Quadrant-Inspired Portfolio Construction

Image Source: Pexels

A couple of times previously, I've mentioned not wanting to own multiple alts from the same fund company. The idea is that there can be an overlap of the same trades across several different funds. A company might have half a dozen 5-Star funds, but if they have a lot of overlap despite having different named strategies, then the diversification benefit diminishes, and there is potentially more risk by using more than one of them, not less risk.

Those six funds are from the same provider as of Tuesday's pricing. Tuesday was a mixed day for various alts, but all six of these were down. It's just a microcosm, but this sort of overlap risk seems like an easy one to avoid.

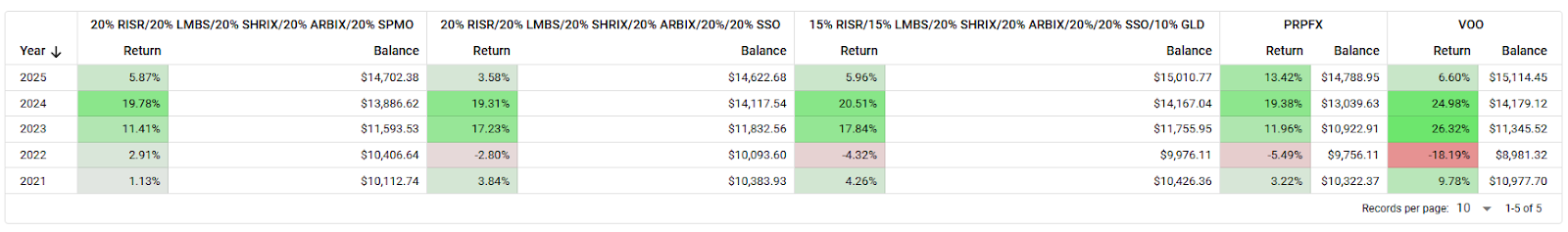

Let's play around with a couple of quadrant-inspired portfolios.

These are long/short heavy between RISR/LMBS and ARBIX, but they are in very different parts of the markets, vulnerable to different things. RISR/LMBS has compounded at just over 10% while ARBIX has compounded at just over 4% so in the neighborhood of treasuries over the duration of the backtest, but in 2023 and 2024, it had higher returns than treasuries. They had spread over treasuries, but the returns were less when treasuries yielded zero. ARBIX was down 54 basis points in 2022, so it was not crushed like duration products.

I would not expect RISR/LMBS to compounded at such a high rate, and although clearly not riskless, the volatility profile can stand up, they are different sides of the same trade, which provides an offset.

Obviously, I have become a big believer in cat bonds over the last couple of years, and again, far from riskless but vulnerable to different things than RISR/LMBS and ARBIX. These three offer the opportunity for 7-8% returns with very little volatility, the vast majority of the time. Not always, but most of the time.

Momentum (SPMO) versus 2x S&P 500 (SSO), both are just equity exposure, not the plainest vanilla, but still are equities. For the backtested period there was not much difference between the two, but since SPMO's inception, the 2x meaningfully further ahead of SPMO. Including SSO, of course, introduces capital efficiency into the discussion, but leverage has plenty of risks in downturn,s and of cours,e there are also risks just related to tracking.

I included a little gold in the third portfolio because how can we have a discussion about quadrant-inspired portfolios and not include gold in there somewhere?

In addition to being quadrant-inspired, there is something of a barbell trade put on, too. Equities are going to be the thing that goes up the most, most of the time. None of these will keep up with 100% equities, but a good chunk in equities and the rest in much lower volatility exposures that can do a little better than T-bills probably gets someone who has maintained an adequate savings rate a total return that can get the job done.

In real life, I would go smaller than 20% in the various alts, which is something I say in just about every one of these posts.

More By This Author:

What To Make Of A 14% Yield In A 5% World

Managing Portfolio Misery

Portfolio Heresy; Levered ETFs

Disclaimer: The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not ...

more