Q2 Earnings Reports Confirm Economic Boom Ahead

Image: Bigstock

We are off to a great start in the Q2 earnings season, with the big banks coming out with a much stronger profitability picture relative to what they were able to show in the preceding periods.

This reconfirms our bullish earnings outlook that envisions estimates going up significantly over the coming months as the full extent of the economic rebound becomes clearer. While some brokers have recently tweaked their 2021 GDP growth forecasts for the U.S. a bit lower, the expectation is still for the U.S. economy to expand in the +6.5% to 7% range this year and north of +5% next year.

We typically associated growth rates in these ranges with emerging economies and not the mature U.S. market. We still remain confident that actual growth will surprise to the upside relative to current expectations, but these consensus projections nevertheless qualify as boom times ahead in our worldview.

Getting back to the Q2 earnings discussion, the sample of reports at this stage remains weighted towards the Finance sector, with the outsized numbers from the big banks seemingly distorting the aggregate picture for the 41 S&P 500 members that have reported already.

The Q2 reporting cycle accelerates meaningfully this week, with more than 250 companies on deck to report results, including 73 S&P 500 members. This week’s reporting docket is dominated by banks and brokers, but we do have number of bellwethers like Netflix (NFLX - Free Report), Johnson & Johnson (JNJ - Free Report), IBM (IBM - Free Report), Texas Instruments (TXN - Free Report) and others reporting as well.

The important takeaway from the big-bank results isn’t the huge bottom-line results that included significant reserve releases, but rather what these reserve releases and, even more importantly, management’s commentary about the state of the consumer and the economy tell us about the coming quarters.

In effect, these banks are saying, through these reserve releases, that they expect economic conditions in the coming quarters to be stronger relative to what they had originally modeled. This has a favorable read-through for all sectors, particularly the economically sensitive ones.

The unusually high year-over-year growth rates for bank earnings are primarily a function of easy comparisons and the aforementioned reserve releases. But that’s not to suggest that there wasn’t genuine strength in the quarterly numbers, as the group’s investment banking business was literally on fire, offsetting tough comparisons on the trading front.

The core business of lending still remains muted, but there was plenty of qualitative commentary from the management teams that suggest a brighter horizon.

JPMorgan (JPM - Free Report) reported that Q2 credit card spending exceeded pre-Covid levels, though card balances remained low given strong household financial health as a result of expansive fiscal measures. At Citigroup (C - Free Report), spending on credit cards increased +40% from the Covid-depressed levels of the year-earlier period, but they were also up +6% from the pre-Covid period.

Housing remained strong, with both JPMorgan and Wells Fargo (WFC - Free Report) extending more mortgage loans (mortgage originations) in Q2 than they did in 2021 Q1, which itself was a record period. JPMorgan reported $39.6 billion in mortgage originations in Q2, up from Q1’s $39.3 billion. At Wells where housing is a much bigger piece of the business mix, mortgage originations reached $53.2 billion in Q2 from Q1’s $51.8 billion level.

The market’s lukewarm reaction to these bank results is solely a function of how strong these stocks have been this year. Also, the perception of these stocks as essentially plays on treasury yields saw them lose ground lately, as benchmark yields have come down for reasons that appear ‘technical’ to us.

Q2 Earnings Season Scorecard

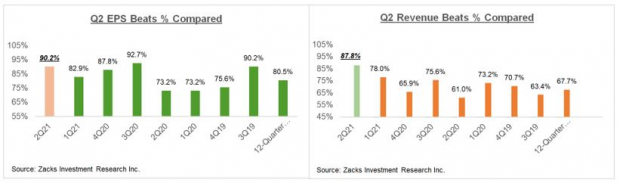

We now have Q2 results from 41 S&P 500 members or 8.2% of the index’s total membership. Total earnings (or aggregate net income) for these 41 companies are up +132.7% from the same period last year on +13.8% lower revenues, with 90.2% beating EPS estimates and 87.8% beating revenue estimates.

