Pure-Play Quantum Computing Stocks Fell Almost 16% Last Week - Here's Why

Image Source: Pixabay

The quantum computing (QC) industry is a rapidly evolving and expanding field that is expected to experience a compound annual growth rate of 36.9% between now and 2030 with an estimated 5,000 quantum computers operational by then. That being said, however, there will be bumps along the way and last week the 4 pure-play constituents in our Pure-play Quantum Computing Stocks Portfolio declined sharply. This article describes in layman terms just what quantum computing is, each constituent with their current market capitalization, performance week-ending November 7th and for the month of October YTD, the catalyst(s) contributing to the change in their stock price, and charts both the portfolio performance and the performance of each constituent in comparison to each other.

What Is Quantum Computing?

The race is on for companies to radically upgrade the computing power of their models and that’s where QC comes in.

- Computers currently operate on a binary system that is equipped with chips that use bits to perform computations but these bits can only show a value of zero or one and, as a result, it takes a lot of zeros and ones arranged in specific orders for a computer to do anything. (Check out this video on Quantum Computing: 4 Things You Need to Know.)

- QCs, however, operate with subatomic particles that use quantum bits (qubits) to allow the particles to exist simultaneously in more than one state which increases processing speeds dramatically – and quicker processing speeds mean that computers can tackle more complex problems, which will improve predictive analytics, pattern recognition and complex optimization tasks.

Building a quantum computer is extremely expensive, complex and massive, and needs to be kept in stable laboratory conditions, and cooled to nearly absolute zero (-459 degrees Fahrenheit) so, while there are close to 200 companies whose primary focus is on QC Software, according to The Quantum Insider, just over 20 companies worldwide are working on QC Processors and Chips. Of those 20+ companies only 4 companies are researching and developing quantum computers exclusive of anything else

Our Pure-Play Quantum Computing Stocks Portfolio

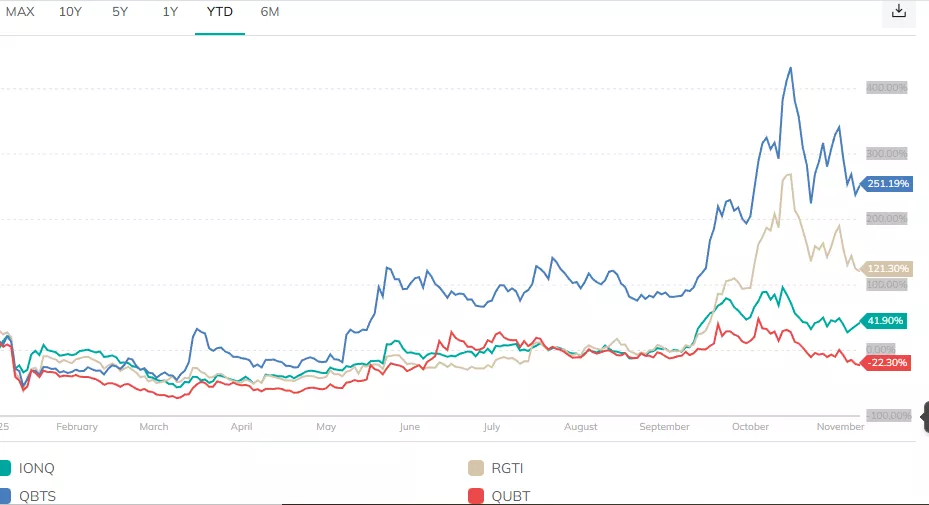

In general, the pure-play quantum computing stocks QBTS, RGTI, IONQ, and QUBT fell sharply last week due to valuation concerns, bearish analyst commentary, and pre-earnings uncertainty. Below is a description of each of the 4 constituents with their current market capitalization, performance week-ending November 7th, for the month of October, and YTD, and the catalyst(s) contributing to the change in their stock price:

- IonQ (IONQ): down 5.0% w/e Nov. 7th; up 1.4% in October; up 41.9% YTD

- Focus: building a network of quantum computers accessible via the cloud using trapped-ion technology in its processing units which relies on suspending ions in space using electromagnetic fields, and transmitting information through the movement of those ions in a “shared trap”.

- Market Capitalization: $21.0B

- Catalysts:

- fell due to a massive Q3 net loss of $1.05 billion that, while primarily was attributed to large non-cash charges, caused investors to react negatively to the headline figure triggering a valuation reset.

