Q2 Earnings Season Starts Positively

Image Source: Pixabay

- We are off to a good start in the Q2 earnings season, with the growth pace steadily improving, an above-average proportion of companies beating EPS estimates, and companies generally providing a reassuring outlook for the coming periods. This should help sustain the favorable revisions trend that we experienced ahead of the start of the Q2 earnings season.

- Partly offsetting the above positive take is companies’ difficulty in beating consensus revenue estimates, with the Q2 revenue beats percentage the lowest of the preceding 20-quarter period at this stage of the reporting cycle.

- For the 45 S&P 500 companies that have reported Q2 results, total earnings are up +8.7% from the same period last year on +5.2% higher revenues, with 82.2% beating EPS estimates and 55.6% beating revenue estimates.

- Except for the revenue beats percentage, which at 55.6% is the lowest for this group of 45 index members over the preceding 20-quarter period, all of the other performance metrics are tracking better relative to what we have seen in other recent periods.

The big banks kicked off the Q2 reporting cycle for the Finance sector, with the market markedly appreciating the results from Bank of America (BAC - Free Report) and Goldman Sachs (GS - Free Report). That said, all of the major banks came out with better-than-expected results.

The key difference between the Bank of America and, say, JPMorgan (JPM - Free Report) results was the former’s explicit favorable outlook for the second half of the year, particularly in the context of net interest income.

Bank of America also came out with good investment banking results, but we are seeing improving results on that count from all of the players, including Goldman Sachs. Management teams had been talking about ‘green shoots’ on the investment banking side for some time now, but greater visibility on the monetary policy front appears to have finally cleared the path for greater deal flow.

Banks are still facing multiple headwinds that are pressuring their profitability, including margin pressures and subdued loan demand, but there is reasonable optimism about their earnings outlook due to the beneficial effects of the expected Fed easing cycle.

While we have a reasonably representative sample of results from the Finance sector, it is still very early for other sectors. For the quarter as a whole, S&P 500 earnings are expected to be up +8.7% on +4.8% higher revenues.

As we have been flagging all along, the Q2 revisions trend was very favorable, with estimates barely coming down since the quarter got underway. Estimates increased for the Tech, Utilities, Transportation, Autos, and Consumer Discretionary sectors, helping partly offset negative cuts for the other sectors.

The revisions trend for the Tech sector has been positive for a while now, which is important since the sector alone is on track to bring in almost 30% of all S&P 500 earnings over the coming four-quarter period.

The 2024 Q2 quarter will be the fourth consecutive quarter of robust Tech sector earnings growth, with total earnings for the sector expected to be up +15.5% from the same period last year.

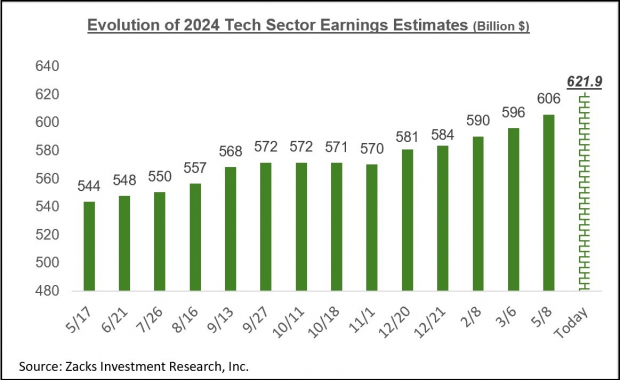

For full-year 2024, Tech sector earnings are expected to be up +17.2%, followed by another strong showing expected next year. The chart below shows how the aggregate earnings total for the Tech sector has evolved over the past year.

Image Source: Zacks Investment Research

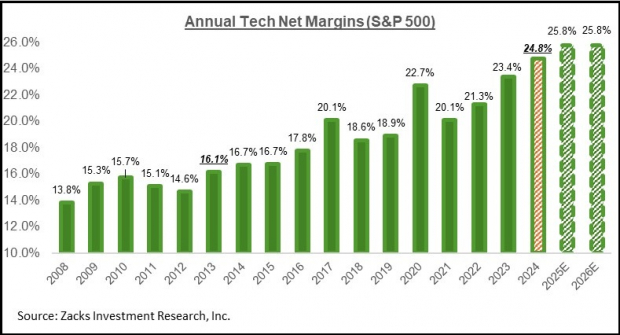

A big contributing factor to the Tech sector’s positive earnings outlook is the sector’s margins outlook, as the chart below shows.

Image Source: Zacks Investment Research

We are already in record territory with Tech sector margins, with 2024 margins expected to exceed last year’s record level. The expectation is for some more gains next year and the year after, with the ever-growing share of higher-margin software and services in the overall Tech earnings pie explaining the favorable trend. Part of this likely also reflects optimism about the impact of AI on the sector’s productivity.

The Earnings Big Picture

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

Please note that this year’s +8.8% earnings growth on only +1.6% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +8.7%, and the revenue growth rate improves to +3.9%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest.

On the margins front, 11 of the 16 Zacks sectors are expected to have higher margins in 2024 relative to last year, with Tech, Finance, and Consumer Discretionary as the big gainers.

More By This Author:

Q2 Earnings Growth Expected To Reach Two-Year HighEarnings Season Gets Underway: Bank Earnings In Focus

3 Key Things To Know About The Q2 Earnings Season