Pure-Play Semiconductor Foundries Portfolio Went Up 14% In June; Now Up 34% YTD

Image Source: Unsplash

An Introduction

There are 5 segments in the semiconductor value chain whose pure-play (i.e. companies that concentrate their efforts on one single line of business) constituent stock performances are tracked and commented on by munKNEE in its frequent articles on the category. The semiconductor foundry category is one of the 5 and the other 4 are fabless semiconductor companies; equipment and materials suppliers; integrated device manufacturers ( see my latest article here); and electronic design automation software designers (see my latest article here).

What Is A Pure-Play Semiconductor Foundry?

A pure-play semiconductor foundry (also known as a fabrication or "fab" plant) does not create its own integrated circuit products but, instead, concentrates all its efforts in the manufacturing of chips based on designs provided by other semiconductor companies which allows it to specialize in manufacturing processes and technologies.

What Is An Integrated Circuit?

Wikipedia defines an integrated circuit, also known as a microchip, computer chip, or simply chip, as a small electronic device made up of multiple interconnected electronic components, created by photolithographic techniques, which are etched on to a small piece of semiconductor material, usually silicon, which, in turn, is laminated on printed circuit board and fused with a metal alloy to create a permanent bond between metal workpieces to create a finished integrated circuit.

What Is A Superconductor?

Again, according to an edited and abridged version from Wikipedia, a semiconductor is a material that has an electrical conductivity value falling between that of a conductor, such as copper, and an insulator, such as glass. In many cases their conducting properties are altered by introducing impurities (doping) into the crystal structure and when two differently doped regions exist in the same crystal, a semiconductor junction is created. Connecting the two materials causes creation of a depletion region near the boundary, as the free electrons fill the available holes, which, in turn, allows electric current to pass through the junction only in one direction. and is the basis of diodes, transistors, and most modern electronics. Silicon is a critical element for fabricating most electronic circuits and is the most common semiconductor. After silicon, gallium arsenide is the second-most common semiconductor and is used in laser diodes, solar cells, microwave-frequency integrated circuits, and others.

The munKNEE Pure-Play Semiconductor Foundries Portfolio

There are only 4 pure-play semiconductor foundries trading on U.S. stock exchanges and they are outlined below as to their stock performances in June, and YTD along with their current market capitalizations, and any recent news, analyses and commentary on them where available:

- Taiwan Semiconductor Manufacturing Company (TSM): UP 15.1% in June; UP 67.1% YTD

- TSM was the world’s first pure-play and is the largest foundry company. Its primary fab is in Taiwan with additional wholly owned subsidiary fabs in Japan (2), USA (1); China (1); Germany (1 - a JV fab with ESMC to begin production in 2027; U.S. (3 in Arizona with production to begin in 2025, 2028, and 2029/2030; and Japan (2 - by majority owned JASM with production to begin in 2024 and 2027)

- Market Capitalization of $770B.

- Market Share: 60.1%

- Recent news, analyses and commentary:

- Tower Semiconductor (TSEM): UP 4.7% in June; UP 28.8% YTD

- TSEM is domiciled in Israel with a design center there and operates 7 manufacturing facilities: Israel (2); USA (2); Japan (2) and Italy (1 shared with ST Microelectronics).

- Market Capitalization: $4.4B

- Market Share: 1.3%

- Recent news, analyses and commentary: None

- GlobalFoundries (GFS): UP 3.2% in June; DOWN 16.6% YTD

- GFS is headquartered in New York with fabs in Singapore (2); the U.S. (2); and Germany (1). GFS has already received over $1.5 billion via the CHIPS and Science Act.

- Market Capitalization: $28B

- Market Share: 6.6%

- Recent news, analyses and commentary:

- BAE Systems and GlobalFoundries Collaborate to Strengthen Supply of Essential Semiconductors for National Security Programs

- United Microelectronics Corporation (UMC): UP 3.1% in June; UP 3.5% YTD

- UMC is headquartered in Taiwan, with fabs in Taiwan (8); China (2); Singapore (1) and Japan (1).

- Market Capitalization: $46B

- Market Share: 6.4%

- Recent news, analyses and commentary:

In Summary:

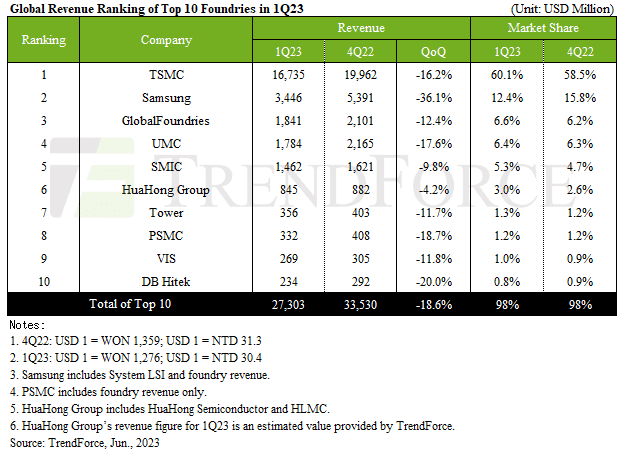

The above 4 pure-play semiconductor foundry stocks account for 74.4% share of the total market and were UP 14.4% in June and are now UP 33.8% YTD.

Not included in the above analysis are Samsung Foundry; SMIC, HuaHong; PSMC; VIS; and DB Hitek with at total of 25.6% in total market share as they are either not pure-play foundries or are not traded on a U.S. stock exchange.

Global Market Share of the 10 Global Semiconductor Foundries

More By This Author:

Micro/Small Cap AI Stocks Portfolio Declined +10% In June

Clinical-Stage BioTech Drug Stocks Declined 13% In June

12 Largest Cannabis Stocks Declined +11%, On Average, In June

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more