Pure-Play Cloud Computing SaaS Stocks Portfolio Is Down MTD

Image Source: DepositPhotos

What is Cloud Computing?

Cloud computing (CC) is the technique of processing, storing, and managing data on a network of remote computers hosted on the internet by cloud service providers rather than on a personal computer or local server using only as much compute power and storage as needed to meet demand. This theoretically allows for cheaper and faster computing because it eliminates the need to purchase, install, and maintain servers.

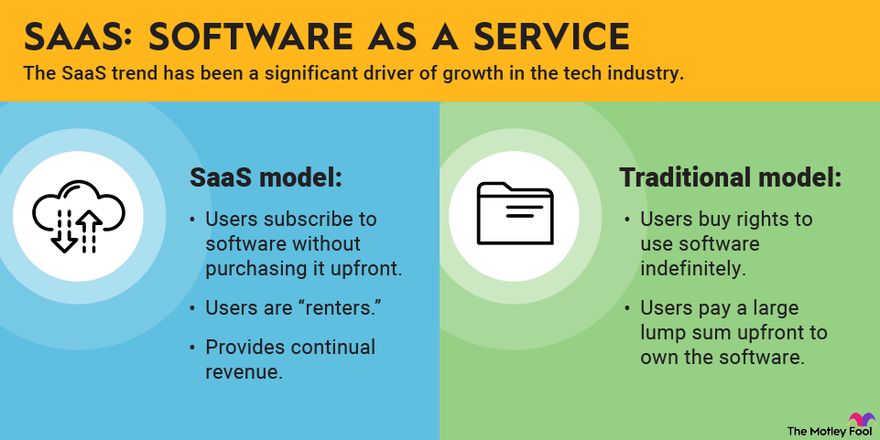

What is SaaS?

SaaS, also known as cloud application services, makes software available to users over the internet, usually for a monthly subscription fee. They are typically ready-to-use and are run from a users’ web browser which allow businesses to skip any additional downloads or application installations. SaaS accounts for 38.5% of cloud computing revenue. (Source) For more insightful information you are encouraged to read Cloud Computing 101.

Image source: The Motley Fool

What is the Price-to-Sales Ratio

The price-to-sales (P/S) ratio, which equals a company's market capitalization divided by its annual revenue, is often used as a valuation metric for SaaS companies in place of the P/E ratio. A higher P/S ratio denotes optimism among investors that attractive revenue growth will continue and that the revenue will eventually generate profits.

Our Pure-Play Cloud Computing SaaS Stocks Portfolio

Below is a list of the 8 pure-play constituent cloud computing companies with market capitalizations of $20B or more presented in descending order of their performances MTD, their market capitalizations, their forward price-to-sales ratios and ranks, and any pertinent news, analyses and/or commentary where available.

- ServiceNow (NOW): UP 2.8% MTD

- Market Capitalization: $184B

- Forward Price-to-Sales Ratio: 15.2 (Ranks #1)

- News, Analyses, and Commentary:

- MongoDB (MDB): DOWN 0.2% MTD

- Market Capitalization: $21B

- Forward Price-to-Sales Ratio: 10.1 (Ranks #4)

- News, Analyses, and Commentary:

- Snowflake (SNOW): DOWN 0.5% MTD

- Market Capitalization: $38B

- Forward Price-to-Sales Ratio: 9.6 (Ranks #5)

- News, Analyses, and Commentary:

- Atlassian (TEAM): DOWN 1.1% MTD

- Market Capitalization: $43B

- Forward Price-to-Sales Ratio: 9.6 (Ranks #7)

- News, Analyses, and Commentary:

- HubSpot (HUBS): DOWN 1.6% MTD

- Market Capitalization: $25B

- Forward Price-to-Sales Ratio: 9.0 (Ranks #6)

- News, Analyses, and Commentary:

- Cloudflare (NET): DOWN 4.3% MTD

- Market Capitalization: $27B

- Forward Price-to-Sales Ratio: 14.6 (Ranks #2)

- News, Analyses, and Commentary:

- Workday (WDAY): DOWN 5.0% MTD

- Market Capitalization: $66B

- Forward Price-to-Sales Ratio: 7.2 (Ranks #8)

- News, Analyses, and Commentary:

- Does Workday Have a Major Revenue Problem?

- Datadog (DDOG): DOWN 6.0% MTD

- Market Capitalization: $37B

- Forward Price-to-Sales Ratio: 12.8 (Ranks #3)

- News, Analyses, and Commentary:

Summary

The above 8 cloud computing stocks, with an average market capitalization of $55.1B, went UP 2.8% w/e September 13th and are DOWN just 0.5% MTD.

Conclusion

According to Fortune Business Insights, the global cloud computing SaaS market is projected to have a CAGR of 18.4% between now and 2032 which should bode well for CC companies.

More By This Author:

Our Conservative Cannabis Stock Portfolio Continues To Outperform

Pure-Play Cybersecurity Software Stocks Bounced Back Last Week

Our AI Mega-Cap Portfolio +6 Last Week Vs. -5% The Previous Week

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.