Q3 Earnings: Top-Performing AI Stock Set To Report Results

Photo by Steve Johnson on Unsplash

Earnings season continues its rapid pace this week, with a wide variety of companies lined up to report quarterly results. Among the bunch is a highly recognizable name involved in the AI frenzy, Supermicro (SMCI - Free Report).

Given the positivity of the Q3 cycle so far, is it reasonable to expect the AI player to keep the momentum rolling? Let’s take a closer look at expectations.

Quarterly Expectations Plummet

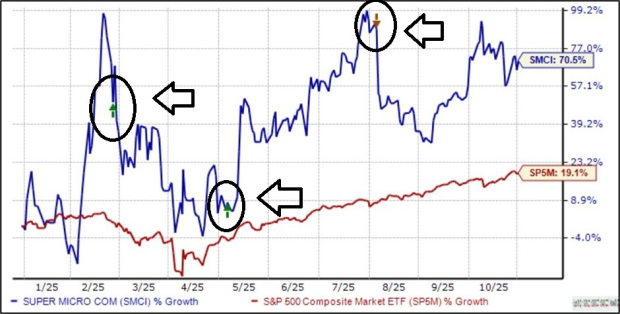

Supermicro is a global leader in application-optimized IT solutions for Enterprise, cloud, AI, and 5G Telco/Edge Infrastructure. Shares have largely outperformed in 2025, climbing 70% compared to the S&P 500’s 19% gain.

As we can see highlighted below, quarterly releases have regularly brought steep post-earnings volatility, a key factor to keep in mind. The stock’s volatile nature is unsurprising given its exposure to the AI frenzy.

Image Source: Zacks Investment Research

EPS and sales revisions heading into the release do warrant some caution, with the current $0.28 Zacks Consensus EPS estimate down nearly 50% since the beginning of August. The value suggests a 62% decline from the year-ago period.

Image Source: Zacks Investment Research

Sales revisions have largely followed the same path, with the current $5.5 billion expected down 15% across the same timeframe and suggesting 15% lower sales. The sales decline here is quite notable, reflecting the first expected year-over-year decline since 2023.

As shown below, sales growth has significantly tapered off over recent periods, well off the steep rates seen throughout 2024. Please note that the chart below shows the % YoY change in sales, not actual sales numbers.

Image Source: Zacks Investment Research

The Post-Earnings Reaction

Overall, guidance will play a major role in the company’s post-earnings reaction, particularly regarding the top line. The quarterly year-over-year sales decline is a stark difference relative to what the company had been experiencing over the past year, a key factor.

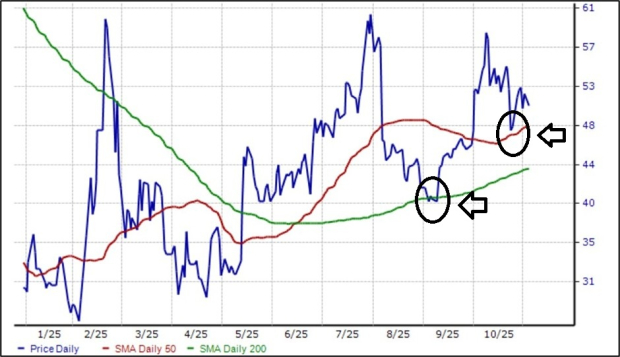

From a simple technical standpoint, shares recently saw strong buying pressure near the 50-day MA, with the 200-day MA also seeing buyers step in near the beginning of September. A retest of these levels post-earnings could be in store given its already-massive gains YTD, with recent downward revisions also painting a challenging picture for post-earnings momentum.

Image Source: Zacks Investment Research

But it’s also important to remember that Supermicro remains on a path to meaningful expansion. The company served four large-scale datacenter customers throughout its FY25, with that number expected to reach 6-8 within its FY26. Keep in mind that the upcoming set of results will be for its FY26 Q1.

More By This Author:

This Stock Soared On Robust Quarterly ResultsShares Of These Companies Soared Following Robust Results

PepsiCo Vs. Coca-Cola: What's The Stronger Near-Term Buy?