Qualcomm Inc. - Elliott Wave Technical Analysis

QCOM Elliott Wave Analysis | Trading Lounge

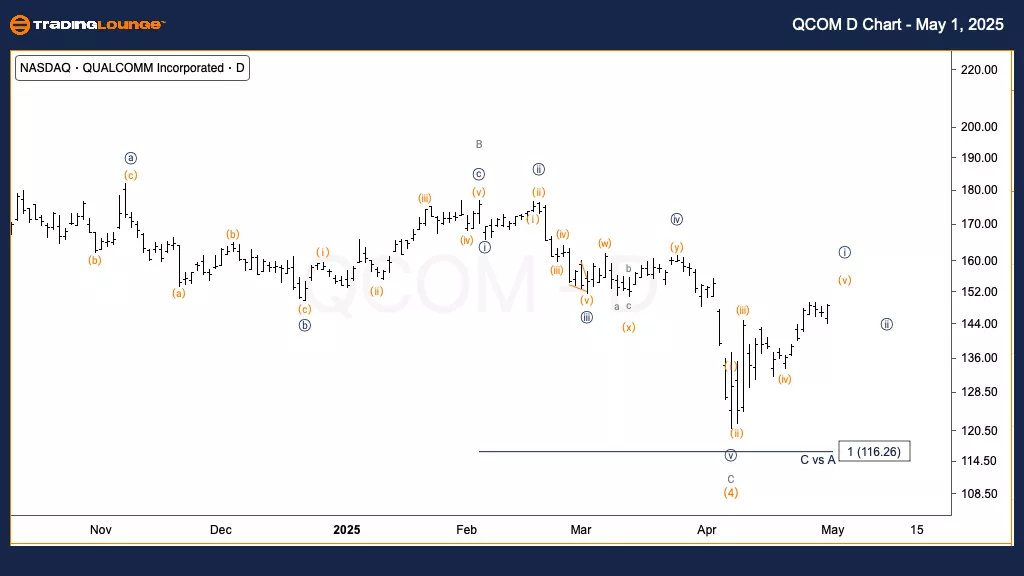

QUALCOMM Inc. (QCOM) Daily Chart

QCOM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 1

Direction: Upside in Wave 1

Details: A bottom in Intermediate Wave (4) appears confirmed, supported by a five-wave count in Wave C, which narrowly missed matching Wave A. We are now watching for a top in Wave {i} and preparing to analyze the pullback in potential Wave {ii} for new upside opportunities.

(Click on image to enlarge)

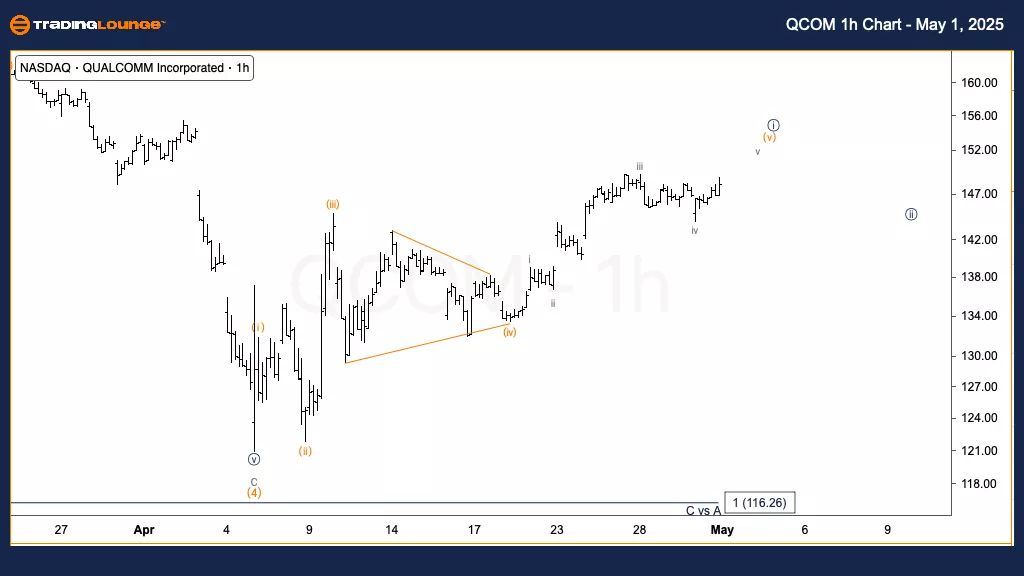

QUALCOMM Inc. (QCOM) 1H Chart

QCOM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (v) of {i}

Direction: Upside in Wave (v)

Details: Monitoring one final move higher in Wave v of (v) before reaching a potential top near the Medium Level around 150 dollars.

(Click on image to enlarge)

Summary

This analysis covers the current trend structure of QUALCOMM Inc. (QCOM) through Elliott Wave Theory using both daily and 1-hour charts. Here's a quick breakdown:

QCOM Elliott Wave Technical Analysis – Daily Chart

QUALCOMM seems to have finalized Intermediate Wave (4) with a five-wave C structure, missing equality with Wave A by a few dollars. The stock is now progressing upward in Wave {i}. We are anticipating a short-term top and will focus on the potential pullback in Wave {ii} to find new long trade setups.

QCOM Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, QCOM is in Wave (v) of {i}, with a final push higher expected before a potential top forms around the MediumLevel at $150. This zone will be key for observing resistance and potential trend changes.

Technical Analyst: Alessio Barretta

Source: Visit TradingLounge.com and learn from the experts.

More By This Author:

Elliott Wave Technical Analysis: Ripple Crypto Price News For Thursday, May 1

Unlocking ASX Trading Success: Car Group Limited - Wednesday, April 30

Elliott Wave Technical Analysis: MicroStrategy Inc. - Wednesday, April 30

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more