Pure-Play Semiconductor Equipment/Material Suppliers Were Up 2.8%, On Average, Last Week

Image Source: Unsplash

An Introduction

The AI hardware (semiconductor/computer chip/wafer) sector consists of 6 distinct sub-segments, each with its own unique dynamics and growth trajectories. The first 4 sub-segments are referred to as the semiconductor value chain and consist of the pure-play design, equipment/material supply, fabrication, and assembly/testing/packaging of semiconductors. The 5th sub-segment consists of pure-play companies that outsource the fabrication of their chips, to specialized manufacturers as opposed to doing so themselves (i.e. are fabrication-less, or "fabless" in semiconductor jargon) and the 6th sub-segment are integrated device manufacturers who do everything themselves in house to control the entire production process.

The 6 Sub-Segments In the AI Hardware Sector

The sub-segments constituents are captured in 6 Portfolios, as follows:

- The Pure-Play EDA Software Chip Design Model Portfolio

- The Pure-Play Semiconductor Equipment/Materials Suppliers Model Portfolio

- Constituents: Applied Materials (AMAT); ASML Holding (ASML); Entegris (ENTG); KLAC Corp. (KLAC); Lam Research (LRCX); Tokyo Electron (TOELF); Advantest Corporation (ATEYY); and ASM International (ASMIY).

- The Pure-Play Semiconductor Foundries Model Portfolio

- The Pure-Play Outsourced Semiconductor Assembly and Test (OSAT) Model Portfolio

- The Pure-Play Fabless Semiconductor Companies Model Portfolio

- The Integrated Device Manufacturer (IDM) Model Portfolio

The Pure-Play Semiconductor Equipment/Material Suppliers Model Portfolio

This article highlights the differences in each company's focus, market capitalization and the stock performances of each constituent last week, in descending order, and YTD, of the Pure-Play Semiconductor Equipment/Material Suppliers Model Portfolio, as follows:

- ASML Holding (ASML): UP 5.3% last week; UP 12.8% YTD

- Specialty: EUV lithography systems

- Market Capitalization: $300B

- KLA Corporation (KLAC): UP 3.8% last week; UP 43.6% YTD

- Specialty: Metrology and defect inspection

- Market Capitalization: $119B

- Lam Research: (LRCX): UP 1.9% last week; UP 41.6% YTD

- Specialty: Etch and deposition equipment

- Market Capitalization: $130B

- ASM International (ASMIY): UP 1.9% last week; DOWN 14.0% YTD

- Specialty: wafer processing equipment

- Market Capitalization: $24B

- Applied Materials (AMAT): UP 1.2% last week; No Change YTD

- Specialty: Broad fab equipment (CVD, PVD, CMP)

- Market Capitalization: $130B

- Advantest Corporation (ADTTF): DOWN 1.3% last week; UP 27.9% YTD

- Specialty: Automated test equipment

- Market Capitalization: $57B

- Entegris (ENTG): DOWN 2.1% last week; DOWN 17.2% YTD

- Specialty: CMP slurries, deposition chemicals, filtration systems

- Market Capitalization: $12B

- Tokyo Electron (TOELF): DOWN 5.6% last week; DOWN 7.0% YTD

- Specialty: Etch, deposition, cleaning systems

- Market Capitalization: $63B

Summary

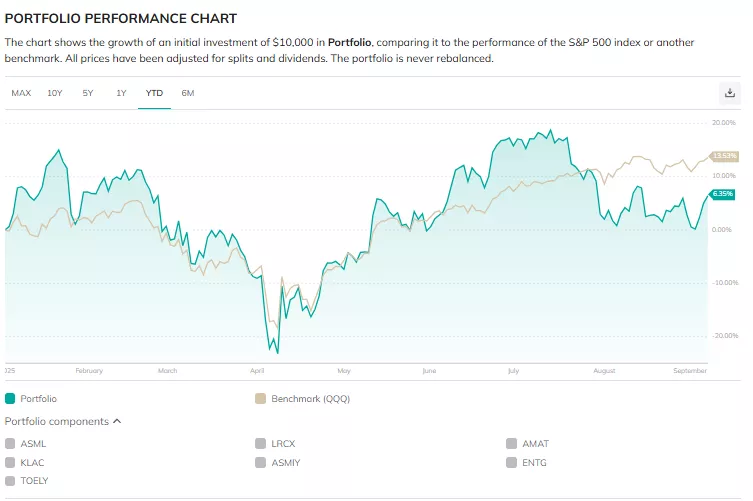

The Portfolio was UP 2.8% last week and is now UP 12.5% YTD

The above portfolio chart has been generated using the tools provided by PortfoliosLab.com and easy step-by-step instructions are available more