparison, the Nasdaq is only up 14.9% since the end of April and up 29.5% YTD.

- Rigetti Computing (RGTI): +320.5% since the end of April

- is currently developing a new 84-qubit processor with plans to put four such processors together to form a 336-qubit machine and also has plans to build a processor that can support 1,000 qubits in 2025 and one with 4,000 qubits in 2027.

- D-Wave Quantum (QBTS): +196.0% since the end of April

- was the world's first organization to sell a commercial quantum computer (to Lockheed Martin back in 2011) using a process called quantum annealing and has recently entered a multi-year agreement with Lockheed Martin to upgrade its quantum computer system with 1,000+ qubits.

- IonQ (IONQ): +167.2% since the end of April

- uses trapped-ion technology in its processing units which relies on suspending ions in space using electromagnetic fields, and transmitting information through the movement of those ions in a “shared trap” and currently has 2 quantum systems: an 11-qubit system launched in 2020; a 25-qubit system launched in 2022; and has a 32-qubit system under development and in beta testing with researchers.

- Nvidia Corporation (NVDA): +52.8% since the end of April

- has introduced a platform to construct quantum algorithms by employing widely known classical computer coding languages which have the ability to choose whether to run the algorithm on a classical computer or quantum computing based on efficiency and is the leading designer of graphics processing units required for powerful computer processing.

- Amazon (AMZN): +35.1% since the end of April

- has partnered with the California Institute of Technology to foster the next generation of quantum scientists and fuel their efforts to build a fault-tolerant quantum computer.

- Alphabet (GOOGL): +23.9% since the end of April

- has already built a programmable superconducting processor that is about 158 million times faster than the world’s fastest supercomputer. and is continuing to push innovation in quantum computing, from hardware control systems and quantum control to physics modeling and quantum error correction.

- Alibaba Group (BABA): +21.8% since the end of April

- is investing heavily in quantum computing research and building a quantum computing chip based on superconducting qubit technology.

- Intel (INTC): +19.4% since the end of April

- has constructed a 49 qubit superconducting chip and has developed a testing tool for quantum computers which allows researchers to validate quantum wafers and check that their qubits are working correctly before they are constructed into a full quantum processor.

- Baidu (BIDU): +19.2% since the end of April

- has developed a quantum computer with a 10 qubit processor and has developed a 36-qubit quantum chip.

- IBM (IBM): +18.5% since the end of April

- plans to develop a multichip processor that is 860% faster than its current fastest processor by 2025 and have its quantum computers commercialized within 5 years.

- Microsoft (MSFT): +17.3% since the end of April

- is developing a quantum machine using a proprietary control chip and a cryo-compute core that work together to maintain a stable cold environment and offers a portfolio of quantum computers from other hardware providers as a service to provide an open development environment for researchers, businesses and developers that enables the flexibility to tune algorithms and explore today's quantum systems.

- Taiwan Semiconductor (TSM): +15.3% since the end of April

- plans to use its new cloud computing platform to develop quantum computing applications.

The above 12 stocks were up 28.9% since the end of April so there may well be considerable room to run in the months and years to come.

Investing In Quantum Computer Stocks

To take full advantage of what the future might well hold consider investing in one or more of the stocks highlighted in this article. Naturally, it is imperative that you do your own due diligence before making a decision to do so as my comments are not recommendations, per se. I hope this article has made you aware of the opportunities.

It is still too early to determine the best quantum computing stocks to invest in because the technology is rapidly advancing with several competing approaches so investors might want to buy the Defiance Quantum ETF (QTUM) which provides exposure to 71 companies on the forefront of machine learning, quantum computing, cloud computing, and other transformative computing technologies thereby providing - albeit not quantum computing specific - diversified exposure. It is up 14.6% since the end of April.

More By This Author:

Cronos Brands' Q2 Financials Show Major Reduction In Net Loss

Curaleaf Q2 Financials Report 31% Increase In Net Loss

Canopy Growth Q1 Financial Report: Cannabis Revenue Down 26%

Disclosure: None

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more