- D-Wave Computing (QBTS): down 20.4% w/e Nov. 7th; up 50.0% in October; up 251.2% YTD

- Focus: specializes in quantum annealing technology

- Market Capitalization: $10.3B

- Catalyst(s):

- fell due to a combination of disappointing Q3 earnings, valuation concerns, and investor skepticism about its long-term viability. Specifically,

- D-Wave posted a Q3 loss which was worse than expected and, while the company beat revenue estimates, the net loss and cash burn raised red flags about sustainability;

- the 50.0% surge in it stock price in October (and 251% YTD) prompted fears of a bubble with analysts beginning to issue lower price targets, and Zacks downgrading the stock to a “Strong Sell”;

- a forced warrant redemption was interpreted by investors as a desperate cash-raising move, further eroding confidence; and

- given rising interest rates and tighter capital markets, investors began questioning the commercial timeline for quantum technologies of 5,000 QCs in operation by 2030..

- fell due to a combination of disappointing Q3 earnings, valuation concerns, and investor skepticism about its long-term viability. Specifically,

- Quantum Computing Inc. (QUBT): down 23.0% w/e Nov. 7th; down 9.2% in October; down 22.3% YTD

- Focus: specializes in photonic qubits that offer a number of key advantages over trapped ions or superconducting qubits

- Market Capitalization: $2.9B

- Catalysts:

- fell due to investor backlash over a large insider share sale, fading confidence in its commercialization timeline, and lingering financial concerns. Specifically,

- QUBT filed to sell approximately 37.18 million shares on behalf of existing holders which was interpreted as a liquidity event, sparking fears of dilution and eroding investor trust. in addition, the filing came shortly after a fourfold rally, amplifying concerns about insider profit-taking; and

- the broader quantum computing space saw declines due to valuation resets and pre-earnings jitters, impacting speculative names like QUBT disproportionately.

- fell due to investor backlash over a large insider share sale, fading confidence in its commercialization timeline, and lingering financial concerns. Specifically,

- Rigetti Computing (RGTI): down 23.7% w/e Nov. 7th; up 48.6% in October; up 121.3% YTD

- Focus: specializes in superconducting qubit technology and has developed a suite of software tools and algorithms for programming and simulating quantum computations

- Market Capitalization: $11.0B

- Catalysts:

- fell due to pre-earnings uncertainty, weak revenue expectations, and fading investor momentum in the quantum computing sector. Specifically,

- Rigetti is scheduled to report Q3 earnings on November 10, and investors are bracing for mixed results and,

- while some analysts have maintained bullish targets, recent commentary has been focused on execution risk and cash burn, dampening enthusiasm.

- fell due to pre-earnings uncertainty, weak revenue expectations, and fading investor momentum in the quantum computing sector. Specifically,

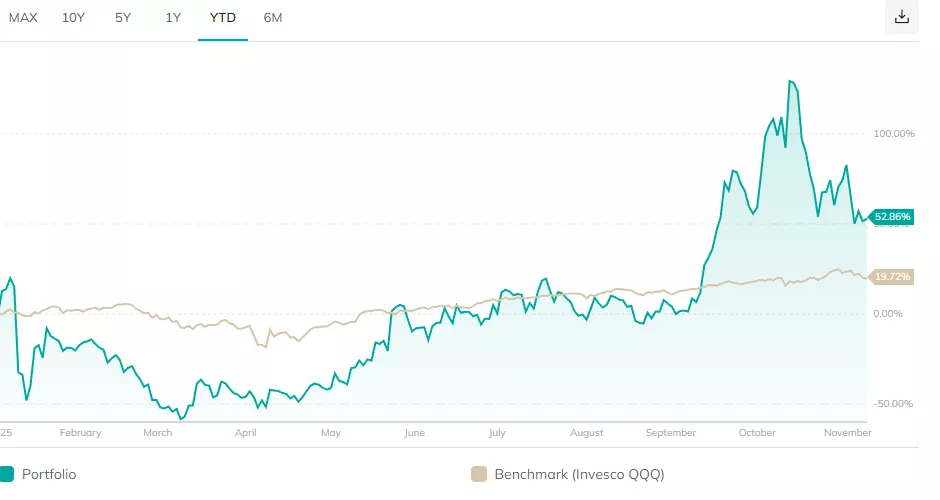

Chart of Portfolio Performance YTD

Source of Chart: PortfoliosLab.com

Chart Comparing Constituent Performances YTD

Source of Chart: PortfoliosLab.com

Summary

The Portfolio was down 15.6% last week after having gone up 19.4% in October, and is now "only" up 65.7% YTD.

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.