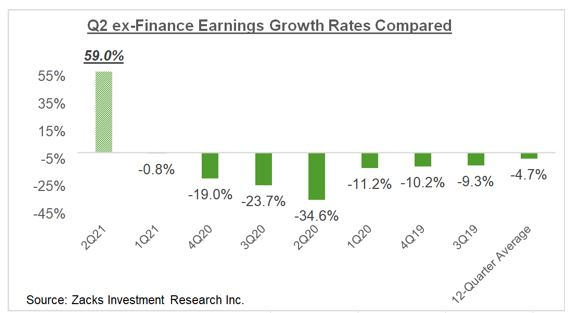

The two sets of comparison charts below put the Q2 results from these 41 index members in a historical context, which should give us a sense how the Q2 earnings season is tracking at this stage relative to other recent periods.

The first set of comparison charts compare the earnings and revenue growth rates for these 41 index members.

Image Source: Zacks Investment Research

The growth comparison is likely not fair, given the unusually high year-over-year growth rates in the Finance sector, a function of big reserve releases and easy comparisons in 2021 Q2.

The Finance sector is a big factor in the outsized earnings growth rate for the 41 index members that have reported at this stage. But even on an ex-Finance basis, the Q2 earnings growth for the remaining companies that have reported drops to only +59%. This shows you the power of easy comps, as the year-earlier period was literally battered by the Covid-driven lockdowns and other business disruptions.

Image Source: Zacks Investment Research

The second set of charts compare the proportion of these 41 index members beating EPS and revenue estimates.

Image Source: Zacks Investment Research

These are impressive numbers, any way you look at them. The momentum on the revenue front is notably striking, both in terms of the growth rate as well as the beats percentages.

For the Finance sector, we now have Q2 results from 39.8% of the sector’s total market capitalization in the S&P 500 index and a big part of the remainder will report results this week. Total earnings for these Finance companies are up +190.4% from the same period last year on +3.5% higher revenues, with 100% beating EPS estimates and 81.3% beating revenue estimates.

This is a significantly better performance than we have seen from these banks in recent quarters.

What is Expected for 2021 Q2 & Beyond?

Total Q2 earnings for the S&P 500 index are currently expected to be up +69% from the same period last year on +19.2% higher revenues, with the growth rate steadily going up as companies come out with better-than-expected results. This would follow the +49.3% earnings growth on +10.3% higher revenues in 2021 Q1.

A big part of the unusually strong earnings growth expected in the Q2 earnings season is due to easy comparisons to last year’s Covid-hit period. But as we have been consistently pointing out, not all of the growth is a result of easy comparisons.

Given how strong earnings surprises turned out to be in the preceding reporting cycle (2021 Q1), the final earnings growth tally for 2021 Q1 could be as high as +80%.

The chart below takes a big-picture view of the quarterly earnings and revenue growth pace.

Image Source: Zacks Investment Research

The chart below shows the aggregate bottom-up quarterly earnings tallies, actual earnings for the reported periods, and estimates for 2021 Q2 and beyond, to give us a better sense of the easy-comps question.

Image Source: Zacks Investment Research

As you can see here, 2021 Q2 at $412 billion is +69% above the Covid-hit $243.8 billion tally achieved in 2020 Q2. You can also see here that 2021 Q2 is +14.5% above the comparable pre-Covid 2019 period.

The chart below presents the big-picture view on an annual basis. As you can see below, 2021 earnings and revenues are expected to be up +36.1% and +11.2%, respectively, which follows the Covid-driven decline of -13.1% in 2020.

Image Source: Zacks Investment Research

Please note the double-digit earnings growth expected in each of the next two years. This suggests that the market isn’t looking for a one-off rebound this year, but rather an enduring growth cycle that continues over the next couple of years.

To the extent that this growth outlook can improve as we move into the back half of 2021 will determine whether the overall earnings picture is getting better or leveling off.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more